California Minimum Wage Tax Rate, California Minimum Wage And California Minimum Salary Thresholds Through 2023 Hrcalifornia

California minimum wage tax rate Indeed lately has been sought by consumers around us, perhaps one of you. People now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of this post I will discuss about California Minimum Wage Tax Rate.

- California Minimum Wage 2020 Minimum Wage Org

- Http Www Ci Emeryville Ca Us Documentcenter Home View 8034

- Mountain View Minimum Wage Local Ordinance Supplemental Poster

- Tax Relief For Low Income And Minimum Wage Workers Ontario Ca

- 1

- Taxtips Ca Canadian Tax Calculators And Financial Calculators

Find, Read, And Discover California Minimum Wage Tax Rate, Such Us:

- An Overview Of Canada S Tax Brackets 2020 Turbotax Canada Tips

- The Cost Of Hiring Employees In California Infographic

- 9 2 4 Tax Brackets And Rates Canada Ca

- Califonia Income Tax Tax Brackets Rjs Law San Diego

- Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy

If you are searching for Marijuana Legalization News North Carolina you've come to the right place. We have 104 images about marijuana legalization news north carolina including images, pictures, photos, wallpapers, and much more. In such page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times Marijuana Legalization News North Carolina

The federal minimum wage is 725 per hour and the california state minimum.

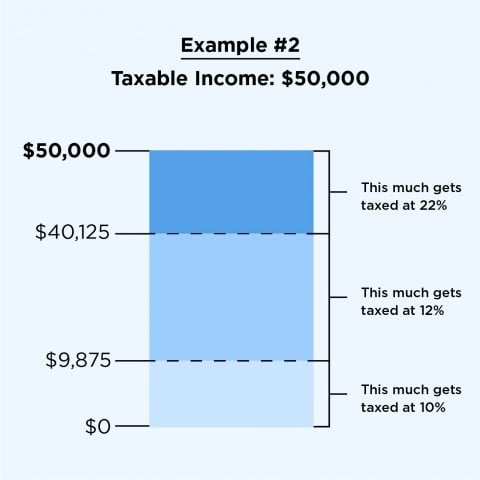

Marijuana legalization news north carolina. Individuals or families who do not earn a significant gross income may not have to file a federal income tax return but there can still be advantages to doing so. Use our calculator to discover the california minimum wage. As of 2015 this would mean that a single filer would be paying 10 percent federal income tax on the first 9075 and 15 percent on the remaining 6525.

Californias state minimum wage rate is 1300 per hourthis is greater than the federal minimum wage of 725. Based on a 40 hour work week this works out to an annual salary of 15600. The california minimum wage was last changed in 2008 when it.

The state minimum wage rate in california is 12hour for employers with 25 or fewer employees. You are entitled to be paid the higher state minimum wage. These california cities have a local minimum wage rate that is higher than the states rate and supersedes the states minimum.

The unemployment insurance ui rate schedule in effect for 2020 is schedule f. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The california minimum wage is the lowermost hourly rate that any employee in california can expect by law.

Californias maximum marginal income tax rate is the 1st highest in the united states ranking directly below. The federal minimum wage is 750 per hour as of 2015. The minimum wage applies to most employees in california with limited exceptions including tipped employees some student workers and other exempt occupations.

Local minimum wage rates in california. There are legal minimum wages set by the federal government and the state government of california. This rate will increase 1hour every year until it reaches 15hour in 2023.

For many california residents filing taxes is a requirement but there can be some exceptions based on income and other factors. Ui ett and sdi rates.

More From Marijuana Legalization News North Carolina

- Nyc Minimum Wage After Taxes

- What Is The Minimum Wage In California Per Year

- Federal Minimum Wage What Is It

- 2020 Minimum Wage For California

- What Is Minimum Wage London 2020

Incoming Search Terms:

- Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More What Is Minimum Wage London 2020,

- How Doug Ford S Pledge Of Zero Income Tax Leaves Minimum Wage Earners Worse Off Cbc News What Is Minimum Wage London 2020,

- Free California Payroll Calculator 2020 Ca Tax Rates Onpay What Is Minimum Wage London 2020,

- What Are Marriage Penalties And Bonuses Tax Policy Center What Is Minimum Wage London 2020,

- 2019 Payroll Taxes Will Hit Higher Incomes What Is Minimum Wage London 2020,

- California Paycheck Calculator Smartasset What Is Minimum Wage London 2020,