How Much Is Minimum Wage In California After Taxes, The True Cost To Hire An Employee In California Infographic

How much is minimum wage in california after taxes Indeed recently is being sought by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of this post I will discuss about How Much Is Minimum Wage In California After Taxes.

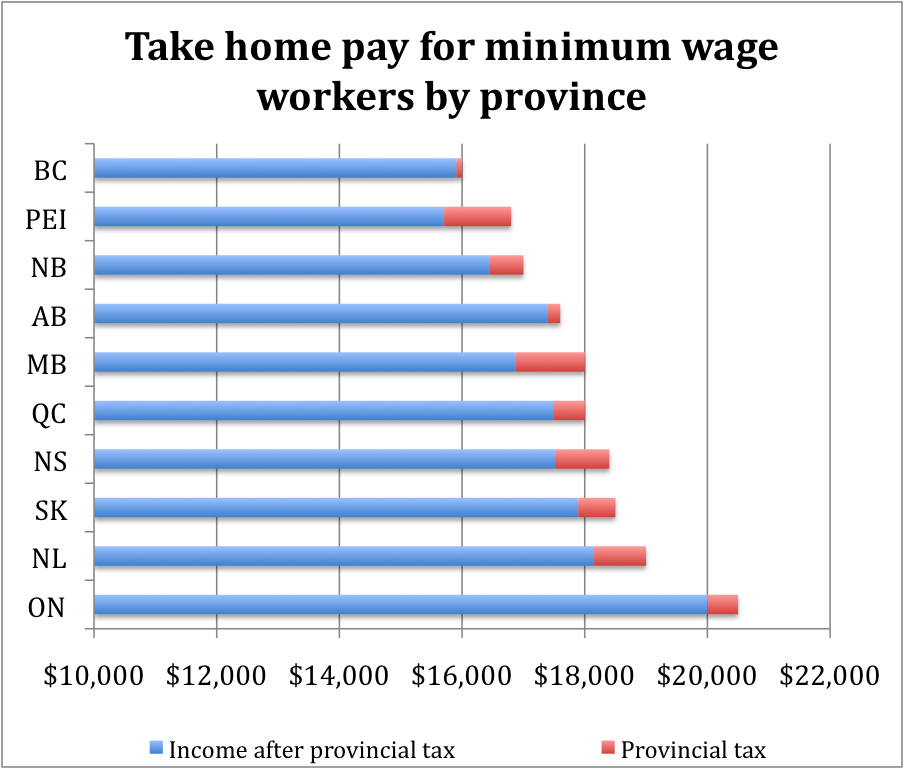

- Making Sense Of A 15 Minimum Wage In Alberta Macleans Ca

- 2019 Ontario Budget Giving Parents Flexible And Affordable Child Care Choices

- Tax Plan Alberta Ca

- Who Pays 6th Edition Itep

- State Corporate Income Tax Rates And Brackets For 2020

- Understanding California S Property Taxes

Find, Read, And Discover How Much Is Minimum Wage In California After Taxes, Such Us:

- State Income Tax Wikipedia

- California Voters Support Increasing Tobacco Tax Raising Minimum Wage The Sacramento Bee

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- California State Tax H R Block

- 15 Minimum Wage Is Not How To Help Poor Workers Time

If you are looking for What Is The Minimum Wage In Japan In Us Dollars you've reached the right location. We have 104 graphics about what is the minimum wage in japan in us dollars including images, photos, pictures, wallpapers, and much more. In such web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Low Income Health Insurance In California Health For California What Is The Minimum Wage In Japan In Us Dollars

You are entitled to be paid the higher state minimum wage.

What is the minimum wage in japan in us dollars. For instance where are you. Your average tax rate is 2072 and your marginal tax rate is 3765this marginal tax rate means that your immediate additional income will be taxed at this rate. The minimum wage is the minimum hourly rate that nearly all california employees must be paid for their work by law.

These assume a 40 hour working week. The federal minimum wage. Although there are some exceptions almost all employees in california must be paid the minimum wage as required by state law.

Your take home pay is just that you get paid 9hr in calif. In states with a higher rate such as oregon and washington minimum wage workers earn more than the national average. Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950.

Workers in the state of washington trail close earning a minimum wage rate of 947 hourly. The minimum wage will vary depending on what state you are in or even what you do. The minimum wage in california means that a full time worker can expect to earn the following sums as a minimum before tax.

In 2020 californias minimum wage is 1200 per hour for employees that work for employers with 25 or fewer employees and 1300 per hour for larger employers. The california minimum wage was last changed in 2008 when it. If you make 55000 a year living in the region of california usa you will be taxed 11394that means that your net pay will be 43606 per year or 3634 per month.

The minimum wage applies to most employees in california with limited exceptions including tipped employees some student workers and other exempt occupations. Effective january 1 2017 the minimum wage for all industries will be increased yearly. 52000 per working week.

If that was your only source of income than after taking the standard deduction on your tax return and getting your personal exemptions then the tax owed would be little or none. From january 1 2017 to january 1 2022 the minimum wage will increase for employers employing 26 or more employees. The methodology for further increases essentially applies an increase over the prior minimum wage that is equal to the lesser of.

These assume a 40 hour working week. As of july 1 the minimum wage in calif. The only answer i can give you is not much any more than that depends on many facts that i do not know.

If it were a full time job then you would get about 16000 a year. In california the applicable minimum wage depends on the size of the employer. Most likely if you get a minimum wage job it will not be full time.

And it remains that rate for 1 12 yrs. Californias state minimum wage rate is 1300 per hourthis is greater than the federal minimum wage of 725.

California Taxes A Guide To The California State Tax Rates What Is The Minimum Wage In Japan In Us Dollars

More From What Is The Minimum Wage In Japan In Us Dollars

- Federal Minimum Wage Act Posting

- Nys Minimum Wage Increase 2021

- Us Minimum Wage History

- Minimum Wage Tampa Florida

- 2020 Minimum Wage Oregon

Incoming Search Terms:

- The Cost Of Hiring Employees In California Infographic 2020 Minimum Wage Oregon,

- Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More 2020 Minimum Wage Oregon,

- How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center 2020 Minimum Wage Oregon,

- California Cupertino Minimum Wage 2020 Minimum Wage Oregon,

- California S Corporate Income Tax Rate Could Rival The Federal Rate Tax Foundation 2020 Minimum Wage Oregon,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrxmvuztydis77 Knr Mxlkzg7tqzt Ysq51hhw3og2y Jzmup2 Usqp Cau 2020 Minimum Wage Oregon,