Marijuana Legalization And Taxes Federal Revenue Impact, Risk Management Within The Cannabis Industry Building A Framework For The Cannabis Industry Parker 2019 Financial Markets Institutions Amp Instruments Wiley Online Library

Marijuana legalization and taxes federal revenue impact Indeed recently has been sought by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of this post I will talk about about Marijuana Legalization And Taxes Federal Revenue Impact.

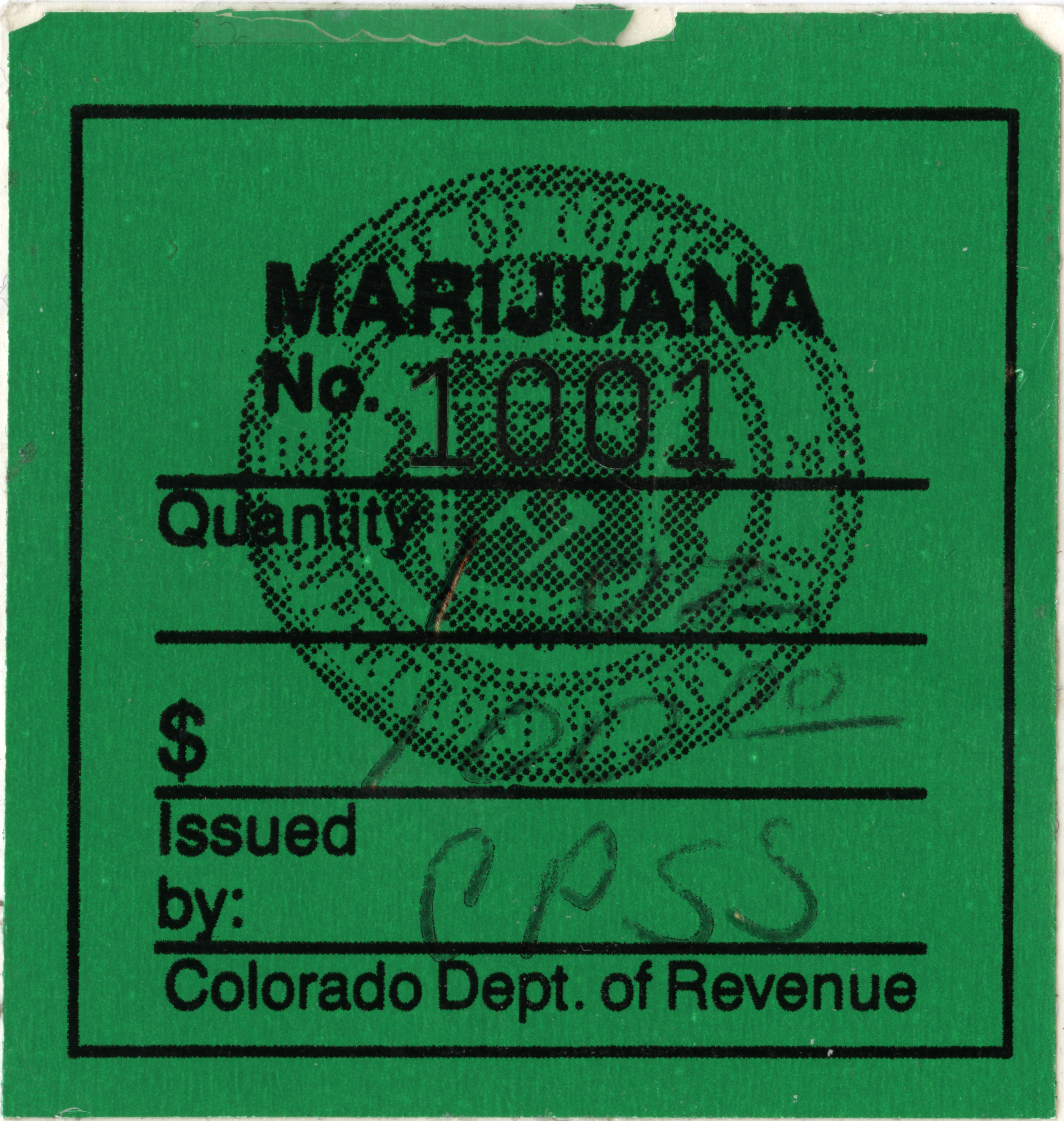

- Colorado Marijuana Tax Cash Fund Spent On Variety Of Needs

- Https Www Aclu Nj Org Files 7414 6409 3443 2016 05 24 Mjrevenue Pdf

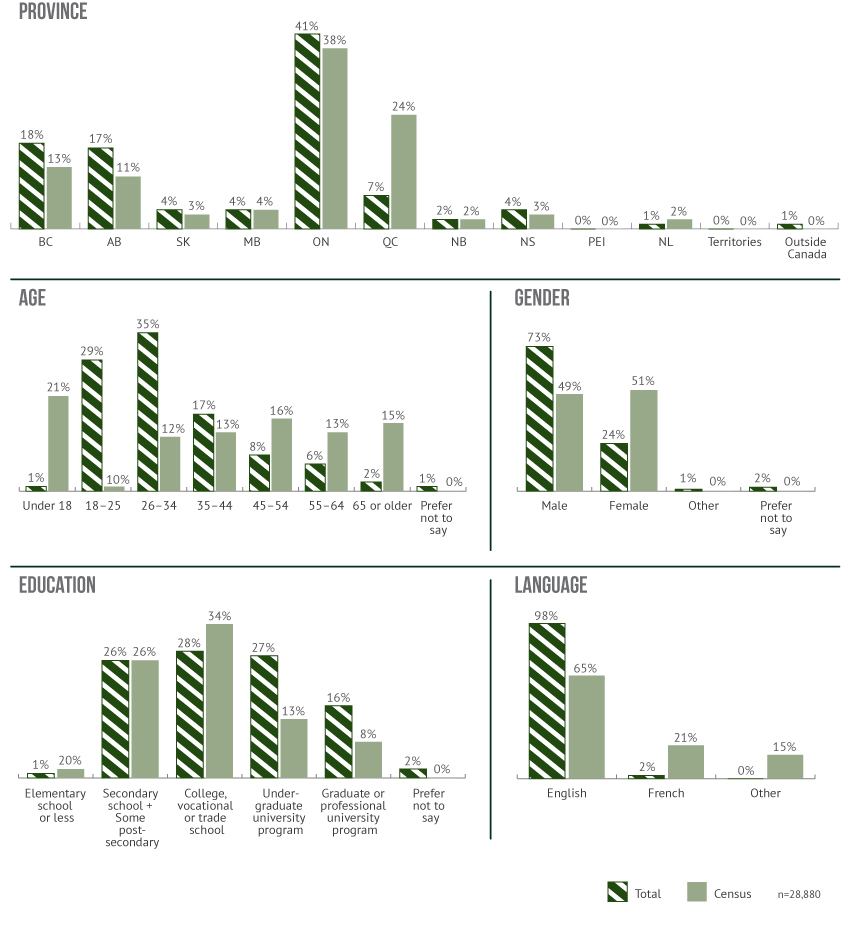

- A Framework For The Legalization And Regulation Of Cannabis In Canada Canada Ca

- The Economic Benefits Of Legalizing Weed

- A Framework For The Legalization And Regulation Of Cannabis In Canada Canada Ca

- Marijuana Is A Budding Industry Can It Be Scaled Issue Number One

Find, Read, And Discover Marijuana Legalization And Taxes Federal Revenue Impact, Such Us:

- 86 Billion In Additional U S Tax Revenues By 2025 New Frontier Data Projects Federal Cannabis Legalization Will Boost Growth Across Many Industries As 116th Congress Discusses Cannabis Policy

- Taxing Cannabis Itep

- Https Www Aclu Nj Org Files 7414 6409 3443 2016 05 24 Mjrevenue Pdf

- Don T Get Too High On Potential Marijuana Revenues Cbcny

- The Economic Effects Of The Marijuana Industry In Colorado

If you re looking for Minimum Wage January 2020 you've reached the ideal location. We have 101 graphics about minimum wage january 2020 adding images, photos, pictures, wallpapers, and more. In these web page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

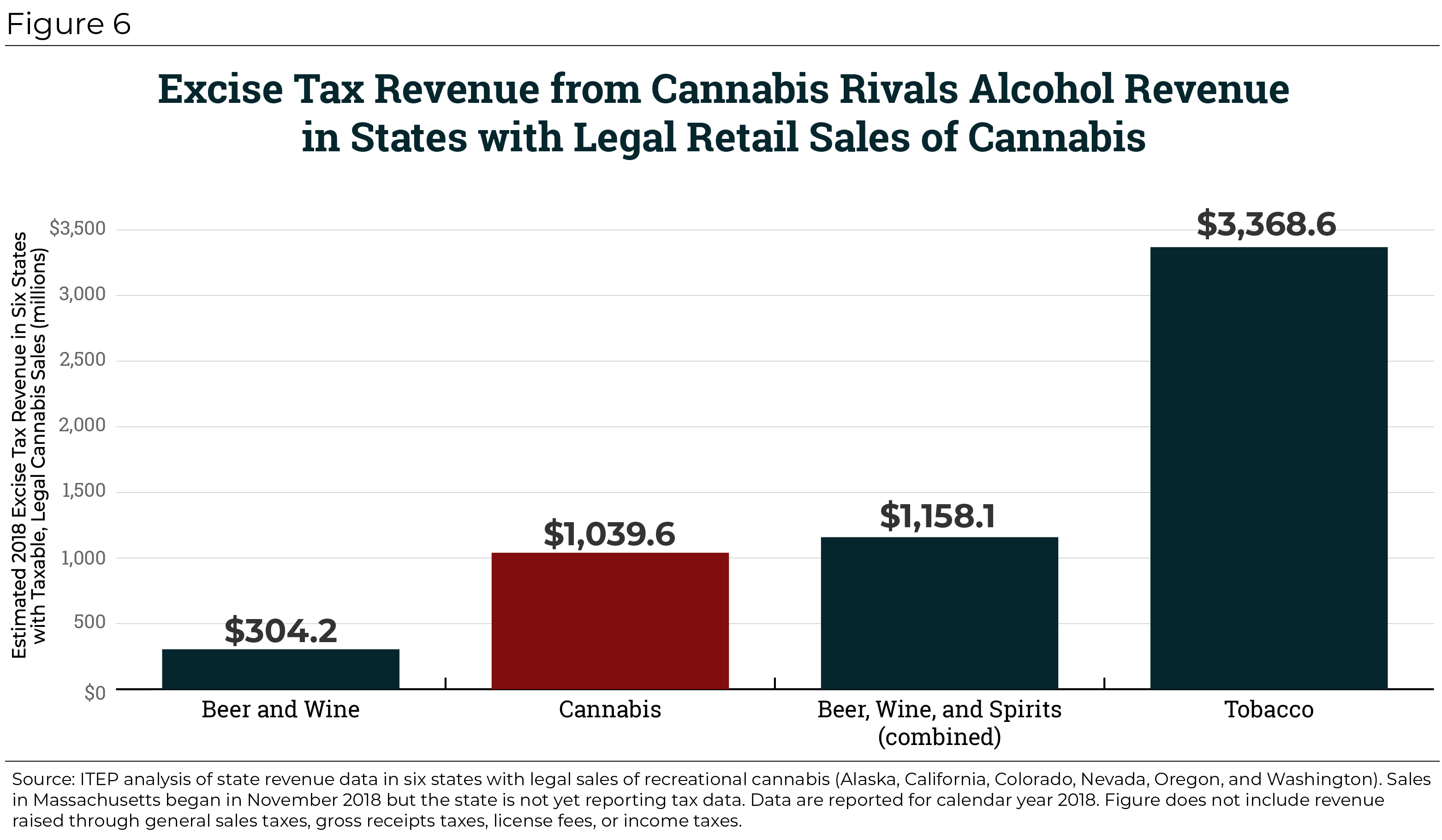

These tax rates are relatively high especially when compared to standard state sales tax rates but they are accepted by the industry as part of the cost of doing businessthis has been a huge boon for these states as a recent study by new frontier data reports that theyre on track to take in about 655 million in taxes on the legal marijuana industry in 2017.

/shutterstock_357883577-5bfc3b2946e0fb00511dd3bc.jpg)

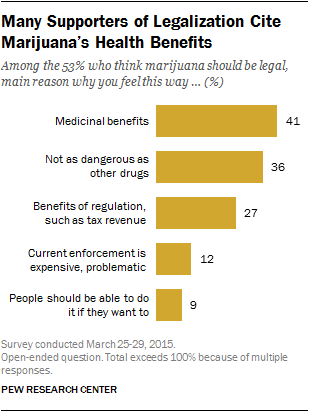

Minimum wage january 2020. Clinical and experimental research explores how marijuana legalization impacts alcohol consumption. A mature marijuana industry could generate up to 28 billion in tax revenues for. The information is in its new study marijuana legalization and taxes.

55 billion from business taxes and 15 billion from income and payroll taxes. A 2015 study published in alcoholism. Marijuana legalization and taxes.

509 may 2016 key findings marijuana tax collections in colorado and washington have exceeded initial estimates. Federal revenue impact by gavin ekins joseph henchman research economist vice president legal state projects no. Easton attempted to calculate how much tax revenue the canadian government could gain by legalizing marijuana.

A 2016 rcg economics and marijuana policy group study on nevada says that legalizing recreational marijuana in the state could support over 41000 jobs till 2024 and generate over 17 billion in. About 28 b per annum according to the tax foundation. The federal government would reap 517 billion in sales tax from a legal marijuana market between 2017 and 2025 entirely new revenue for a business that remains illegal and unable to be taxed.

Oglesby claims that washington states legalization proposal initiative 502 which includes restrictions on advertising and drugged driving and has three distinct excise taxes could generate approximately 500 million in state revenue 9. Marijuana tax collections in colorado and washington have exceeded initial estimates. Marijuana legalization taxes.

Theres another cost to the war on drugs toothe revenue lost by governments that cannot collect taxes on the sale of illegal drugsin a 2010 study for the fraser institute economist stephen t. Tax expert and attorney pat oglesby conducted an analysis of existing marijuana tax proposals 8.

More From Minimum Wage January 2020

- Legalization Of Marijuana Montana

- California Minimum Wage 2021 Exempt

- Federal Marijuana Legalization Is Close Suggests Canopy Acreage Deal

- Legalization Of Weed Effect On Economy

- California Minimum Wage Raise Schedule

Incoming Search Terms:

- A Framework For The Legalization And Regulation Of Cannabis In Canada Canada Ca California Minimum Wage Raise Schedule,

- The Federal Government And Marijuana Legalization Guinn Center For Policy Priorities California Minimum Wage Raise Schedule,

- 6 Ways Legal Cannabis Is Good For The Economy Greenstar Atm California Minimum Wage Raise Schedule,

- Here S What The Numbers Show About The Impact Of Legal Marijuana Marketwatch California Minimum Wage Raise Schedule,

- A Road Map To Recreational Marijuana Taxation Tax Foundation California Minimum Wage Raise Schedule,

- View Of The Politics Of Pot In Canada Consumers Enforcers And Profiteers Journal Of Community Safety And Well Being California Minimum Wage Raise Schedule,