Florida Minimum Wage Law For Tipped Employees, Https Floridajobs Org Docs Default Source 2016 Minimum Wage Increases Florida Minimum Wage 2016 Announcement Pdf

Florida minimum wage law for tipped employees Indeed recently has been hunted by consumers around us, maybe one of you. People are now accustomed to using the net in gadgets to see video and image data for inspiration, and according to the title of the article I will talk about about Florida Minimum Wage Law For Tipped Employees.

- Minimum Wage Increases 2017 A Complete Guide To State City Law

- Twenty Three Years And Still Waiting For Change Why It S Time To Give Tipped Workers The Regular Minimum Wage Economic Policy Institute

- Tipping Your Servers 15 20 Is Standard But What If Chicago Requires They Get Paid Full Minimum Wage Chicago Tribune

- What You Need To Know About Michigan S New Minimum Wage Sick Pay Laws Mlive Com

- Montgomery County Md Minimum Wage And Overtime Law Poster

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqvgmif2jfkg0uqoougd4k2fzumu Rc536bglbc Qmxlod5xu2i Usqp Cau

Find, Read, And Discover Florida Minimum Wage Law For Tipped Employees, Such Us:

- Joel Franco On Twitter Florida Minimum Wage Will Go Up From 8 25 To 8 46 Per Hour On Jan 1 2019

- Understanding Florida Minimum Wage Laws Resourceful Compliance

- Georgia Tip Pooling And Tip Credit Laws Tipmetric 2020 By Restaurant Tip Laws Medium

- After 23 Years Your Waiter Is Ready For A Raise The Salt Npr

- Florida S 2020 Minimum Wage Increase The Labor Employment Blog

If you re searching for Minimum Wage In California In 2021 you've arrived at the ideal location. We have 104 graphics about minimum wage in california in 2021 including pictures, photos, pictures, backgrounds, and much more. In such webpage, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

This is called a tip.

/person-paying-waiter-for-restaurant-bill-88305841-5a309a8489eacc0037df4a32.jpg)

Minimum wage in california in 2021. The minimum wage in florida is 856 as of 2020. Minimum wage and overtime for tipped employees. Georgia has a state minimum wage law but it does not apply to tipped employees.

As long as an employee makes at least 302 in tips florida employers can pay them 554 per hour. Under the flsa and florida law however employers can apply a tip credit to the wages of qualified tipped employees. Because the florida minimum wage is higher employees are entitled to earn at least that much per hour.

In florida the minimum wage is 856 per hour for most employees and 554 per hour for tipped workers 2020. Under this law a florida employer receives a tip credit for the 302 difference between the employees actual hourly wage and the minimum wage. The florida constitution provides that tipped employees may be paid an hourly rate of only of 302 less than the current florida minimum wage.

Tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit. Under the flsa employers may take a tip credit for the amount of tips received by a tipped employee. 11 us virgin islands.

An employer must pay tipped employees at least 213 per hour. Restaurant servers and other employees who earn tips must earn the florida minimum wage of 825 per hour. Under federal law and in most states employers may pay tipped employees less than the minimum wage as long as employees earn enough in tips to make up the difference.

In other words florida employers can take a 302 wage credit for all tipped employees. Section 3m of the flsa permits an employer to take a tip credit toward its minimum wage obligation for tipped employees equal to the difference between the required cash wage which must be at least 213 and the federal minimum wage. Floridas current minimum wage for tipped employees is 554.

Just like at the federal level hourly earnings can exceed the minimum wage rate due to increased tips. In arkansas where the minimum wage rate is 10 per hour the maximum tip credit is 737 making the minimum cash wage for tipped employees 263. The state minimum wage rates may be increased annually based upon changes in the cost of living index which would in turn increase the minimum cash wage for tipped employees.

Under florida minimum wage laws if employers choose to pay the tipped minimum wage they must ensure that tipped employees are paid the regular minimum wage rate of 805 when the tipped wage rate is combined with tips received.

More From Minimum Wage In California In 2021

- What Is Minimum Wage Tn

- Marijuana Legalization Ny Bill

- How Much Is Minimum Wage For Over 25s In The Uk

- Florida Minimum Wage Jobs

- Minimum Wage Quebec May 2020

Incoming Search Terms:

- State By State Minimum Wage Updates For 2020 Minimum Wage Quebec May 2020,

- What Is Minimum Wage For Servers In Florida Law Offices Of Eddy Marban Minimum Wage Quebec May 2020,

- Mandatory Florida Poster Update 2019 Minimum Wage Compliance Poster Company Minimum Wage Quebec May 2020,

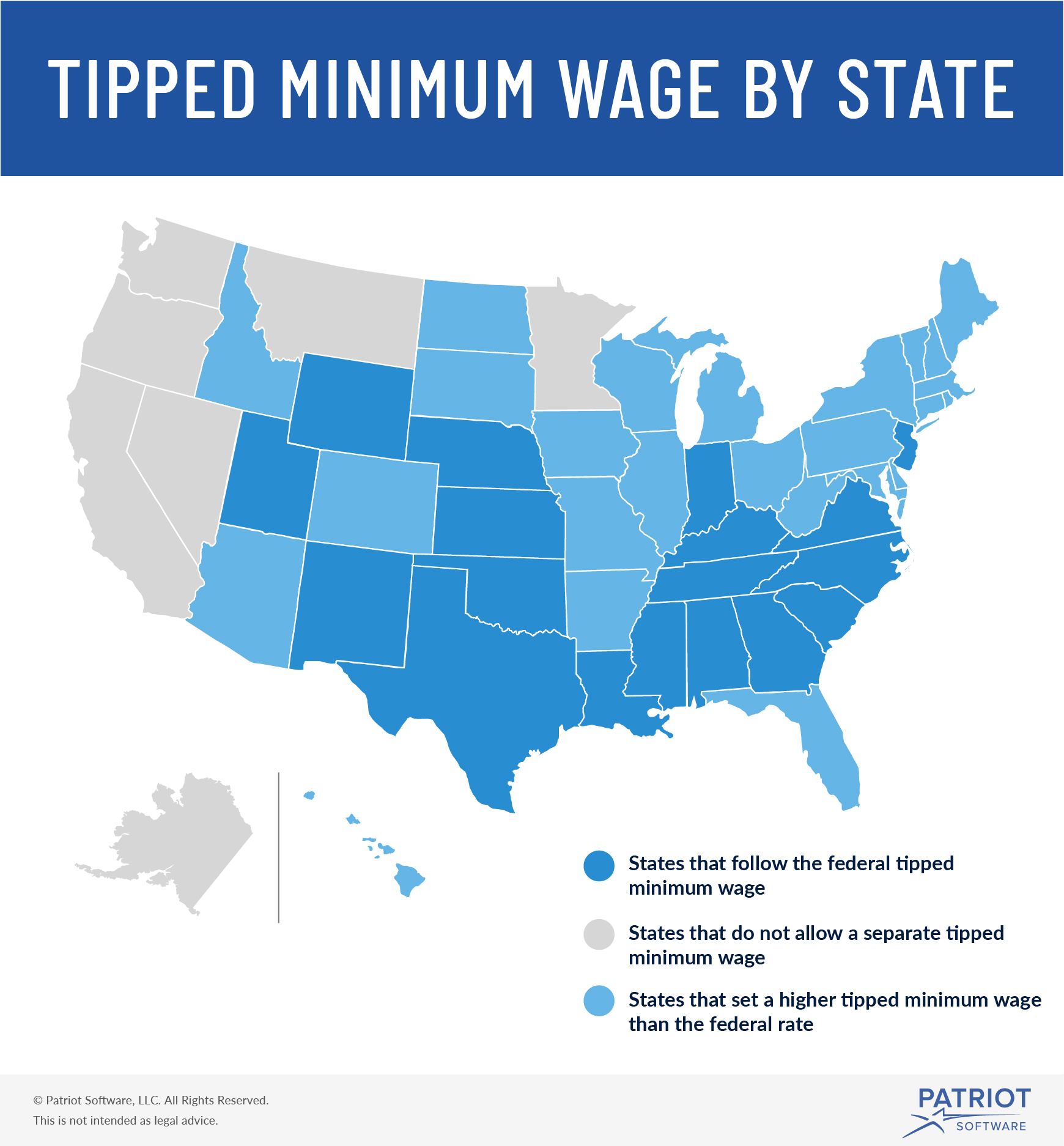

- Tipped Minimum Wage Federal Rate And Rates By State Chart Minimum Wage Quebec May 2020,

- Restaurant Law Firm Defending Claims From Waitresses Servers And Bartenders In Florida Minimum Wage Quebec May 2020,

- Twenty Three Years And Still Waiting For Change Why It S Time To Give Tipped Workers The Regular Minimum Wage Economic Policy Institute Minimum Wage Quebec May 2020,

/2020-federal-state-minimum-wage-rates-2061043-final-d82d14b0792c49c8a7b85e3666d8b6b2.png)

/StateMinimumWageLegislation-c8edd859dde74814a6538680e3a216fd.png)