Minimum Wage For Tipped Employees 2020, Free New York Minimum Wage Labor Law Poster 2021

Minimum wage for tipped employees 2020 Indeed lately is being hunted by users around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of the post I will talk about about Minimum Wage For Tipped Employees 2020.

- State To End Below Minimum Wage For Some Tipped Employees

- 2020 State Minimum Wage Updates Govdocs

- New Jersey Tip Pooling And Tip Credit Laws Tipmetric 2020 By Restaurant Tip Laws Medium

- Early 2019 State Minimum Wage Updates Govdocs

- New Minimum Wage Rates July 1 A Guide For Employers

- Minimum Wage Workers In 21 States Will Get Raises In 2020 Across America Us Patch

Find, Read, And Discover Minimum Wage For Tipped Employees 2020, Such Us:

- New Jersey Updates Minimum Wage Rules For Tipped Employees Govdocs

- New York Minimum Wage Attorneys Nyc Employment Law Firm

- Texas Minimum Wage 2020 Resourceful Compliance

- 2020 State Minimum Wage Updates Govdocs

- New Jersey Tip Pooling And Tip Credit Laws Tipmetric 2020 By Restaurant Tip Laws Medium

If you are looking for Federal Minimum Wage Rates By Year you've come to the ideal location. We ve got 101 graphics about federal minimum wage rates by year including pictures, photos, photographs, backgrounds, and much more. In such page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Be Prepared For July 1 Minimum Wage Increases The Dancing Accountant Federal Minimum Wage Rates By Year

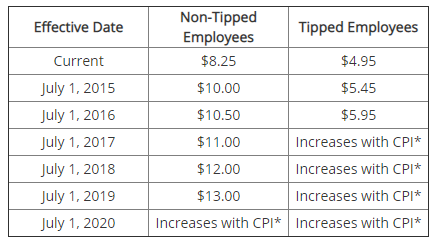

Tipped minimum wage laws by state 2020 tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit.

Federal minimum wage rates by year. In certain places employers may be able to count tips an employee receives toward the minimum wage. In some states employers must pay tipped employees the full state minimum wage before tips. 2020 tipped rate increases.

For these employees the state wage is tied to the federal minimum wage of 725 per hour which requires an act of congress and the presidents signature to change. Certain employees must be paid overtime at time and one half of the regular rate after 40 hours of work in a workweek. Tipped employees may be paid 60 of the hourly minimum wage.

The group maintained that the tipped minimum wage was in fact an all around win win since it allows tipped employees to earn far more than the minimum wage while helping to reduce labor. For employers with fewer than 10 full time employees at any one location who have gross annual sales of 100000 or less the basic minimum rate is 200 per hour. Exemptions from minimum wage.

Beginning january 1 2020 if a worker under 18 works more than 650 hours for the employer during any calendar year they must be paid the regular over 18 wage. Additionally effective january 1 2020 tipped employees performing work on or in connection with covered federal contracts generally must be paid a minimum cash wage of 755 per hour. Federal tipped minimum wage is currently 213 per hour which is lower than the 2020 colorado tipped minimum wage of 898 per hour.

Minimum wage for tipped workers june 30 2020 through december 30 2020 new york city long island and westchester county remainder of new york state service employees 1250 cash wage 250 tip credit 1085 cash wage 215 tip credit 985 cash wage 195 tip credit food service workers 1000 cash wage 500 tip credit. In these jurisdictions if the direct wage an employer pays an employee and tips equals the minimum wage an employer satisfies its minimum wage obligation.

Colorado Minimum Wage Denver Labor Law Denver Employment Lawyer Information Federal Minimum Wage Rates By Year

More From Federal Minimum Wage Rates By Year

- Minimum Wage In Florida

- California Minimum Wages 2020

- Marijuana Hawaii News

- Marijuana News Perris

- How Much Is Minimum Wage For 17 Year Olds Uk

Incoming Search Terms:

- Denver City Council Considers 15 Plus Minimum Wage Govdocs How Much Is Minimum Wage For 17 Year Olds Uk,

- Be Prepared For July 1 Minimum Wage Increases The Dancing Accountant How Much Is Minimum Wage For 17 Year Olds Uk,

- 2020 Federal And State Minimum Wage Rates How Much Is Minimum Wage For 17 Year Olds Uk,

- 2020 Vision Labor Laws To Watch In The Year Ahead Shiftboard How Much Is Minimum Wage For 17 Year Olds Uk,

- Effective July 1 2020 Illinois Minimum Wage To Increase James Hamlin Co P C How Much Is Minimum Wage For 17 Year Olds Uk,

- Iowa Tip Pooling And Tip Credit Laws Tipmetric 2020 By Restaurant Tip Laws Medium How Much Is Minimum Wage For 17 Year Olds Uk,