Minimum Wage In California For Garnishment, Garnishing California S Future New Bill Seeks To Curb Wage Seizures Portside

Minimum wage in california for garnishment Indeed lately is being hunted by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this post I will talk about about Minimum Wage In California For Garnishment.

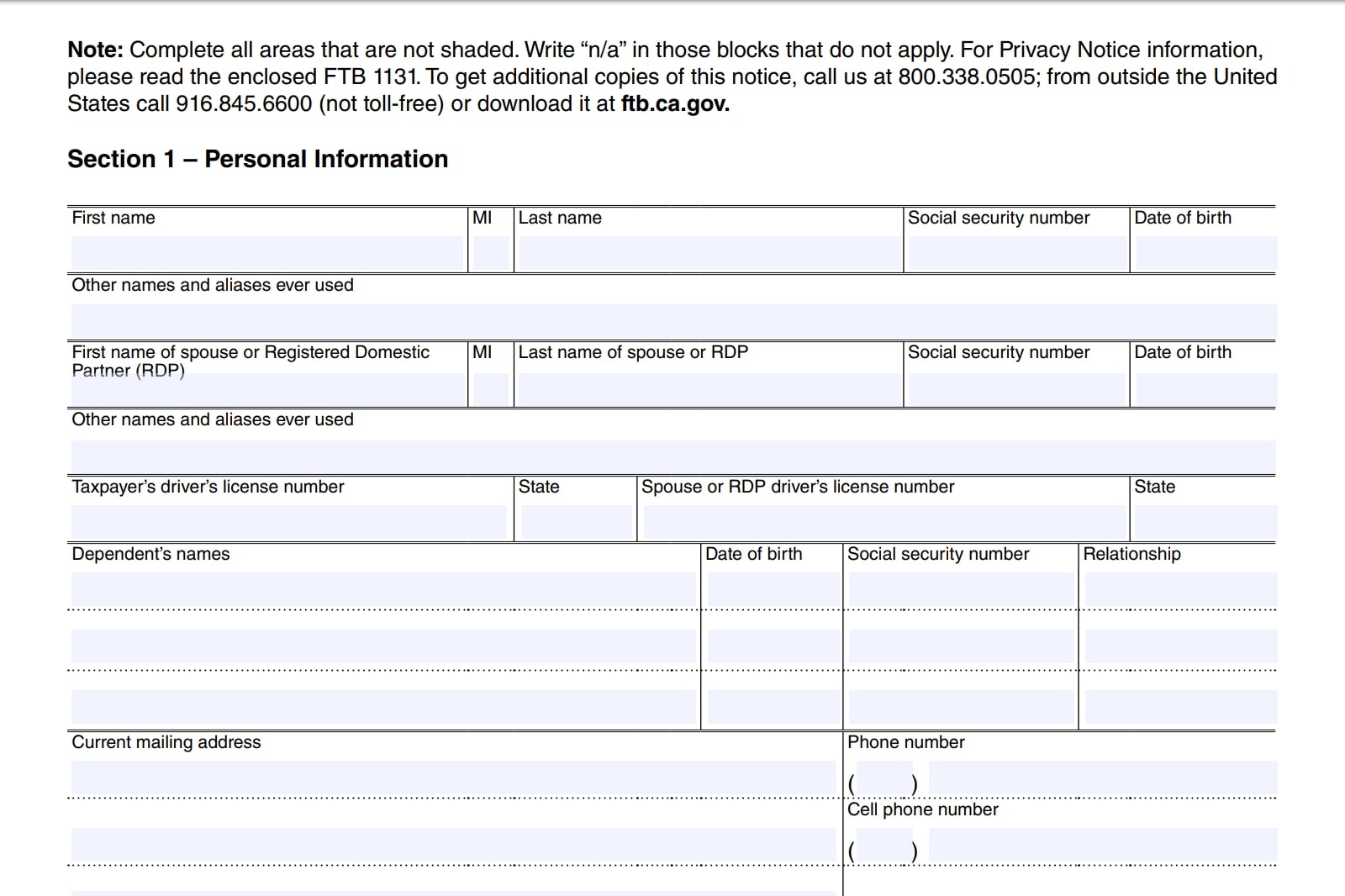

- Http Www Courts Ca Gov Documents Wg002 Pdf

- Dealing With Multiple Wage Garnishments Garnishment Laws

- California Garnishment Now Provides Greater Protection Of Wages Northern California Bankruptcy Lawyer

- Https Saclaw Org Wp Content Uploads Sbs Wage Garnishment Pdf

- Los Angeles Irs Wage Garnishment Flat Fee Tax Service California Irs Help

- Wage Deductions And Garnishments California Restaurant Association

Find, Read, And Discover Minimum Wage In California For Garnishment, Such Us:

- How To Calculate A Wage Garnishment Small Business Chron Com

- Http Www Publiccounsel Org Tools Publications Files 2011 Wage Garnishment Packet Pdf

- Wage Deductions And Garnishments California Restaurant Association

- California Wage Garnishments What Are Your Rights Rounds Sutter

- Https Saclaw Org Wp Content Uploads Sbs Wage Garnishment Pdf

If you are searching for Marijuana Legalization News Usa you've come to the ideal location. We have 104 images about marijuana legalization news usa adding images, photos, pictures, wallpapers, and much more. In such page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Employee Wage Garnishments Developing An Effective Compliance Program Marijuana Legalization News Usa

Earnings that week exceed the applicable minimum wage.

Marijuana legalization news usa. Personal income tax earnings withholding order for taxes ftb 2905. Wage garnishment limits in california follow federal law but garnishment is calculated as the lesser of either 25 percent of a persons disposable earnings or disposable earnings minus 40 times californias hourly minimum wage. In 2018 the minimum wage is 1050 per hour so we multiply that by 40 to get 420.

In these situations the garnishment will not exceed 30 times the minimum wage. The garnishment of wages due to non payment of student loans can result in payments that are 15 of your disposable income. If there is a local minimum wage in effect in the location where the employee works that exceeds the state minimum wage at the time the earnings are payable the local minimum wage is the applicable minimum wage.

In additional an individual can garnish wages because of the debtors failure to pay a court judgment. Wage garnishment laws in connecticut are strict. We issue 3 types of wage garnishments.

Sections 706022 706025 706050 and 706104 explain the employers duties. Earnings withholding orders for taxes ewot. Workers making close to the california minimum wage got additional protection from wage garnishments under a change in the law effective in 2013.

In california wage garnishment is subject to a number of state laws designed to protect your rights and your livelihood but it can still take a serious chunk out of your paycheck. Garnishments are limited to the lesser. The financial issues that matter to.

If your income is close to the minimum wage california law provides more protection for your wages because the federal minimum wage is lower than californias federal minimum wage is currently 725 as opposed to californias 1100 per hour and the multiplier in federal law is 30 not 40. If the state minimum wage is the applicable minimum wage. For example an employer may withhold the earnings of an employee under a court order because the employee failed to pay child support.

A wage garnishment requires employers to withhold and transmit a portion of an employees wages until the balance on the order is paid in full or the order is released by us. California wage garnishment law is contained in the code of civil procedure beginning with section 706010. Then we compare your disposable income to 40 times the minimum wage.

With the annual increases in the state minimum wage in 2019 california law now protects an employees weekly net wages up to 40 times the state minimum wage currently 11 to 12 per hour. The federal minimum wage federal wage garnishment laws and state wage garnishment laws listed are all accurate as of june 12 2020.

More From Marijuana Legalization News Usa

- How Much Is Minimum Wage In California Per Year

- Vietnam Minimum Wage 2020

- What Is The Minimum Wage In China

- Marijuana News Nj

- Minimum Wage Target Florida

Incoming Search Terms:

- Superior Court Of California County Of Orange Self Help Center Wage Garnishment Self Help Center Loca Ons Pdf Free Download Minimum Wage Target Florida,

- Wage Garnishment To Collect Your Debts Minimum Wage Target Florida,

- Wage Garnishment Lawyer Wipe Away Debts California Minimum Wage Target Florida,

- The Ins And Outs Of Irs Wage Garnishment What You Need To Know Minimum Wage Target Florida,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gct3ysr0s0gtflxgi2akwj7eq Bf 4mg4 Ytghmoidl9gmpsgntq Usqp Cau Minimum Wage Target Florida,

- Wage Deductions And Garnishments California Restaurant Association Minimum Wage Target Florida,