2020 Minimum Wage For Tipped Employees, Workers In Majority Of U S States To See An Increase In Minimum Wage In 2020

2020 minimum wage for tipped employees Indeed recently has been sought by consumers around us, perhaps one of you. People now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the title of the post I will talk about about 2020 Minimum Wage For Tipped Employees.

- Augyzbkjocwrim

- Tennessee Lawmaker Wants Tipped Employees To Receive Basic Minimum Wage On Top Of Tips Wbir Com

- Workers In Majority Of U S States To See An Increase In Minimum Wage In 2020

- These 21 States Are Raising Their Minimum Wage For 2020

- 15 Minimum Wage Will Apply To Almost All Workers In Nyc By End Of 2020 Bklyner

- 2020 Federal And State Minimum Wage Rates

Find, Read, And Discover 2020 Minimum Wage For Tipped Employees, Such Us:

- Free Vermont Minimum Wage 2021

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology

- New Jersey Updates Minimum Wage Rules For Tipped Employees Govdocs

- 2020 Minimum Wage Rates For California Cities Govdocs

- Ny To End Below Minimum Wage For 70k Tipped Employees Nbc New York

If you are looking for Marijuana News Nz you've arrived at the ideal location. We have 104 images about marijuana news nz including images, photos, photographs, wallpapers, and much more. In such page, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

For employers with fewer than 10 full time employees at any one location who have gross annual sales of 100000 or less the basic minimum rate is 200 per hour.

Marijuana news nz. In some states employers must pay tipped employees the full state minimum wage before tips. Minimum wage for tipped workers june 30 2020 through december 30 2020 new york city long island and westchester county remainder of new york state service employees 1250 cash wage 250 tip credit 1085 cash wage 215 tip credit 985 cash wage 195 tip credit food service workers 1000 cash wage 500 tip credit. For these employees the state wage is tied to the federal minimum wage of 725 per hour which requires an act of congress and the presidents signature to change.

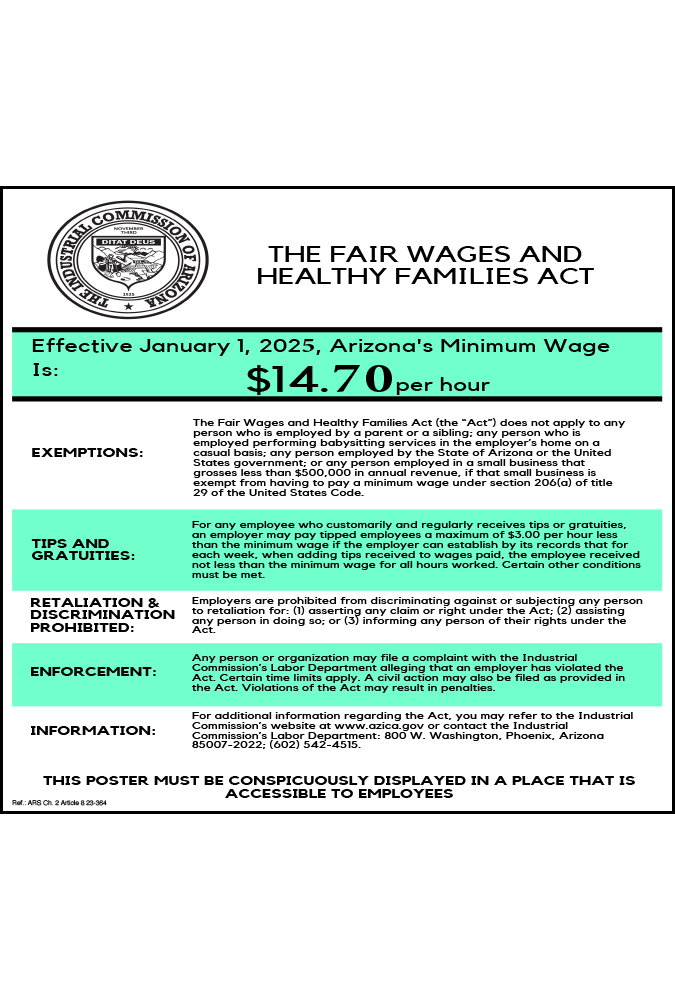

To help your organization stay aware of the latest labor law paycor has created a breakdown of tipped minimum wage requirements by state for 2020. In certain places employers may be able to count tips an employee receives toward the minimum wage. Additionally effective january 1 2020 tipped employees performing work on or in connection with covered federal contracts generally must be paid a minimum cash wage of 755 per hour.

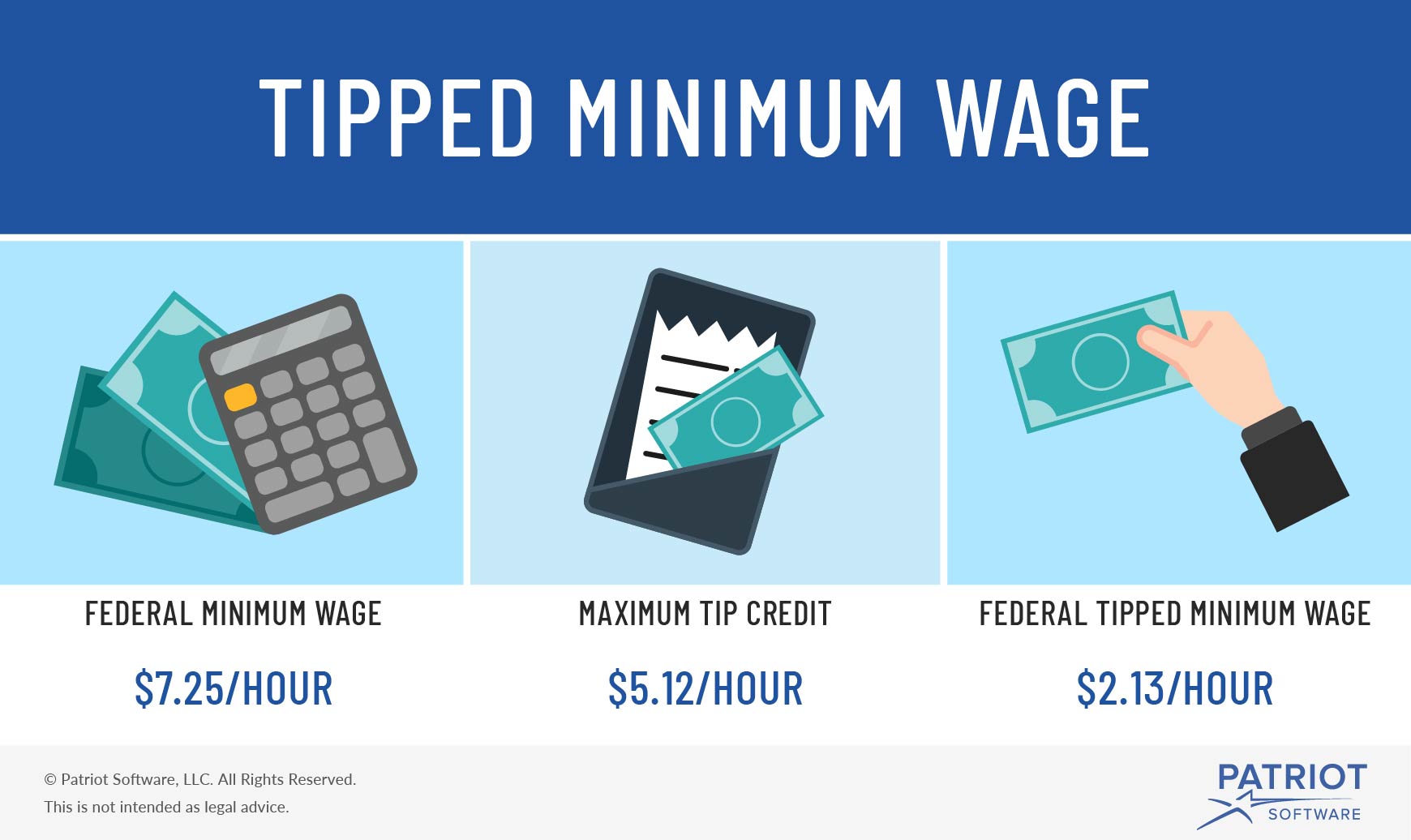

2020 tipped rate increases. Federal tipped minimum wage is currently 213 per hour which is lower than the 2020 colorado tipped minimum wage of 898 per hour. Federal law sets the minimum basic cash wage at 213 per hour but many states mandate a higher level.

Tipped minimum wage laws by state 2020 tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit. Under current federal law the minimum cash wage for tipped employees is 213 and the maximum tip credit that an employer can currently claim is 512 per hour based on a minimum wage of 725 per hour.

More From Marijuana News Nz

- Minimum Wage California On 2020

- Legalization Of Marijuana In Kansas

- What Is Minimum Wage In Ohio For Minors

- Legalization Of Marijuana In India

- No Minimum Wage

Incoming Search Terms:

- Minimum Wages For Tipped Workers In The United States Scpa Works No Minimum Wage,

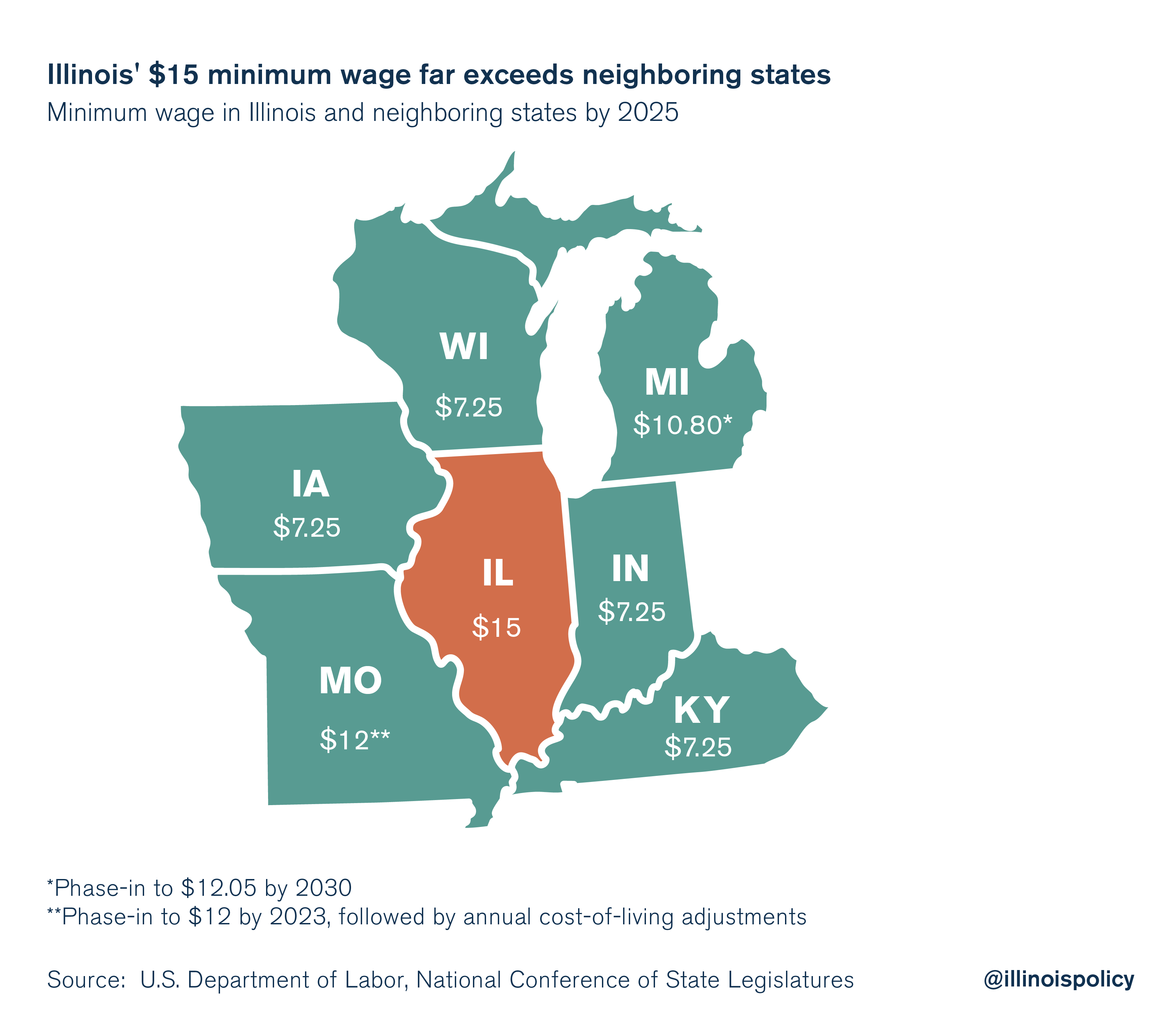

- Employers Take Note Illinois Minimum Wage Set To Increase In 2020 Lexology No Minimum Wage,

- Tipped Minimum Wage Federal Rate And Rates By State Chart No Minimum Wage,

- Minimum Wage State Map And Increases January 2020 Business Insider No Minimum Wage,

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology No Minimum Wage,

- 2020 Vision Labor Laws To Watch In The Year Ahead Shiftboard No Minimum Wage,