Maryland Minimum Wage 2020 For Tipped Employees, Minimum Wage Workers In 21 States Will Get Raises In 2020 Across America Us Patch

Maryland minimum wage 2020 for tipped employees Indeed lately has been hunted by consumers around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the post I will talk about about Maryland Minimum Wage 2020 For Tipped Employees.

- Maryland Chamber Of Commerce From The Halls Unintended Consequences Of Maryland S 15 Minimum Wage

- Twenty Three Years And Still Waiting For Change Why It S Time To Give Tipped Workers The Regular Minimum Wage Economic Policy Institute

- Understanding Maryland Minimum Wage Laws

- Maryland S Minimum Wage Increase Explained Baltimore Sun

- Md Minimum Wage Rises To 8 On Thursday Local News Heraldmailmedia Com

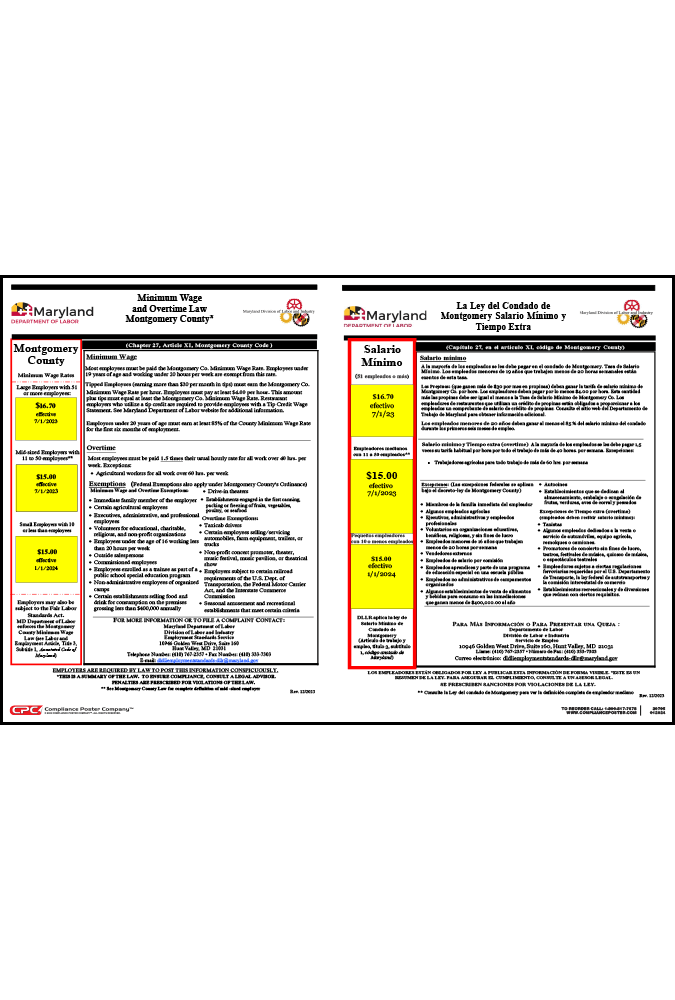

- Maryland Minimum Wage And Overtime Law Notice Updated Compliance Poster Company

Find, Read, And Discover Maryland Minimum Wage 2020 For Tipped Employees, Such Us:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrtkk8q8vzhwaxxnwkc2crzcto3n3rvmlzq2kmzzb1kg5jxzbtw Usqp Cau

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqvgmif2jfkg0uqoougd4k2fzumu Rc536bglbc Qmxlod5xu2i Usqp Cau

- Amazon Com Md Labor Law Poster 2020 Edition State Federal And Osha Compliant Laminated Poster Maryland English Home Kitchen

- 5 Things To Know About Michigan S Minimum Wage Increase Michigan Radio

- 6 Things To Know About Montgomery County S Minimum Wage Legislation

If you re looking for National Minimum Wage Uk 2020 you've come to the perfect place. We have 104 images about national minimum wage uk 2020 adding images, photos, pictures, wallpapers, and much more. In such webpage, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Maryland wage and tax facts minimum wage local income taxes minimum wage.

National minimum wage uk 2020. 2020 employer tax rates. The maryland minimum wage was last changed in 2008 when it was. Marylands state minimum wage rate is 1100 per hourthis is greater than the federal minimum wage of 725.

Tipped employees earning more than 30 per month in tips must earn the state minimum wage rate per hour. Currently the federal minimum wage is 725 an hour. Federal law sets the minimum basic cash wage at 213 per hour but many states mandate a higher level.

Marylands minimum wage is 11 an hour in 2020 so employees are entitled to the higher state minimum wage. Payment of less than minimum wage the maryland guide to wage payment and employment standards. Employers must pay at least 363 per hour.

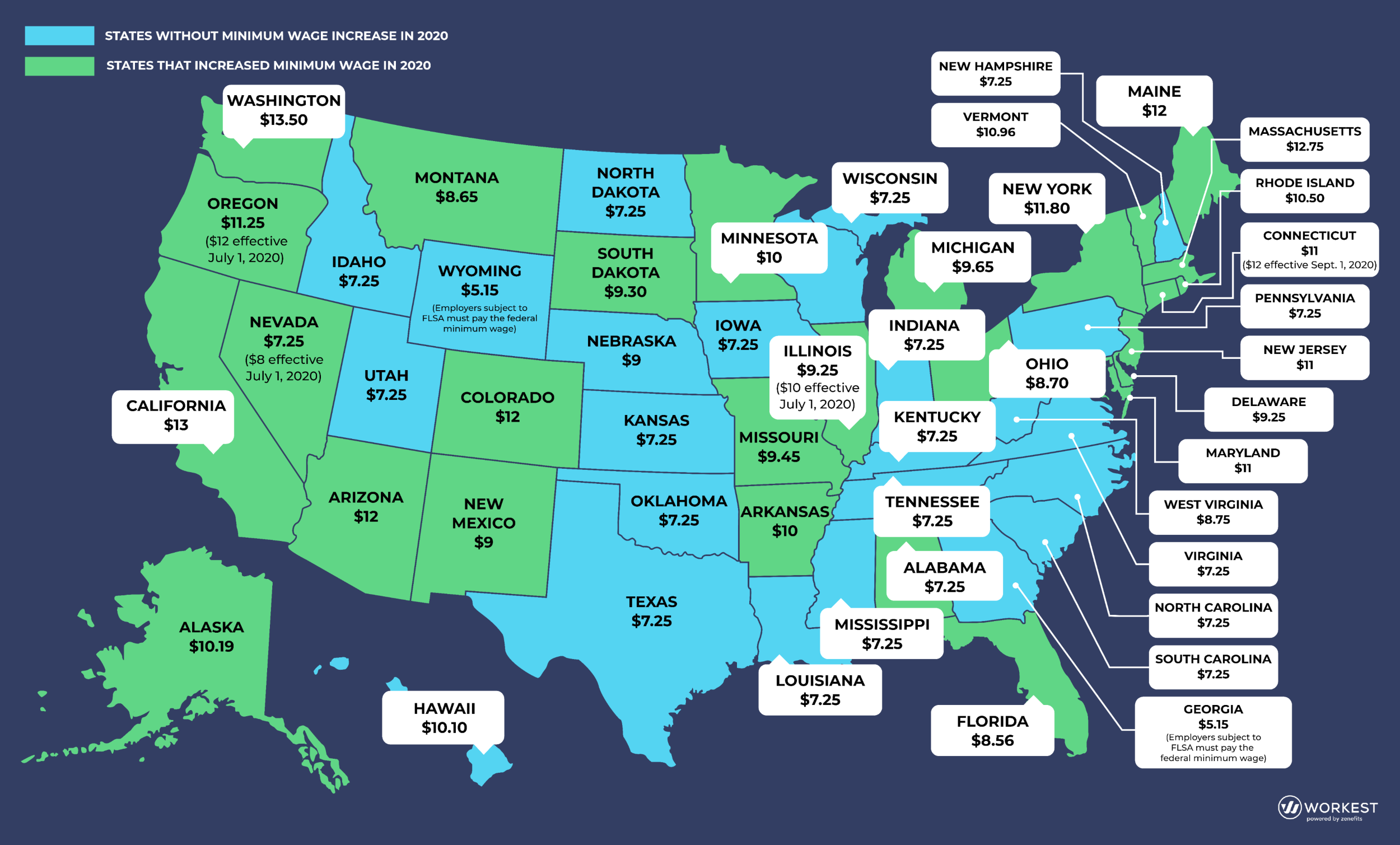

1120 reciprocity rules state income tax wage withholding. Tipped minimum wage laws by state 2020 tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit. To help your organization stay aware of the latest labor law paycor has created a breakdown of tipped minimum wage requirements by state for 2020.

In these jurisdictions if the direct wage an employer pays an employee and tips equals the minimum wage an employer satisfies its minimum wage obligation. Under federal law and in most states employers may pay tipped employees less than the minimum wage as long as employees earn enough in tips to make up the difference. In certain places employers may be able to count tips an employee receives toward the minimum wage.

This amount plus tips must equal at least the state minimum wage rate. District of columbia pennsylvania virginia. Tipped employee maximum tip credit.

In new mexico for example the 2020 minimum wage for tipped employees is 235 an hour compared with 9 and 898 an hour respectively in neighboring states arizona and colorado. Tipped employees earning more than 30 per month in tips must earn the state minimum wage rate per hour. In some states employers must pay tipped employees the full state minimum wage before tips.

The minimum wage applies to most employees in maryland with limited exceptions including tipped employees some student workers and other exempt occupations. Employers must pay at least 363 per hour. This amount plus tips must equal at least the state minimum wage rate.

Please contact your payroll specialist for details.

More From National Minimum Wage Uk 2020

- Illinois Minimum Wage 2020 Poster

- What Is Minimum Wage Pay In Florida

- Legalization Of Marijuana In Kenya

- Minimum Wage Qld 2020

- What Is Minimum Wage Ny 2020

Incoming Search Terms:

- Wtop On Twitter New Laws Went Into Effect Today For Maryland D C And Virginia The Laws Include Topics Ranging From Minimum Wage Increases To An Increase In The Gas Tax Https T Co Shs1fsc7qv What Is Minimum Wage Ny 2020,

- Maryland Minimum Wage 2020 Minimum Wage Org What Is Minimum Wage Ny 2020,

- 2 What Is Minimum Wage Ny 2020,

- To Credit Or Not To Credit That Is The Question Facing The Legislature Citizens Research Council Of Michigan What Is Minimum Wage Ny 2020,

- Minimum Wage In The United States Wikipedia What Is Minimum Wage Ny 2020,

- Maryland Set To Increase Its Minimum Wage To 10 10 By 2018 The Washington Post What Is Minimum Wage Ny 2020,