Federal Minimum Wage For Exempt Employees 2020, For The Love Of Your Small Business 11 Wage Violations To Avoid

Federal minimum wage for exempt employees 2020 Indeed lately is being hunted by consumers around us, perhaps one of you. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of this article I will discuss about Federal Minimum Wage For Exempt Employees 2020.

- Minimum Salary Requirement For Exempt Employees Increases January 1 2020 Trepanier Macgillis Battina P A Minnesota Business Law Firm

- Https Lni Wa Gov Forms Publications F700 205 000 Pdf

- Exempt Employees Archives Astron Solutions

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology

- California Minimum Wage Increases 2019

- Santa Clarita Sees Higher Pay With 2019 Minimum Wage Increase

Find, Read, And Discover Federal Minimum Wage For Exempt Employees 2020, Such Us:

- 2020 Minimum Wage Guide Resourceful Compliance

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology

- Exempt Employees Archives Astron Solutions

- Which States Are Increasing Their Minimum Wage On July 1 2020 Govdocs

- Three Big Changes Should Benefit Washington Workers Beginning In 2020 The Seattle Times

If you are looking for Federal Minimum Wage California 2020 you've arrived at the ideal location. We have 104 images about federal minimum wage california 2020 adding pictures, photos, photographs, wallpapers, and more. In these web page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

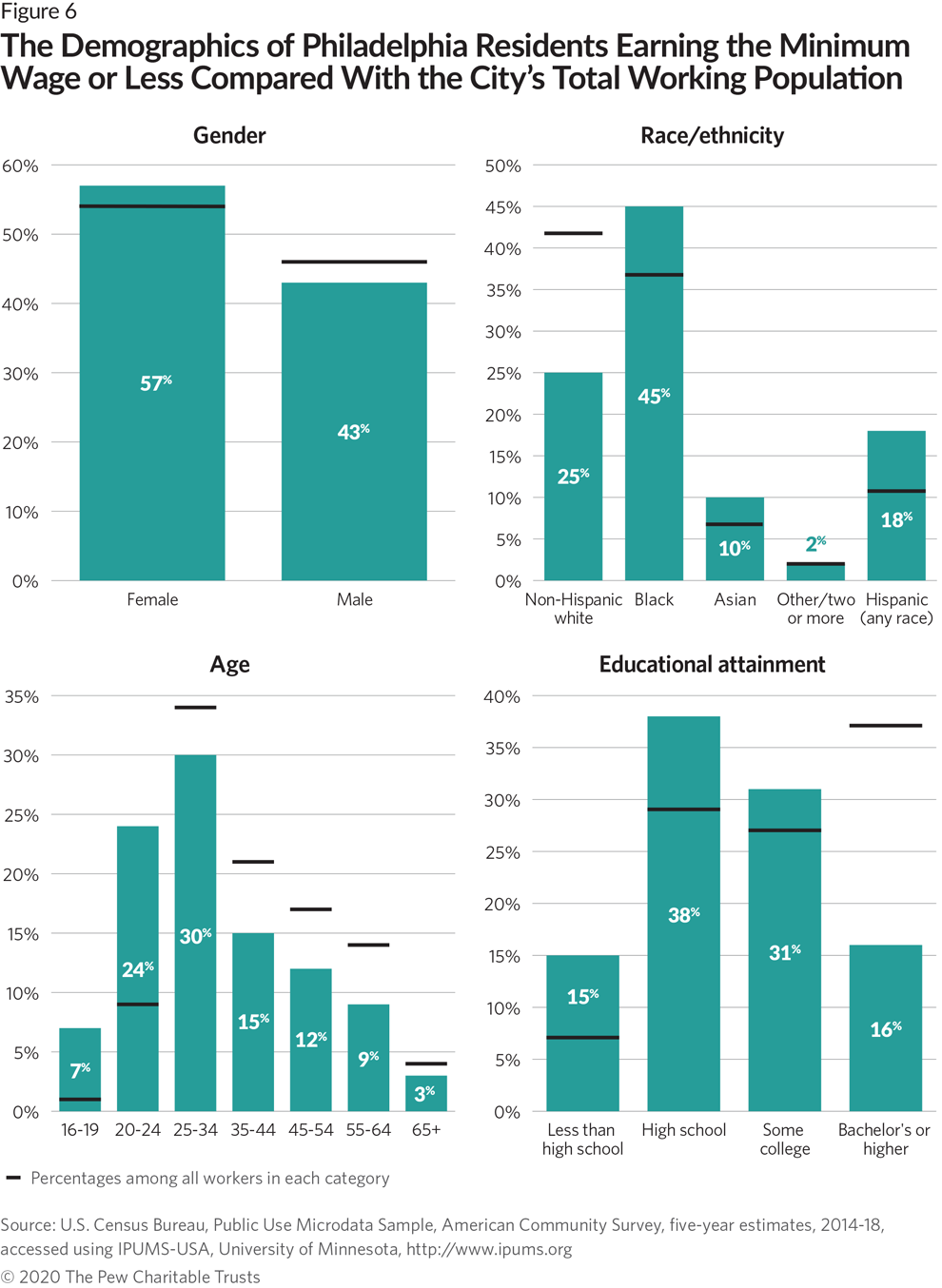

How Philadelphia S Minimum Wage Compares With Other U S Cities The Pew Charitable Trusts Federal Minimum Wage California 2020

Section 13a1 and section 13a17 also exempt certain computer employees.

Federal minimum wage california 2020. If your job is listed as exempt from minimum wage law then your employer is not required by law to pay you at or over federal or state minimum wage. California employers should take note of the following changes to state and local minimum wage laws set to take effect on january 1 2020 and will impact both nonexempt and exempt employees. California state minimum wage.

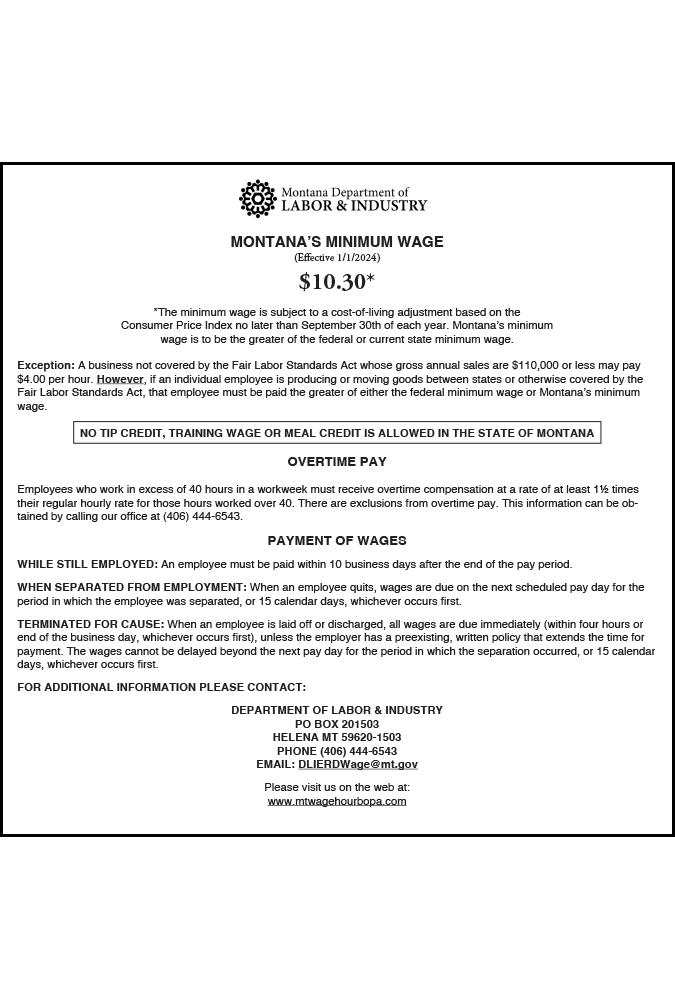

The us department of labor issued a final ruling today on the new salary threshold for overtime exemption. That translates to thousands of extra payroll dollars 11908 annually for companies like retail dry cleaners restaurants cleaning companies and lots of other businesses with traditionally lower wages. The federal department of labor has published the following list of exceptions to minimum wage and overtime wage laws.

However section 13a1 of the flsa provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive administrative professional and outside sales employees. A new year means new changes to californias minimum wage laws. Exemptions from both minimum wage and overtime pay.

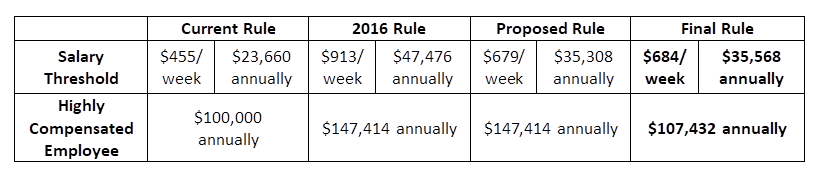

For exempt managerial administrative and professional employees the minimum salary will now be 35568 per year compared to the current 23660. Heres an in depth look at the new overtime rule for 2020 and a few steps on how to adapt. An employees regular rate of pay must exceed one and a half times the state minimum wage which on.

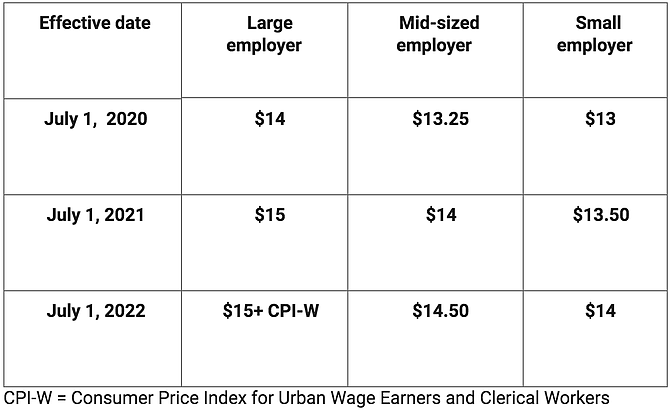

An employees regular rate of pay must exceed one and a half times the state minimum wage which on july 1 2020 will increase to 1325 per hour urban 1200 per hour general and 1150 per hour non urban. The minimum wage rate is the lowest hourly pay that can be awarded to workers also known as a pay floor. On january 1 2020 the department of labors final rule that raises the salary threshold requirement for overtime exemption took effect.

The fair labor standards act flsa determines the minimum wage for employees in private and public sectors in both federal and state governments. 684 per week equivalent to 35568 per year for a full year worker. Executive administrative and professional employees including teachers.

Effective january 1 2020 the federal government is raising the minimum salary requirement for exempt positions from 455 to 684. Department of labor issued its final rule concerning overtime exemptions. Under the flsa non exempt employees must be paid the minimum wage or higher.

The rule increases the salary threshold for employees exempt under the executive administrative and professional exemptions the white collar exemptions from 455 per week or 23660 annually to 684 per week or 35568 annually. Federal law also recognizes a separate highly compensated employee exemption which involves a simpler test for determining whether an employee is exempt from overtime.

More From Federal Minimum Wage California 2020

- California Minimum Wage Hike Schedule

- Legalization Of Marijuana Reaction Paper

- Minimum Wage California On 2020

- Minimum Wage Florida Tipped Employees

- Marijuana News Daily

Incoming Search Terms:

- Minimum Wage In The United States Wikipedia Marijuana News Daily,

- 2020 Federal And State Minimum Wage Rates Marijuana News Daily,

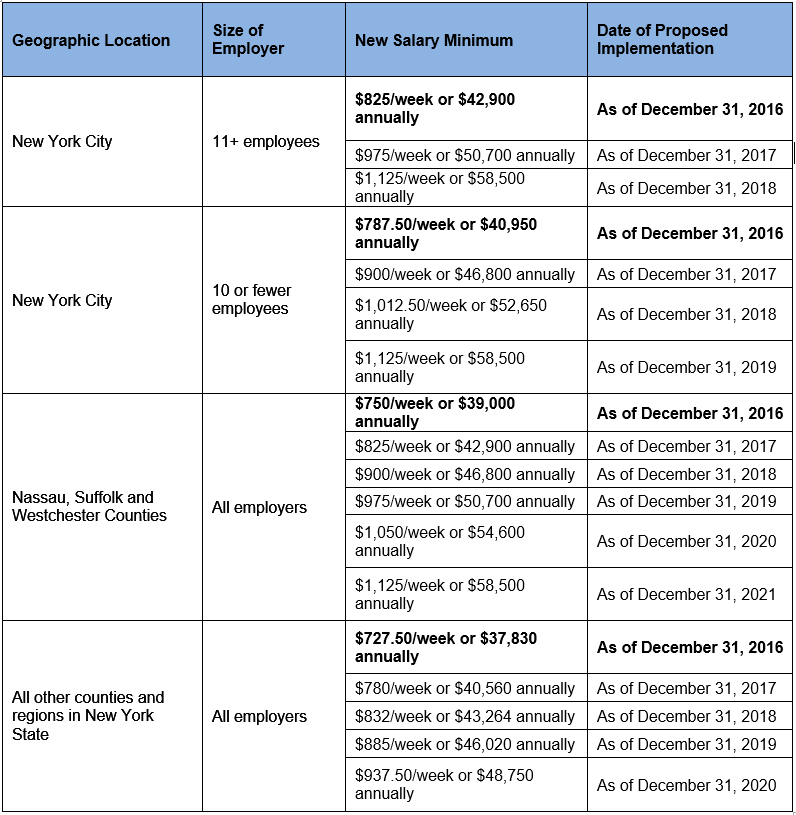

- Http Www Foxrothschild Com Content Uploads 2016 11 L E Alert November 2016 Richmond Guti C3 A9rrez New York Proposes Increase To Minimum Salary Level For Exempt Employees Pdf Marijuana News Daily,

- How Philadelphia S Minimum Wage Compares With Other U S Cities The Pew Charitable Trusts Marijuana News Daily,

- 2020 Minimum Wage Guide Resourceful Compliance Marijuana News Daily,

- Minimum Salary Requirement For Exempt Employees Increases January 1 2020 Trepanier Macgillis Battina P A Minnesota Business Law Firm Marijuana News Daily,