California Minimum Wage Garnishment, Wage Garnishment Hackler Flynn Associates

California minimum wage garnishment Indeed lately has been hunted by users around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the article I will talk about about California Minimum Wage Garnishment.

- For The Love Of Your Small Business 11 Wage Violations To Avoid

- The Ins And Outs Of Irs Wage Garnishment What You Need To Know

- Form Wg 002 Download Fillable Pdf Or Fill Online Earnings Withholding Order Wage Garnishment California Templateroller

- Wage Garnishment What Is It Opploans

- Wage Garnishment Management A Guide For Employers

- California Garnishment Now Provides Greater Protection Of Wages Northern California Bankruptcy Lawyer

Find, Read, And Discover California Minimum Wage Garnishment, Such Us:

- Collecting Money Judgments In Divorce Cases Enforcing Child Support Spousal Support And Property Division

- Enforcement Of Judgments Saclaw Org Pages 1 6 Text Version Anyflip

- Wg 002 Earnings Withholding Order Free Download

- Https Saclaw Org Wp Content Uploads Sbs Wage Garnishment Pdf

- Wage Garnishment Hackler Flynn Associates

If you re looking for Illinois Minimum Wage 2020 Poster you've reached the right place. We have 100 graphics about illinois minimum wage 2020 poster including images, photos, photographs, backgrounds, and more. In these web page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Http Www Publiccounsel Org Tools Publications Files 2011 Wage Garnishment Packet Pdf Illinois Minimum Wage 2020 Poster

Http Scholarship Law Wm Edu Cgi Viewcontent Cgi Article 2729 Context Wmlr Illinois Minimum Wage 2020 Poster

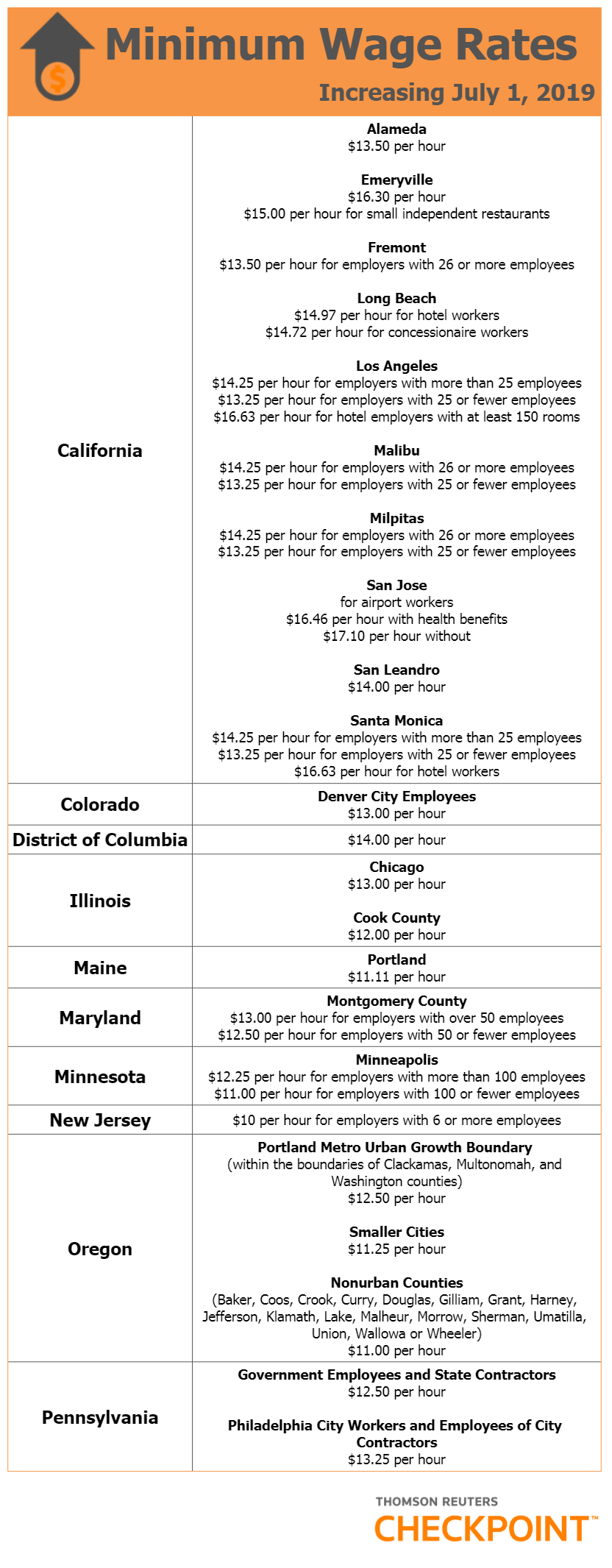

Earnings that week exceed the applicable minimum wage.

Illinois minimum wage 2020 poster. Earnings withholding orders for taxes ewot. Personal income tax earnings withholding order for taxes ftb 2905. When someone loses a civil court case and owes money to the winning side called the judgment creditor or creditor the court does not collect the money for the creditor.

To calculate the correct amount follow the steps below. Wage garnishment is more common than you might think. A report by adp research institute found that 72 of the 13 million employees it assessed had wages garnished in 2013.

For workers ages 35 to. We issue 3 types of wage garnishments. A wage garnishment is an order from a court or government agency that is sent to your employer requesting that they withhold a certain amount of money from your paycheck in order to pay back someone you owe a creditor.

California wage garnishment law does not apply to self employed debtors. For example an employer may withhold the earnings of an employee under a court order because the employee failed to pay child support. If there is a local minimum wage in effect in the location where the employee works that exceeds the state minimum wage at the time the earnings are payable the local minimum wage is the applicable minimum wage.

Workers making close to the california minimum wage got additional protection from wage garnishments under a change in the law effective in 2013. Like federal wage garnishment laws also called wage attachments california creditors cant garnish more than 25 of an employees wages after deductions. With the annual increases in the state minimum wage in 2019 california law now protects an employees weekly net wages up to 40 times the state minimum wage currently 11 to 12 per hour.

A wage garnishment requires employers to withhold and transmit a portion of an employees wages until the balance on the order is paid in full or the order is released by us. There are certain rules regarding what types of wages can be garnished and how much money can be withheld. Deversecy 1984 157 calapp3d 1071 1073.

However monies due from clients or customers may be levied via a writ of execution. Wage garnishment is a legal method of debt collection available in certain circumstances. In additional an individual can garnish wages because of the debtors failure to pay a court judgment.

If an employer has operations in several states a garnishment order delivered to the employers representative in another state binds the employer to the issuing states garnishment laws. For more information on child support wage garnishments call the california department of social services at 9166518848.

More From Illinois Minimum Wage 2020 Poster

- 2020 Minimum Wage Kansas

- What Is Minimum Wage In Pasadena California

- Federal Minimum Wage For Tipped Workers

- Federal Minimum Wage What Is It

- 2020 Minimum Wage Turkey

Incoming Search Terms:

- A Guide On How To Read Your Pay Stub Accupay Systems 2020 Minimum Wage Turkey,

- Https Saclaw Org Wp Content Uploads Sbs Wage Garnishment Pdf 2020 Minimum Wage Turkey,

- For The Love Of Your Small Business 11 Wage Violations To Avoid 2020 Minimum Wage Turkey,

- 100 Best Human Resources Related Materials Images Employee Relations Human Resources Workforce 2020 Minimum Wage Turkey,

- Https Saclaw Org Wp Content Uploads Sbs Wage Garnishment Pdf 2020 Minimum Wage Turkey,

- What Restaurants Need To Know About Payroll Garnishments Fsr Magazine 2020 Minimum Wage Turkey,