Federal Minimum Wage Laws Tipped Employees, Most Action To Raise Minimum Wage Is At State And Local Level Not In Congress Pew Research Center

Federal minimum wage laws tipped employees Indeed recently has been sought by consumers around us, maybe one of you. People are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of the post I will talk about about Federal Minimum Wage Laws Tipped Employees.

- Tipped Minimum Wage Federal Rate And Rates By State Chart

- Cashing In How The New Jersey Minimum Wage Increase Will Affect Tipped Employees Citrin Cooperman

- 2020 Minimum Wage Rates For California Cities Govdocs

- The Impact Of Minimum Wage Increases On Restaurants And Tipping

- It Recently Got A Bit More Confusing For Massachusetts Employers Of Tipped Employees Employment Business Litigation Resource

- Fair Labor Standards Act Of 1938 Wikipedia

Find, Read, And Discover Federal Minimum Wage Laws Tipped Employees, Such Us:

- Https Www Dol Gov Whd Regs Compliance Whdfs15 Pdf

- Tip Pooling Laws In Restaurants Everything Employers Need To Know

- Minimum Wage In The United States Wikipedia

- How Hard Is Your Server Working To Earn Minimum Wage Fivethirtyeight

- California Minimum Wage Labor Laws Ca

If you are looking for New York Minimum Wage Orders you've reached the perfect place. We have 104 graphics about new york minimum wage orders including images, photos, pictures, wallpapers, and much more. In such web page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

If the employees tips combined with the employers direct wages of at least 213 per.

New york minimum wage orders. An employer of a tipped employee is only required to pay 213 per hour in direct wages if that amount combined with the tips received at least equals the federal minimum wage. Bear in mind that this is not a cap on earnings tipped employees can exceed the tip credit if they earn more tips resulting in a higher take home wage. Tipped minimum wage law federal law.

Thus tipped employees are guaranteed to earn at least minimum wage and can earn more then minimum wage in tips. The minimum hourly rate of pay for a worker subject to tip credit provisions is. Add this to the minimum tipped wage 213 and it equals federal minimum wage 725 per hour.

However most of the payment can come from customers rather than the employer. In states that allow a tip credit a certain amount of received tips per hour may be credited against the minimum wage by an employer although the tipped employee must receive at least the minimum wage with combined. Tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit.

The flsa allows employers to subsidize the minimum wage paid to the tipped employees with gratuities earned by the employees. State laws for tipped employees. For employers with fewer than 10 full time employees.

The united states of america federal government requires a wage of at least 213 per hour be paid to employees who receive at least 30 per month in tips. For these employees the state wage is tied to the federal minimum wage of 725 per hour which requires an act of congress and the presidents signature to change. The youth minimum wage program allows young workers under the age of 20 to be paid a special minimum wage of 425 per hour for the first 90 days of employment with any employer.

Tipped employees are a major exception to the flsas minimum wage requirement. Minors and young workers. 206states may enact their own minimum wage laws provided that their minimum wage is greater than or equal to the federal rate.

29 cfr 53151 additionally the employee must earn the standard minimum wage rate currently 725 when tips earned are combined with wages earned under the tipped wage rate. For employees of employers with gross annual sales of less than 305000 the state minimum wage is 725 per hour. If wages and tips do not equal the federal minimum wage of 725 per hour during any week the employer is required to increase cash wages to compensate.

An employer is permitted to pay an employee the tipped wage rate if the employee customarily and regularly receives more than 30 a month in tips. The maximum federal tip credit is currently set at 512 per hour. A tipped employee engages in an occupation in which he or she customarily and regularly receives more than 30 per month in tips.

More From New York Minimum Wage Orders

- What Is Minimum Wage Per Hour In South Africa

- North Carolina Minimum Wage 2020

- Minimum Wage In Florida 2019

- What Is Minimum Wages Act In Maharashtra

- What Is Minimum Wage Uk

Incoming Search Terms:

- Colorado Minimum Wage Denver Labor Law Denver Employment Lawyer Information What Is Minimum Wage Uk,

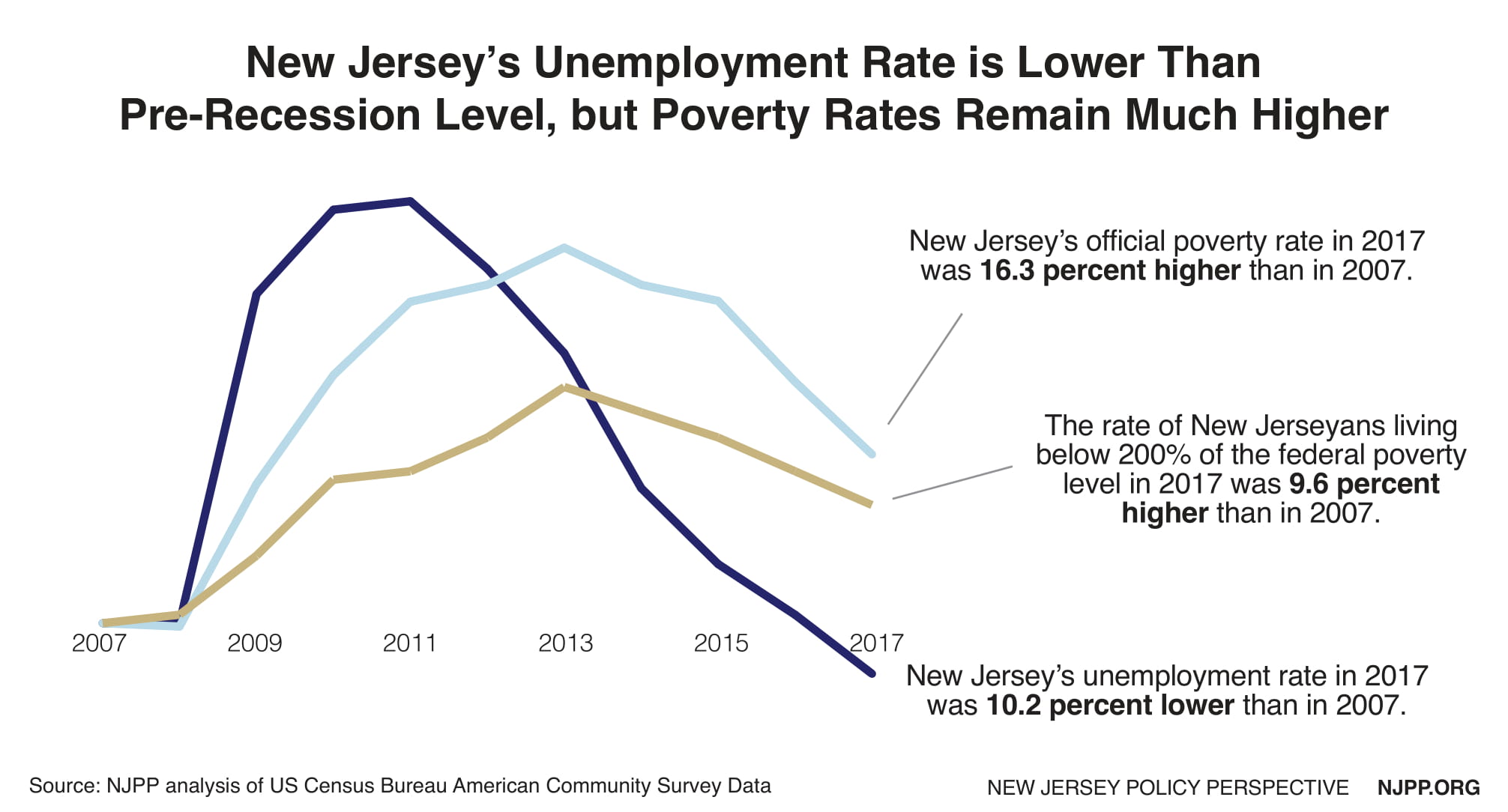

- Cashing In How The New Jersey Minimum Wage Increase Will Affect Tipped Employees Citrin Cooperman What Is Minimum Wage Uk,

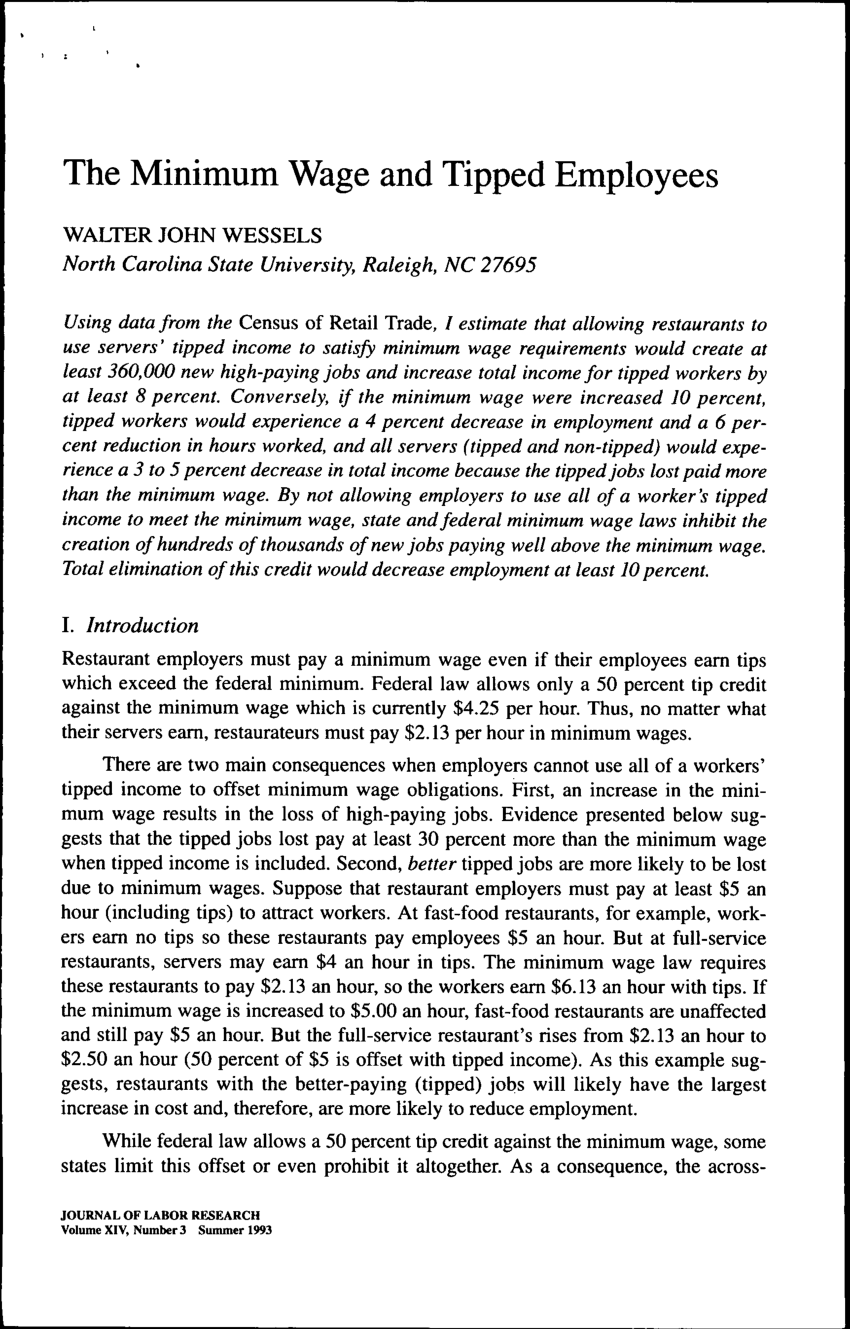

- Pdf The Minimum Wage And Tipped Employees What Is Minimum Wage Uk,

- The Minimum Wage And Tipped Minimum Wage Important Tools To Lift Wages And Reduce Poverty Particularly For Women The White House What Is Minimum Wage Uk,

- The Minimum Wage Movement Is Leaving Tipped Workers Behind Fivethirtyeight What Is Minimum Wage Uk,

- Federal Register Establishing A Minimum Wage For Contractors Notice Of Rate Change In Effect As Of January 1 2018 What Is Minimum Wage Uk,