Federal Minimum Wage With Tips, Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology

Federal minimum wage with tips Indeed lately is being sought by users around us, perhaps one of you. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of the article I will discuss about Federal Minimum Wage With Tips.

- Rhode Island Tip Pooling And Tip Credit Laws Tipmetric Software 2020 By Restaurant Tip Laws Medium

- The Minimum Wage And Tipped Minimum Wage Important Tools To Lift Wages And Reduce Poverty Particularly For Women The White House

- Does A Lower Minimum Wage For Tip Earning Workers Affect Total Pay Glassdoor Economic Research

- Tips Can Now Be Shared Between Servers And Cooks Eater

- Ppt What New Employers Need To Know About Minimum Wage Powerpoint Presentation Id 7867201

- The Minimum Wage A Crash Course The American Prospect

Find, Read, And Discover Federal Minimum Wage With Tips, Such Us:

- Understanding 2020 Us Federal Minimum Wage Laws Workest

- How Tipping Shortchanges Workers The Nation

- The Minimum Wage Movement Is Leaving Tipped Workers Behind Fivethirtyeight

- Texas Minimum Wage 2020 Resourceful Compliance

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctj2sft4wh7xltihok Muzkr2slzsmstqjzfrfyxrtqhe7rr3qh Usqp Cau

If you are looking for Minimum Wage 2020 London you've arrived at the right location. We have 104 graphics about minimum wage 2020 london adding images, photos, pictures, wallpapers, and much more. In these page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

If the employees tips combined with the employers direct wages of at least 213 per.

Minimum wage 2020 london. The flsa says tipped employees such as restaurant servers who frequently earn more than 30 in tips monthly are entitled to direct hourly wages of 213 if that amount plus their tips equal at least the federal minimum wage. If you add the 512 per hour plus the minimum tipped wage of 213 you reach the federal minimum wage of 725 an hour. Tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit.

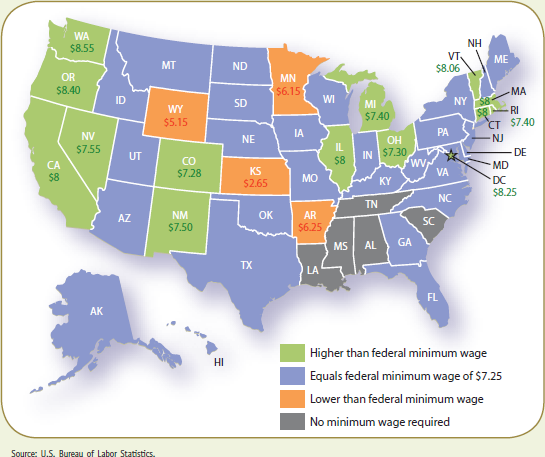

Fair labor standards act flsa 725. Maximum tip credit against minimum wage. The federal minimum wage in the united states was reset to its current rate of 725 per hour in july 2009.

Alaska 1019 american samoa. When the state city or county minimum wage rate is higher than the federal rate employers are required to pay workers the higher amount. Territories such as american samoa are exemptsome types of labor are also exempt.

Minimum cash wage 1. The federal minimum wage in 2020 is 725 per hour and has not increased since july 2009. 29 cfr 53151 additionally the employee must earn the standard minimum wage rate currently 725 when tips earned are combined with wages earned under the tipped wage rate.

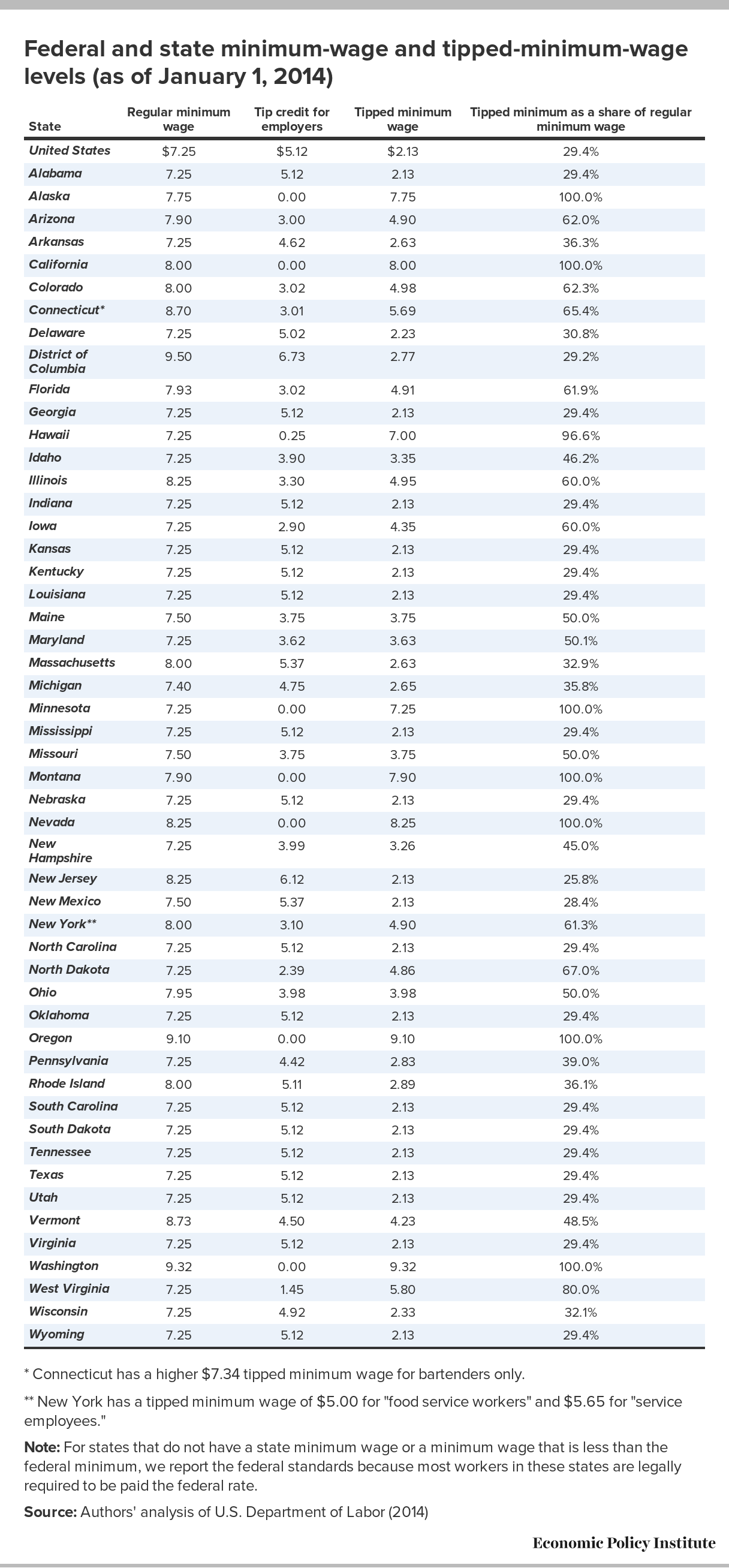

To sum it up the federal minimum wage for tipped employees is 213 per hour 725 512 213. The federal minimum tip wage is combined with a tip credit to reach the federal minimum wage. An employer is permitted to pay an employee the tipped wage rate if the employee customarily and regularly receives more than 30 a month in tips.

In states that allow a tip credit a certain amount of received tips per hour may be credited against the minimum wage by an employer although the tipped employee must receive at least the minimum wage with combined. The united states of america federal government requires a wage of at least 213 per hour be paid to employees who receive at least 30 per month in tips. An employer of a tipped employee is only required to pay 213 per hour in direct wages if that amount combined with the tips received at least equals the federal minimum wage.

Employers may pay tipped labor a minimum of 213 per hour as long as the hour wage plus tip income equals at least the minimum wage. State requires employers to pay tipped employees full state minimum wage before tips. Tipped minimum wage law federal law.

Definition of tipped employee by minimum tips received monthly unless otherwise specified federal. However some states cities and counties have a higher minimum wage rate. Persons under the age of 20 may be paid 425 an hour for.

A tipped employee engages in an occupation in which he or she customarily and regularly receives more than 30 per month in tips. The minimum wage for tipped employees is known as the minimum cash wage. For example the maximum federal tip credit is currently 512 per hour.

More From Minimum Wage 2020 London

- California Minimum Wage Hike Schedule

- How Much Is Minimum Wage In New York Right Now

- What Is The Minimum Wage In California Right Now

- How Much Is Minimum Wage For Over 25s

- Federal Minimum Wage New York

Incoming Search Terms:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctj2sft4wh7xltihok Muzkr2slzsmstqjzfrfyxrtqhe7rr3qh Usqp Cau Federal Minimum Wage New York,

- After 23 Years Your Waiter Is Ready For A Raise Minimum Wage Waiter Chart Federal Minimum Wage New York,

- Early 2019 State Minimum Wage Updates Govdocs Federal Minimum Wage New York,

- Calculating Wages Using Tip Credit Sap Bibliothek Payroll United States Py Us Federal Minimum Wage New York,

- Should Servers Be Paid The Federal Minimum Wage In Addition To Income From Tips Debate Org Federal Minimum Wage New York,

- Rovarovaivalu Thesis The Effect Of The Tipped Minimum Wage On Firm Federal Minimum Wage New York,

:max_bytes(150000):strip_icc()/StateMinimumWageLegislation-c8edd859dde74814a6538680e3a216fd.png)