Minimum Wage In Texas Yearly Income, How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Minimum wage in texas yearly income Indeed lately is being sought by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about Minimum Wage In Texas Yearly Income.

- Minimum Wage Workers In Oklahoma 2017 Southwest Information Office U S Bureau Of Labor Statistics

- 2020 State Minimum Wage Updates Govdocs

- Employers Steal Billions From Workers Paychecks Each Year Survey Data Show Millions Of Workers Are Paid Less Than The Minimum Wage At Significant Cost To Taxpayers And State Economies Economic Policy

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- The Truth On Welder Pay

- Marketing Average Salaries In Texas 2020 The Complete Guide

Find, Read, And Discover Minimum Wage In Texas Yearly Income, Such Us:

- Minimum Wage Workers In Texas 2013 Southwest Information Office U S Bureau Of Labor Statistics

- How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

- The Debate Msnbc 2011

- Minimum Wage Workers In Texas 2015 Southwest Information Office U S Bureau Of Labor Statistics

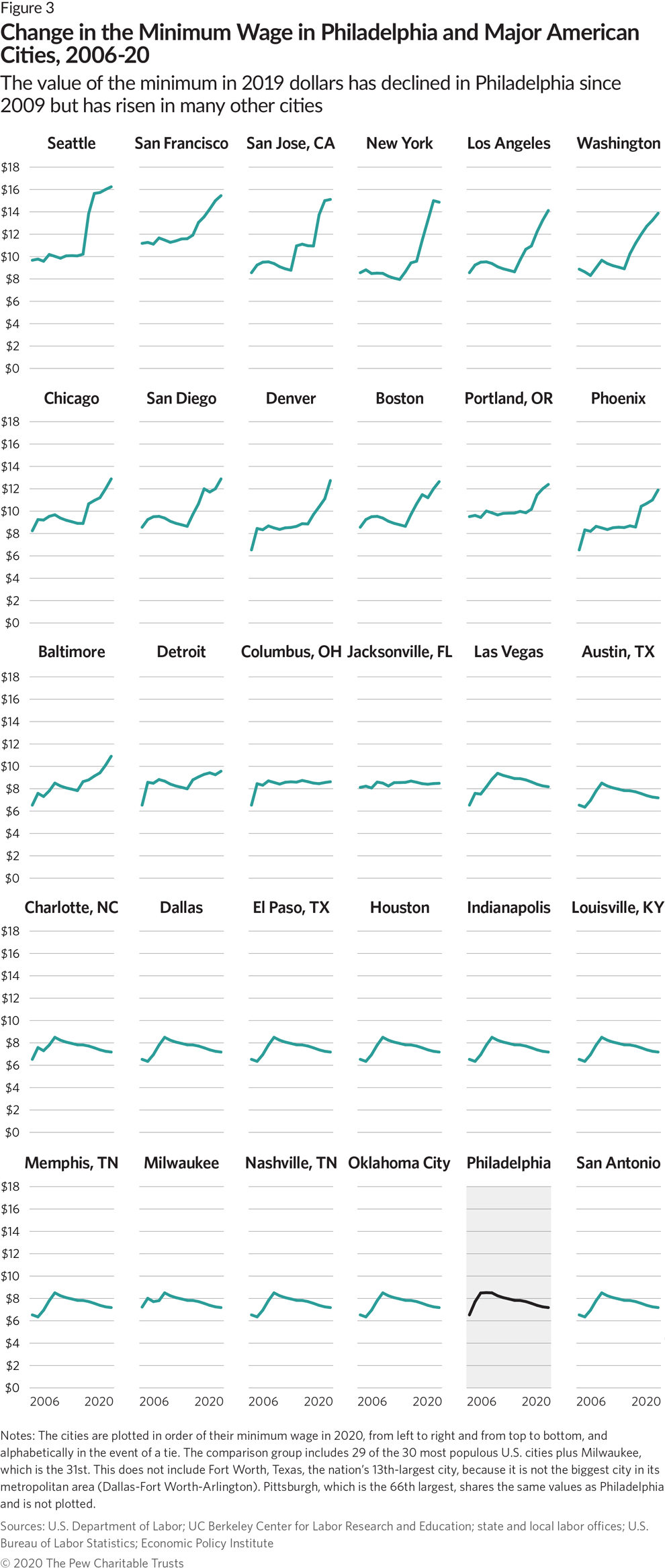

- How Philadelphia S Minimum Wage Compares With Other U S Cities The Pew Charitable Trusts

If you re searching for What Is Minimum Wages In Georgia you've reached the perfect place. We ve got 104 images about what is minimum wages in georgia adding pictures, photos, pictures, backgrounds, and more. In these webpage, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

This calculation results in 125667 in monthly gross wages.

What is minimum wages in georgia. The federal minimum wage has not been increased since 2009. Salaries in texas range from 26600 usd per year minimum salary to 469000 usd per year maximum average salary actual maximum is higher. In the states where there is no established minimum wage the federal minimum wage of 725 per hour will apply.

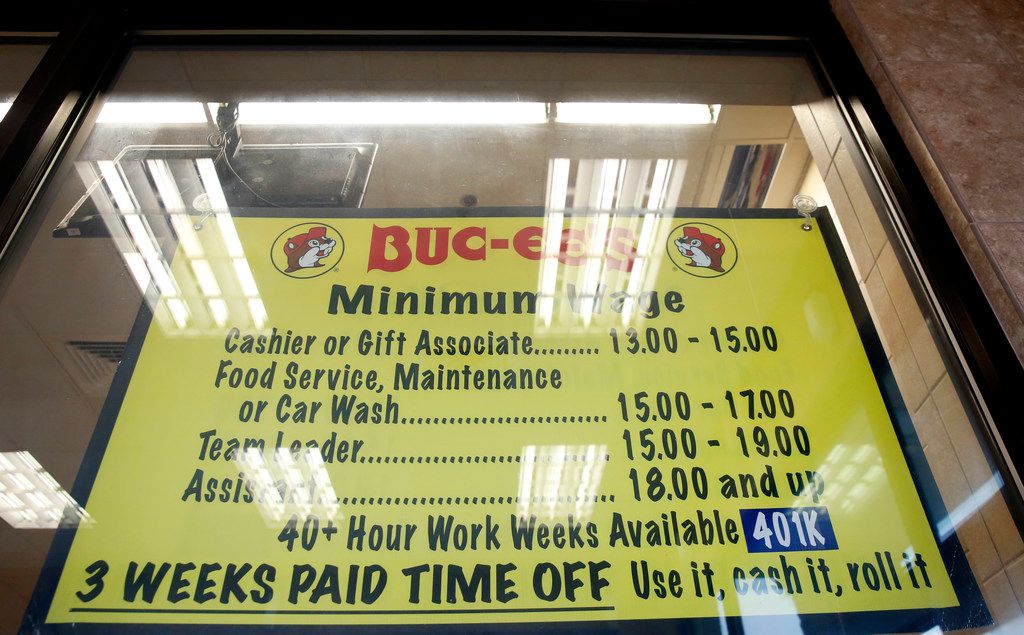

Demands for a living wage that is fair to workers has resulted in numerous location based changes to minimum wage levels. The texas minimum wage was last changed in 2008 when it was raised 070 from 655 to 725. Texas state minimum wage rate is 725 per hourthis is the same as the current federal minimum wage rate.

With specified restrictions employers may count tips and the value of meals and lodging toward minimum wage. The federal minimum wage is 725 per hour and the texas state minimum wage is 725 per hour. Divide this by 12 to obtain monthly wages since not all months have the same number of days.

The texas minimum wage act does not prohibit employees from bargaining collectively with their employers for a higher wage. There are legal minimum wages set by the federal government and the state government of texas. Texas adopts the federal minimum wage rate.

The minimum wage applies to most employees in texas with limited exceptions including tipped employees some student workers and other exempt occupations. Using the federal minimum wage rate of 725 per hour this amounts to total gross wages of 15080 in one calendar year. Effective july 24 2009 the federal minimum wage is 725 per hour.

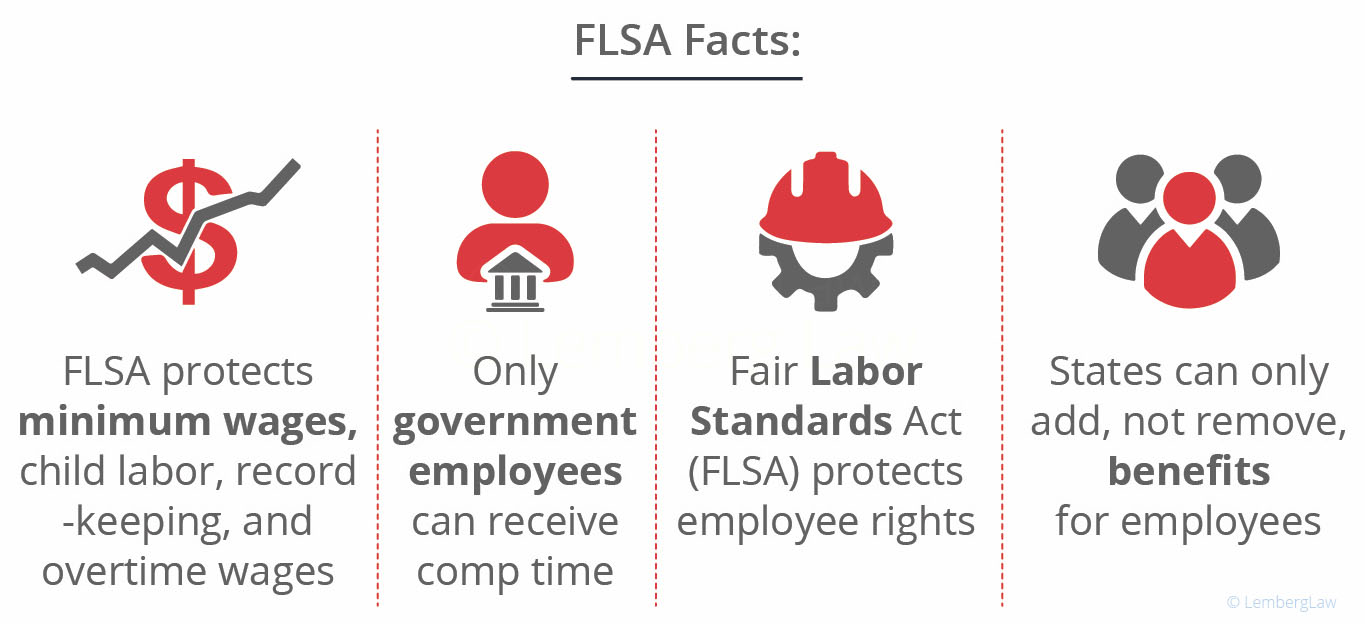

The minimum wage the lowest hourly amount that an employee may be paid for their labor is determined by both state and federal labor laws in the united statesunder the federal fair labor standards act states and localities are permitted to set their own minimum wage rates which will take precedence over the federal minimum wage rate if they are higher. The poverty rate reflects a persons gross annual income. Your average tax rate is 1724 and your marginal tax rate is 2965this marginal tax rate means that your immediate additional income will be taxed at this rate.

State minimum wages are determined based on the posted value of the minimum wage as of january one of the coming year national conference of state legislatures 2019. The texas minimum wage is the lowermost hourly rate that any employee in texas can expect by law. We have converted it to an hourly wage for the sake of comparison.

So if you are earning the texas minimum wage of 725 per hour your gross annual pay for a full time position of 40 hours per week would typically be 1508004 and you would pay no income tax in texas on this.

More From What Is Minimum Wages In Georgia

- How Much Is Minimum Wage In Denmark

- What Is Minimum Wage Nys

- Federal Minimum Wage Essay

- What Is Minimum Wage In Ca

- New York Minimum Wage Hospitality

Incoming Search Terms:

- Overtime Rule The Department Of Labor Just Expanded Overtime Pay Vox New York Minimum Wage Hospitality,

- Marketing Average Salaries In Texas 2020 The Complete Guide New York Minimum Wage Hospitality,

- The Truth On Welder Pay New York Minimum Wage Hospitality,

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities New York Minimum Wage Hospitality,

- 2020 Federal And State Minimum Wage Rates New York Minimum Wage Hospitality,

- Minimum Wage Workers In Oklahoma 2017 Southwest Information Office U S Bureau Of Labor Statistics New York Minimum Wage Hospitality,