Federal Minimum Wage Tipped Workers, Minimum Wage Michigan Restaurant Lodging Association

Federal minimum wage tipped workers Indeed lately has been hunted by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this article I will talk about about Federal Minimum Wage Tipped Workers.

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctj2sft4wh7xltihok Muzkr2slzsmstqjzfrfyxrtqhe7rr3qh Usqp Cau

- Tipped Minimum Wage Federal Rate And Rates By State Chart

- Rovarovaivalu Thesis The Effect Of The Tipped Minimum Wage On Firm

- The Racist History Behind America S Tipping Culture By Shriver Center On Poverty Law Shriver Center On Poverty Law

- Pdf The Effect Of The Tipped Minimum Wage On Employees In The U S Restaurant Industry

- Https Www Michigan Gov Documents Cis Mw Infosheet Tipped Ee 9 25 06 173903 7 Pdf

Find, Read, And Discover Federal Minimum Wage Tipped Workers, Such Us:

- Kill The Tipped Minimum Wage The New Republic

- The Minimum Wage Movement Is Leaving Tipped Workers Behind Fivethirtyeight

- Https Www Cato Org Regulation Spring 2019 Tipped Workers Minimum Wage

- Pdf The Effect Of The Tipped Minimum Wage On Employees In The U S Restaurant Industry

- The Minimum Wage Is Rising But These Workers Are Being Left Behind The New York Times

If you are looking for What Is The Minimum Wage Uk Yearly you've come to the right place. We have 104 graphics about what is the minimum wage uk yearly including pictures, photos, photographs, backgrounds, and much more. In these web page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

The Minimum Wage For Tipped Workers Hasn T Increased Since The Fall Of The Soviet Union Billmoyers Com What Is The Minimum Wage Uk Yearly

The minimum hourly rate of pay for a worker subject to tip credit provisions is.

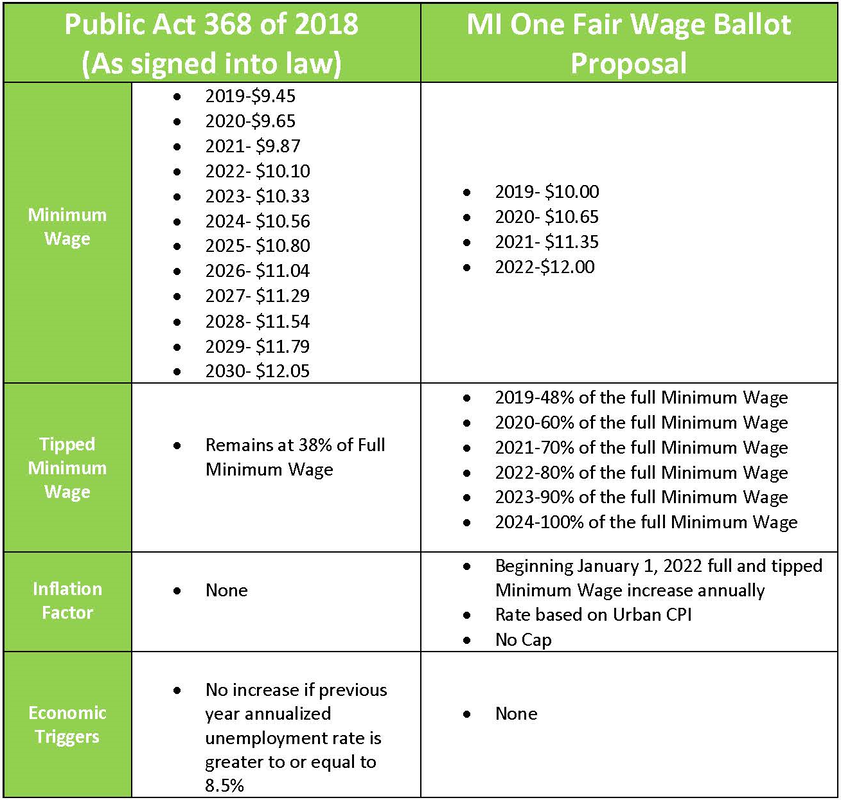

What is the minimum wage uk yearly. Effective date minimum hourly wage rate tipped employee minimum hourly wage rate provided reported tips per hour average at least january 1 2018 925 352 573 march 29 2019 945 359 586 january 1 2020 965 367 598. In states that allow a tip credit a certain amount of received tips per hour may be credited against the minimum wage by an employer although the tipped employee must receive at least the minimum wage with combined. Officials from the new jersey department of labor and workforce development today walked njbia webinar listeners through the most important information they need to know about the states new rules affecting how tipped workers are impacted by the states minimum wage law.

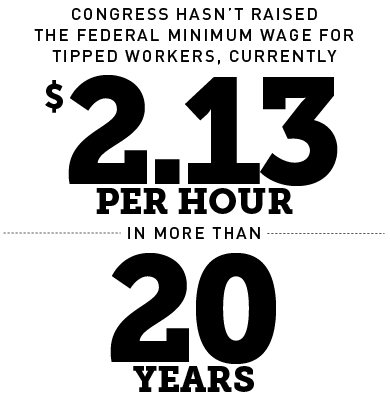

For employers with fewer than 10 full time employees at any one location who have gross annual sales of 100000 or less the basic minimum rate is 200 per hour. A tipped employee engages in an occupation in which he or she customarily and regularly receives more than 30 per month in tips. To sum it up the federal minimum wage for tipped employees is 213 per hour 725 512 213.

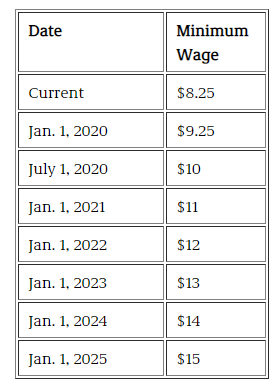

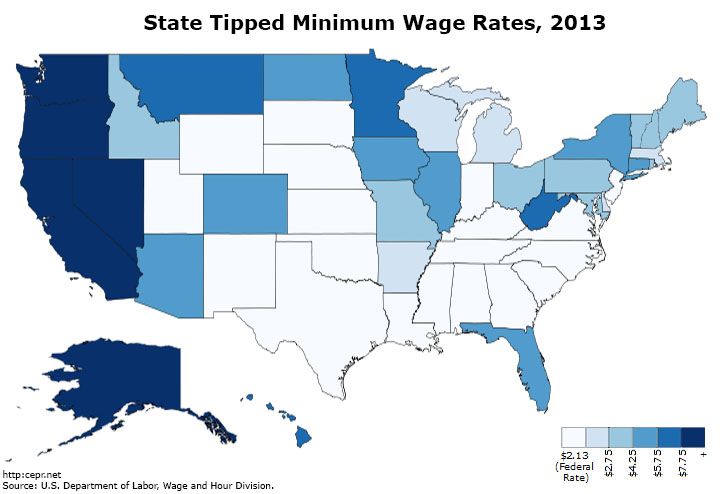

State by state minimum wage for tipped workers. Tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit. If the employees tips combined with the employers direct wages of at least 213 per.

For example for 2019 the arizona minimum cash wage for tipped workers was 800 per hour and in the state of massachusetts it was 375 per hour. For more information about tip credits and state minimum wages please read our article. Currently the federal minimum wage sits at 725 per hour.

Subsequently the sub level maximum tip credit against federal minimum wage stands at 512 per hour with the minimum cash wage at 213 per hour. Some states require employers to pay their workers more than the federal tipped minimum wage. The minimum wage for tipped employees is known as the minimum cash wage.

When the state city or county minimum wage rate is higher than the federal rate employers are required to pay workers the higher amount. If you want to pay your employees the tipped wage you must let them know the amount you are claiming as a tip credit and their hourly rate. For these employees the state wage is tied to the federal minimum wage of 725 per hour which requires an act of congress and the presidents signature to change.

Minimum wage for federal contract workers effective january 1 2020 the executive order 13658 minimum wage rate which generally must be paid to workers performing work on or in connection with covered. Tipped minimum wage law federal law. Federal minimum wage sub level for tipped workers.

More From What Is The Minimum Wage Uk Yearly

- Sc Marijuana Legalization 2020

- What Is Minimum Wage In Florida For Servers

- When Will Federal Marijuana Legalization Happen

- California Minimum Wage Part Time Salary

- California Minimum Wage Monthly After Taxes

Incoming Search Terms:

- Is A 15 Minimum Wage Coming To Hawaii Altres California Minimum Wage Monthly After Taxes,

- New York Minimum Wage For Tipped Workers Bilingual State And Federal Poster California Minimum Wage Monthly After Taxes,

- Twenty Three Years And Still Waiting For Change Why It S Time To Give Tipped Workers The Regular Minimum Wage Economic Policy Institute California Minimum Wage Monthly After Taxes,

- 5 Things That Have Changed Since The Federal Minimum Wage Was Last Increased Afl Cio California Minimum Wage Monthly After Taxes,

- Are Your Pay Rates Compliant For 2020 California Minimum Wage Monthly After Taxes,

- Who Makes Minimum Wage Pew Research Center California Minimum Wage Monthly After Taxes,

/2020-federal-state-minimum-wage-rates-2061043-final-d82d14b0792c49c8a7b85e3666d8b6b2.png)