2020 Minimum Wage For Exempt Employees, Minimum Wages In Asean How Are They Calculated

2020 minimum wage for exempt employees Indeed lately has been hunted by users around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of this post I will talk about about 2020 Minimum Wage For Exempt Employees.

- California 2020 Minimum Wage Increase Impacts Exempt And Nonexempt Employees

- Cleaner Average Salary In Portugal 2020 The Complete Guide

- The Minimum Wage In Indonesia Increased By 8 5 For 2020

- The Minimum Wage In Indonesia Increased By 8 5 For 2020

- Minimum Wage Missouri Labor

- The Month In Wage Hour December 2019 State And Local Increases To Minimum Wage Go Into Effect In On January 1 Lexology

Find, Read, And Discover 2020 Minimum Wage For Exempt Employees, Such Us:

- Which Employees Are Exempt From Minimum Wage And Overtime Requirements People Processes

- The Minimum Salary For Exempt Employees In California 2020 Update

- Washington Employers Prepare For Significant Salary Increase To Meet Overtime Exemptions

- The Minimum Wage In Indonesia Increased By 8 5 For 2020

- Get Ready For New York Minimum Wage And Exempt Salary Changes Lexology

If you are looking for Minimum Wage For California July 2020 you've come to the right location. We have 101 images about minimum wage for california july 2020 including pictures, pictures, photos, backgrounds, and more. In such page, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

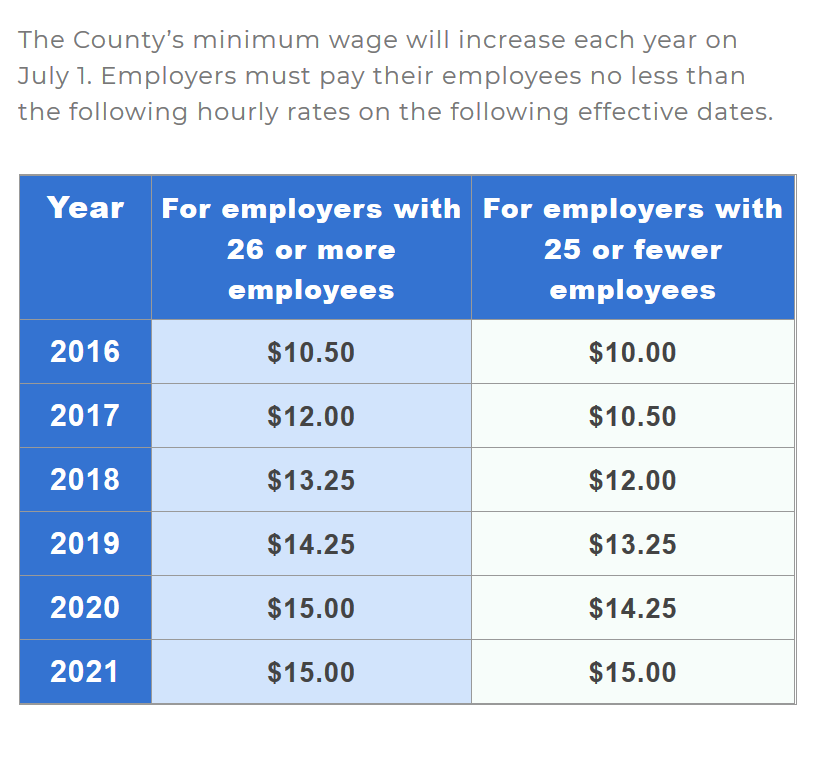

People that work for an employer with more than 25 employees are entitled to be paid a minimum wage of at least 1300 per hour15.

Minimum wage for california july 2020. In 2020 people that work for an employer with 25 or fewer employees are entitled to be paid a minimum wage of at least 1200 per hour. Notwithstanding the 2020 increase concerning the minimum amount 22 employers must pay executive administrative and professional employees for these workers to be exempt from the fair labor standards acts flsa minimum wage and overtime requirements currently at least five states have pay requirements that will or can exceed the revised. Effective january 1 2020 employers must pay.

Changes to exempt employee law and massachusetts minimum wage. Minimum wage 2020 in keeping with the gradual increase in the states minimum wage levels the new tiered minimum wage rates across the state effective december 31 2019 are listed below. To be considered exempt these employees must generally satisfy three tests.

The minimum wage rate is the lowest hourly pay that can be awarded to workers also known as a pay floor. The flsa allows for exemptions from these overtime and minimum wage requirements for certain employees who work in administrative professional and executive jobs known as exempt employees. In states that do not set a minimum wage rate or have an antiquated minimum wage rate that is less than the rate set by the federal government the federal minimum wage rate will take precedence and apply to all employees within that state.

What employers need to know for 2020 by joseph t. On january 1 2019 the minimum wage increased to 12 per hour for employers with 26 or more employees and 11 per hour for employees with 25 or fewer employees. This means that the minimum salary for exempt employees in 2020 is either.

The minimum wage shall be adjusted on a yearly basis through 2023 according to the pre set schedule shown above. Under the flsa non exempt employees must be paid the minimum wage or higher. As all employers know employees fall into one of two distinct categories.

Section 13a1 and section 13a17 also exempt certain computer employees. Nonexempt hourly paid and exempt salaried. The distinction between these two classifications.

That translates to thousands of extra payroll dollars 11908 annually for companies like retail dry cleaners restaurants cleaning companies and lots of other businesses with traditionally lower wages. As they have each year since 2016 the minimum wage and exempt salary threshold will increase for new york employers effective december 31 2019. The table below lists the current prevailing 2020 minimum wage rates for every state in the united states.

More From Minimum Wage For California July 2020

- Minimum Wage Upstate Ny

- Minimum Wage 2020 Yearly

- Minimum Wage In Garland Texas

- Minimum Wage In California For Tipped Employees

- What Is Minimum Wage California 2020

Incoming Search Terms:

- Https Www Lanepowell Com Our Insights 194902 Washington State Overtime Salary Thresholds To Go Up In 2020 And Up And Up In Coming Years What Is Minimum Wage California 2020,

- Minimum Wage Missouri Labor What Is Minimum Wage California 2020,

- New Minimum Salary For Exempt Employees Takes Effect January 1 2020 Wage Hour Insights What Is Minimum Wage California 2020,

- 80 000 Salary To Avoid Overtime Under L I S Proposed Rule What Is Minimum Wage California 2020,

- The Minimum Wage In Indonesia Increased By 8 5 For 2020 What Is Minimum Wage California 2020,

- Average Salary In Hannover 2020 The Complete Guide What Is Minimum Wage California 2020,