How Much Is Minimum Wage After Tax In Nz, New Zealand Nz Salary After Tax Calculator

How much is minimum wage after tax in nz Indeed lately is being sought by consumers around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the article I will discuss about How Much Is Minimum Wage After Tax In Nz.

- Chartered Accountant Average Salary In New Zealand 2020 The Complete Guide

- Emigrating Out Of Singapore Occupations Salary And Cost Of Living

- 1 7b In And 43m Out The Government S Double Standard On Tobacco Stuff Co Nz

- Full Time Work On The Minimum Wage Is Enough To Keep A Nz Family Out Of Poverty Utopia You Are Standing In It

- Economics New Zealand Should We Jack Up The Minimum Wage

- Briefing For The Incoming Minister Of Revenue 2011 2 The New Zealand Tax System And How It Compares Internationally February 2012

Find, Read, And Discover How Much Is Minimum Wage After Tax In Nz, Such Us:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqmozhlncuymewt Qrblxnd N4zfdmzwqantsldxhln2oblkstj Usqp Cau

- Summary Of The Wage Subsidy Scheme And Essential Workers Leave Support Scheme 7 April

- Pdf Possible Value Added Tax Simplification Measures For Small Businesses In Botswana Lessons From New Zealand

- What Is Minimum Wage After Tax Nz

- Nz Income Tax Calculator November 2020 Incomeaftertax Com

If you are looking for Florida Minimum Wage Amendment Pros And Cons you've reached the ideal place. We ve got 104 graphics about florida minimum wage amendment pros and cons adding pictures, pictures, photos, wallpapers, and more. In these page, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

This represents an increase of 73 over the previous level the largest yearly percentage increase within the last 12 years.

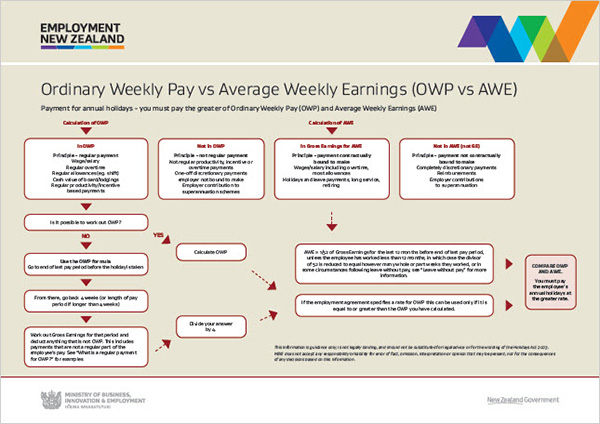

Florida minimum wage amendment pros and cons. 1890 an hour before tax. Current minimum wage rates. Employers in new zealand usually deduct the relevant amount of tax from the salary through a pay as you earn paye system.

The current minimum wage rates before tax are as at 1 april 2020 and apply to employees aged 16 years or over. What is my take home pay on the adult minimum wage. Kiwis who work for 40 hours on the current minimum wage will get an extra 48 per week before tax when it rises.

The adult minimum wage rate for employees aged 16 years or older. Earning 55000 salary per year before tax in new zealand your net take home pay will be 4471550 per year. Your current employer must pay you the adult minimum wage.

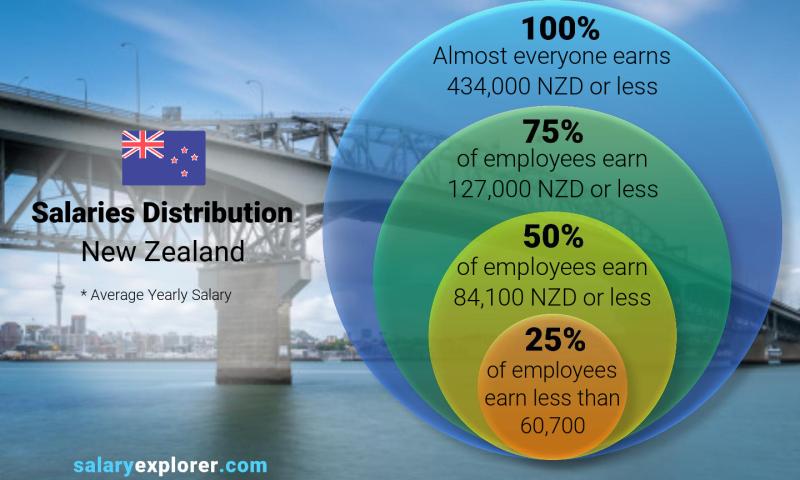

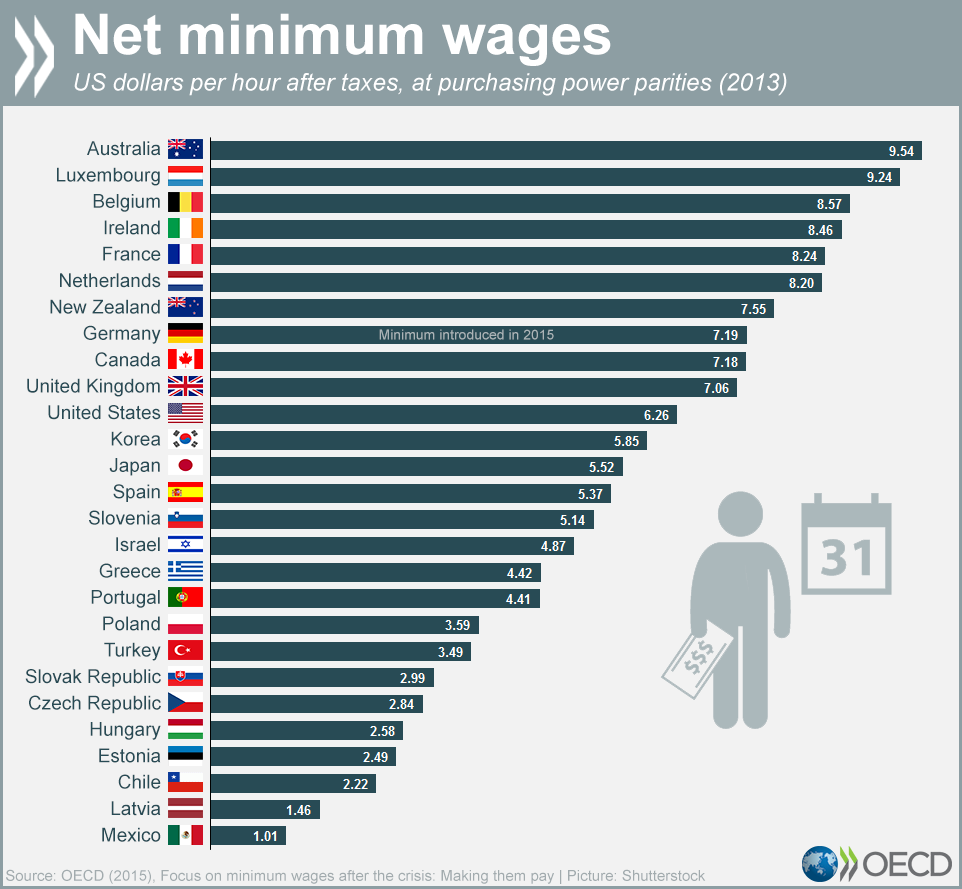

Your average tax rate will be 187. This places new zealand on the 22nd place in the international labour organisation statistics for 2012. Learn about the different ways you might get paid in nz minimum wage and salary rules and paying tax and tax rates when working on a student visa.

Type of minimum wage per hour 8 hour day 40 hour week 80 hour fortnight. This is equivalent to 273883 per month or 63204 per week. Earning the adult minimum wage per year before tax in new zealand your net take home pay will be 3286596 per year.

Your average tax rate is 1749 and your marginal tax rate is 3146this marginal tax rate means that your immediate additional income will be taxed at this rate. 139 acc will also be deducted. What you need to know.

Kiwisaver student loan secondary tax tax code acc paye. New zealands minimum wage will rise to 1890 an hour from april 1 the government. 1770 from 1 april 2019 the adult minimum wage was increased 120 to 1770 as of 1 april 2019.

If you make 50000 a year living in new zealand you will be taxed 8745that means that your net pay will be 41255 per year or 3438 per month. Learn about the different ways you might get paid in nz minimum wage and salary rules and paying tax and tax rates when working on a student visa. Posted on 1 april 2019.

Minimum wage boosted 73 in 2019 new rate. The average monthly net salary in new zealand nz is around 3 117 nzd with a minimum income of 2 157 nzd per month. This is equivalent to 372629 per month or 85991 per week.

756 before tax for a 40 hour week. New zealands best paye calculator. Get the info about minimum wage here on employmentgovtnz.

Your marginal tax rate will be 3000 which is in the 3rd tax bracket.

What Impact Will 2019 S Minimum Wage Hikes Have Restaurant Association Of New Zealand Florida Minimum Wage Amendment Pros And Cons

More From Florida Minimum Wage Amendment Pros And Cons

- Marijuanas Legalized Florida Card

- Az Minimum Wage 2020

- How Much Is Minimum Wage In England 2019

- Federal Minimum Wage For 2020

- What Is The Minimum Wage London 2020

Incoming Search Terms:

- Inequitable Income Distribution General Maharaj Party What Is The Minimum Wage London 2020,

- What Is Minimum Wage After Tax Nz What Is The Minimum Wage London 2020,

- Tax Accountant Tax Rates Income Tax Tax Facts National Accountants What Is The Minimum Wage London 2020,

- Living In New Zealand Guide For Expats Moving Residing Working In Nz What Is The Minimum Wage London 2020,

- Income Gap Widening In New Zealand Evolve What Is The Minimum Wage London 2020,

- Covid 19 Update For Businesses What Is The Minimum Wage London 2020,