How Much Is Minimum Wage After Taxes In California, How Doug Ford S Pledge Of Zero Income Tax Leaves Minimum Wage Earners Worse Off Cbc News

How much is minimum wage after taxes in california Indeed lately has been sought by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of this post I will discuss about How Much Is Minimum Wage After Taxes In California.

- 2020 Tax Changes For 1099 Independent Contractors Updated For 2020

- 2021 State Business Tax Climate Index Tax Foundation

- State Income Tax Wikipedia

- What Are Employee And Employer Payroll Taxes Ask Gusto

- Cupertino City Mandated Minimum Wage Poster

- The Real Value Of 100 In Each State Tax Foundation

Find, Read, And Discover How Much Is Minimum Wage After Taxes In California, Such Us:

- Free California Payroll Calculator 2020 Ca Tax Rates Onpay

- If A Restaurant Adds A Surcharge Do I Still Have To Tip Laist

- 2019 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

- The Cost Of Living In California Smartasset

- The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

If you re searching for Minimum Wage In California Kern County you've come to the right place. We ve got 104 graphics about minimum wage in california kern county including images, photos, photographs, wallpapers, and much more. In these webpage, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Most likely if you get a minimum wage job it will not be full time.

Minimum wage in california kern county. 2020 state minimum wage updates. The minimum wage applies to most employees in california with limited exceptions including tipped employees some student workers and other exempt occupations. The minimum wage in california means that a full time worker can expect to earn the following sums as a minimum before tax.

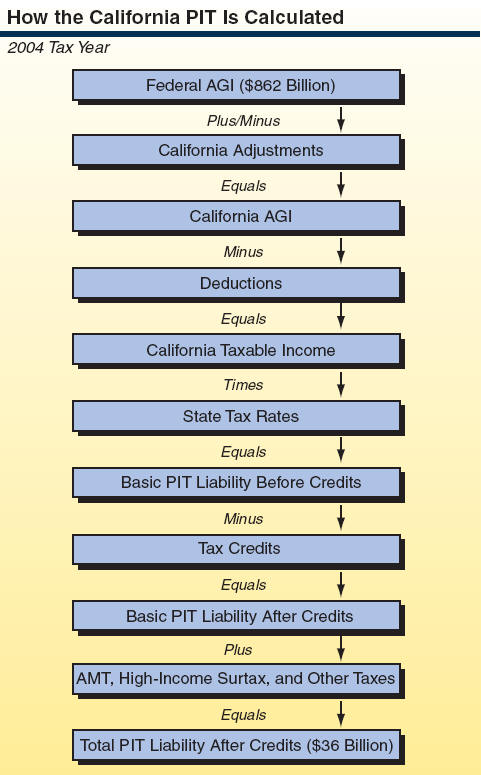

California has 10 personal income tax rates ranging from 0 to 133 percent as of 2020. As of july 1 the minimum wage in calif. If it were a full time job then you would get about 16000 a year.

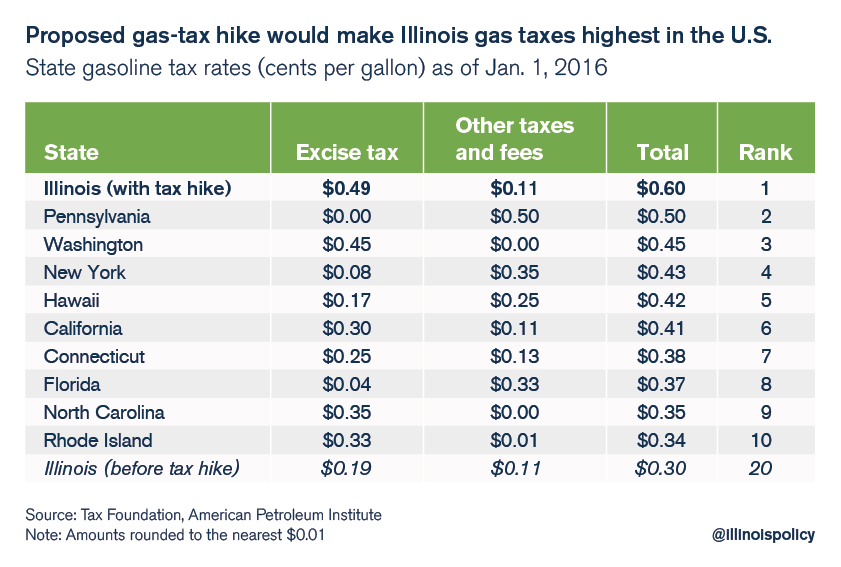

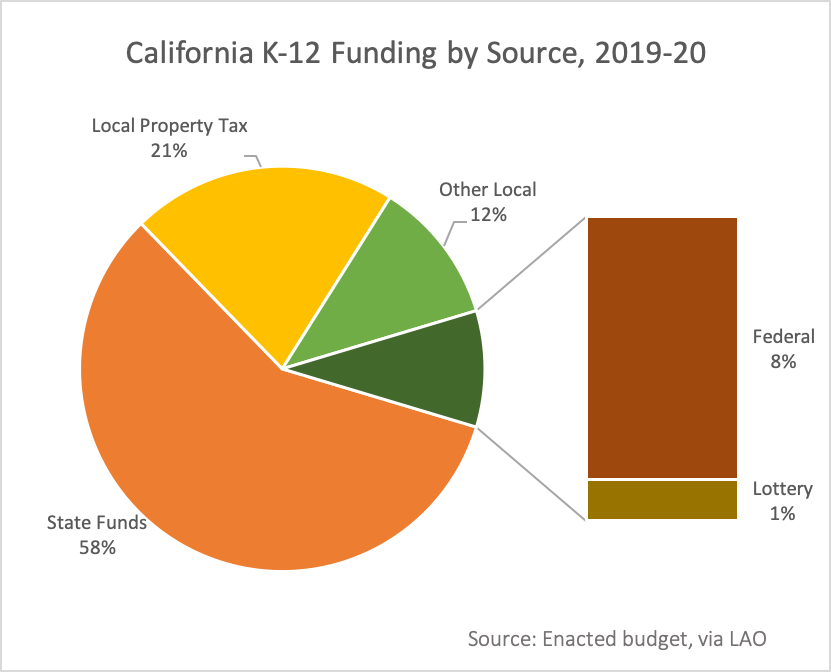

All cities with increasing rates in 2020 will be well above the federal minimum wage of 725. Income taxes are levied on both residents incomes and income earned in the state by non residents. The minimum wage is the minimum hourly rate that nearly all california employees must be paid for their work by law.

Although there are some exceptions almost all employees in california must be paid the minimum wage as required by state law. The states standard deduction however is a fairly decent 4537 per person. 52000 per working week.

If that was your only source of income than after taking the standard deduction on your tax return and getting your personal exemptions then the tax owed would be little or none. In 2020 californias minimum wage is 1200 per hour for employees that work for employers with 25 or fewer employees and 1300 per hour for larger employers. 2020 california city minimum wage rates.

You are entitled to be paid the higher state minimum wage. And it remains that rate for 1 12 yrs. The 2020 state rate for california will be 12 for small employers and 13 for large employers.

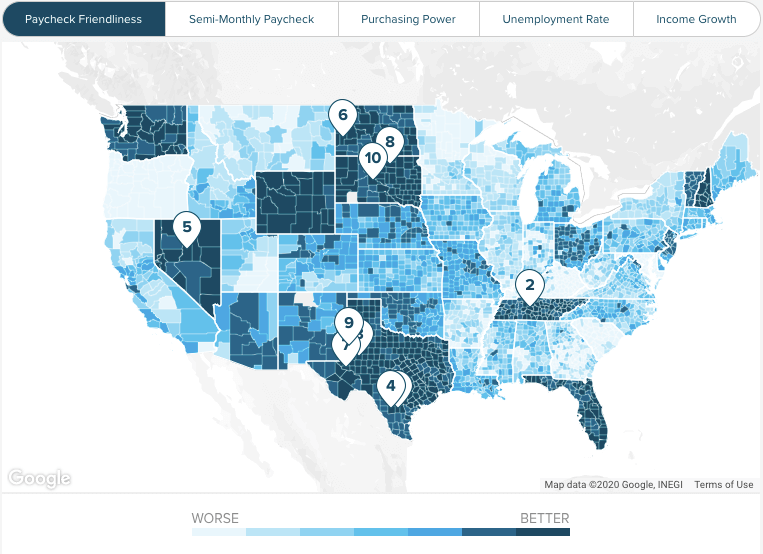

That is what you are taxed on that is what your employer reports on his quarterly reports and what he charges to wages. Your average tax rate is 2072 and your marginal tax rate is 3765this marginal tax rate means that your immediate additional income will be taxed at this rate. Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950.

Effective january 1 2017 the minimum wage for all industries will be increased yearly. These assume a 40 hour working week. From january 1 2017 to january 1 2022 the minimum wage will increase for employers employing 26 or more employees.

In california the applicable minimum wage depends on the size of the employer. One thing about minimum wage in california. Californias state minimum wage rate is 1300 per hourthis is greater than the federal minimum wage of 725.

If you make 55000 a year living in the region of california usa you will be taxed 11394that means that your net pay will be 43606 per year or 3634 per month. These assume a 40 hour working week. Your take home pay is just that you get paid 9hr in calif.

More From Minimum Wage In California Kern County

- Minimum Wage Canada

- Legalization Of Marijuana Essay Outline

- What Is The Minimum Wages In New Zealand

- 2020 Minimum Wage Hawaii

- Minimum Wage In California In 1996

Incoming Search Terms:

- State Income Tax Wikipedia Minimum Wage In California In 1996,

- The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy Minimum Wage In California In 1996,

- California S Tax System A Primer Minimum Wage In California In 1996,

- California S Tax System A Primer Minimum Wage In California In 1996,

- Taxes In California For Small Business The Basics Minimum Wage In California In 1996,

- Amazon Com Ca Labor Law Poster 2020 Edition State Federal And Osha Compliant Laminated Poster California English Prints Office Products Minimum Wage In California In 1996,