Federal Minimum Wage Tipped Employees, South Carolina Tip Pooling And Tip Credit Laws Tipmetric 2020 By Restaurant Tip Laws Medium

Federal minimum wage tipped employees Indeed lately is being sought by consumers around us, perhaps one of you. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of this post I will discuss about Federal Minimum Wage Tipped Employees.

- Rovarovaivalu Thesis The Effect Of The Tipped Minimum Wage On Firm

- Shortchanging Tipped Workers Less Than The Full Minimum Wage Means More Hardships Community Service Society Of New York

- Colorado Minimum Wage Denver Labor Law Denver Employment Lawyer Information

- Tip Pooling Laws In Restaurants Everything Employers Need To Know

- Hawaii Employers Council Minimum Wage Increases Coming For Federal Contractors

- What S Happening To The Tipped Minimum Wage Csny

Find, Read, And Discover Federal Minimum Wage Tipped Employees, Such Us:

- The State Of Tipped Minimum Wage In The Restaurant Industry

- 5 Facts About The Minimum Wage Pew Research Center

- Shortchanging Tipped Workers Less Than The Full Minimum Wage Means More Hardships Community Service Society Of New York

- Minimum Wage Tipped Employees And The Tip Credit Employment Law Handbook

- Petition Demand A Federal Minimum Wage Increase For Tipped Employees Change Org

If you are searching for Minimum Wage Nj 2020 you've reached the perfect place. We have 104 graphics about minimum wage nj 2020 adding images, pictures, photos, wallpapers, and more. In these webpage, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

If the employees tips combined with the employers direct wages of at least 213 per.

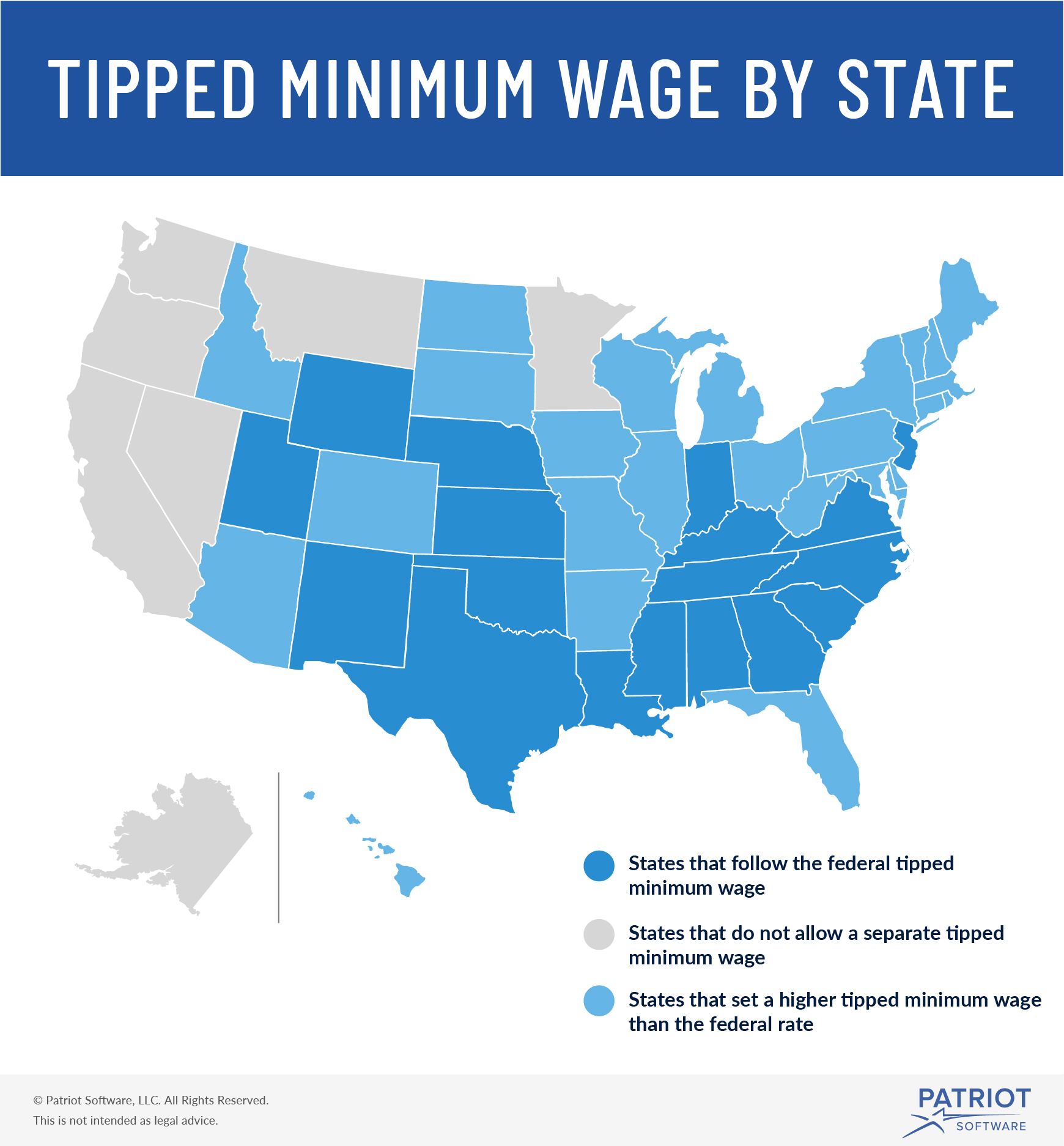

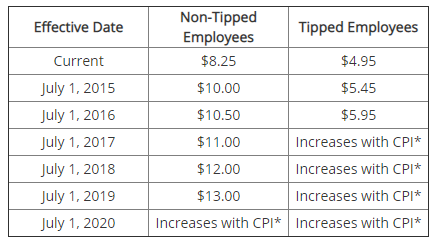

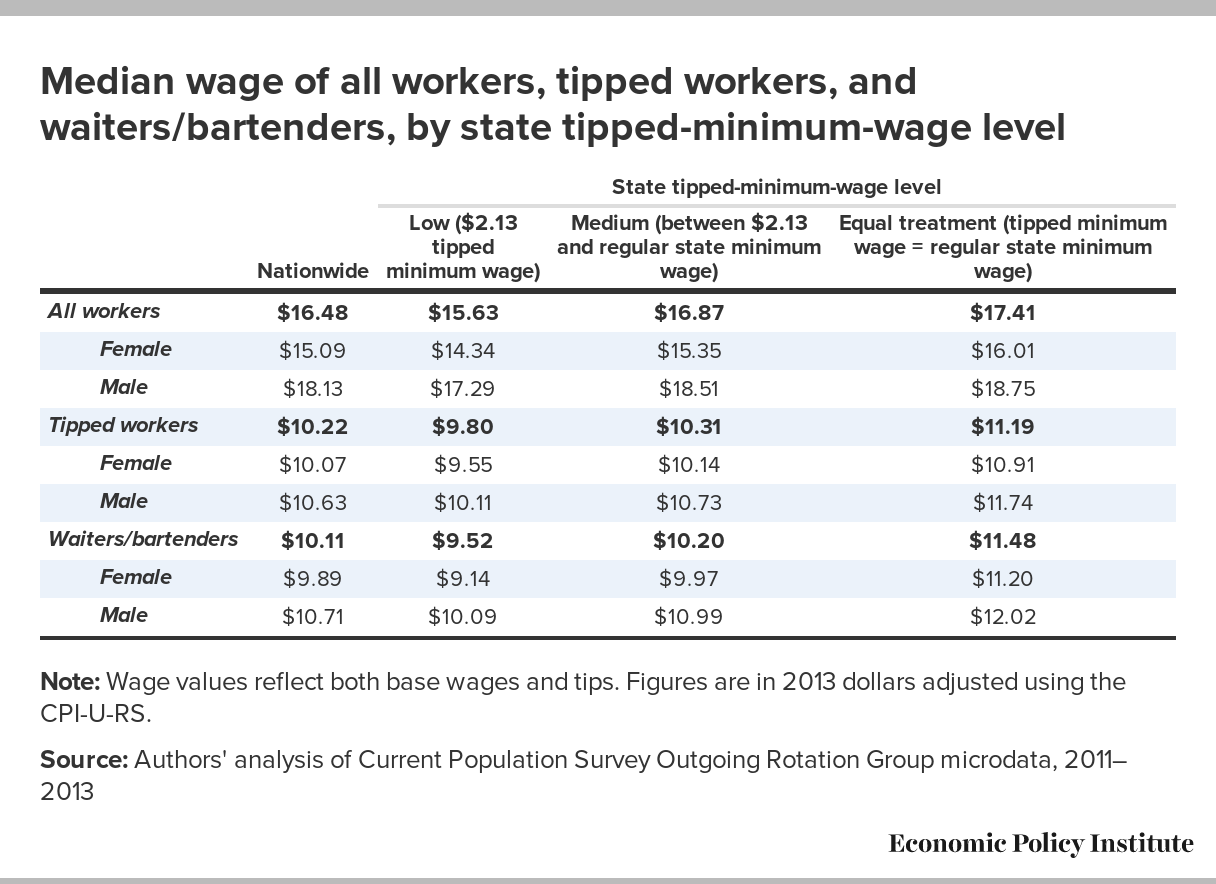

Minimum wage nj 2020. The reality is that federal and state minimum wage laws require employers to pay tipped employees the standard minimum wage but allow them to rely on tips received by employees to fill the gap between the tipped minimum wage and the standard minimum wage. For these employees the state wage is tied to the federal minimum wage of 725 per hour which requires an act of congress and the presidents signature to change. Tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit.

The employers tip credit of 300 per hour is not enough to meet the minimum wage requirement. This information sheet is intended to summarize the requirements for taking a minimum wage tip credit. If you want to pay your employees the tipped wage you must let them know the amount you are claiming as a tip credit and their hourly rate.

The minimum wage for tipped employees is known as the minimum cash wage. The employer must pay the employee an additional 212 per hour to reach the federal minimum wage of 725. The minimum wage rate is the lowest hourly pay that can be awarded to workers also known as a pay floor.

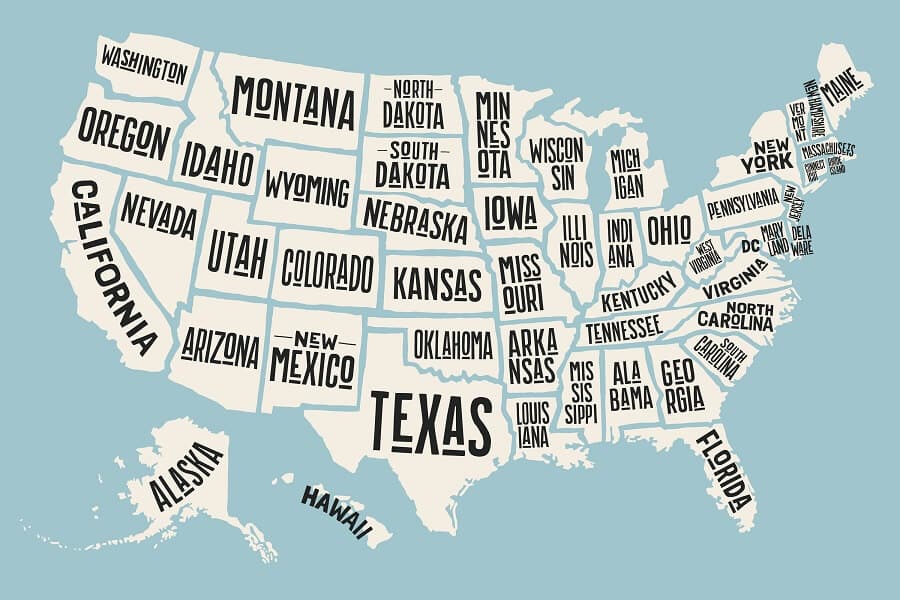

As long as an employees tipped income is equal to or greater than 512 the employer is only required by law to pay 213 per hour. Tipped minimum wage law federal law. If wages and tips do not equal the federal minimum wage of 725 per hour during any week the employer is required to increase cash wages to compensate.

Unfortunately this label can be a little deceptive. In states that allow a tip credit a certain amount of received tips per hour may be credited against the minimum wage by an employer although the tipped employee must receive at least the minimum wage with combined. Under the flsa non exempt employees must be paid the minimum wage or higher.

A tipped employee engages in an occupation in which he or she customarily and regularly receives more than 30 per month in tips. An employer of a tipped employee is only required to pay 213 per hour in direct wages if that amount combined with the tips received at least equals the federal minimum wage. The fair labor standards act flsa determines the minimum wage for employees in private and public sectors in both federal and state governments.

The united states of america federal government requires a wage of at least 213 per hour be paid to employees who receive at least 30 per month in tips. Tipped employees the improved workforce opportunity wage act public act 337 of 2018 as amended allows employers to take a tip credit on minimum wage under certain conditions for those employees who customarily and regularly receive tips. To sum it up the federal minimum wage for tipped employees is 213 per hour 725 512 213.

More From Minimum Wage Nj 2020

- 2020 Minimum Wage In The Philippines

- Minimum Wage In California August 2020

- What Is The Minimum Wage Per Hour In Florida

- California Minimum Wage A Year

- Marijuana Legalization Bill

Incoming Search Terms:

- Rhode Island Tip Pooling And Tip Credit Laws Tipmetric Software 2020 By Restaurant Tip Laws Medium Marijuana Legalization Bill,

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology Marijuana Legalization Bill,

- 1 Marijuana Legalization Bill,

- Minimum Wage Workers By State Marijuana Legalization Bill,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqvgmif2jfkg0uqoougd4k2fzumu Rc536bglbc Qmxlod5xu2i Usqp Cau Marijuana Legalization Bill,

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology Marijuana Legalization Bill,