Minimum Wage Texas After Taxes, Dallas County Raises Minimum Wage For Its Employees To 15 An Hour

Minimum wage texas after taxes Indeed recently has been hunted by consumers around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the article I will discuss about Minimum Wage Texas After Taxes.

- State Income Tax Wikipedia

- Texas Minimum Wage 2020 Minimum Wage Org

- Minimum Wage In Texas Texas Minimum Wage 2020

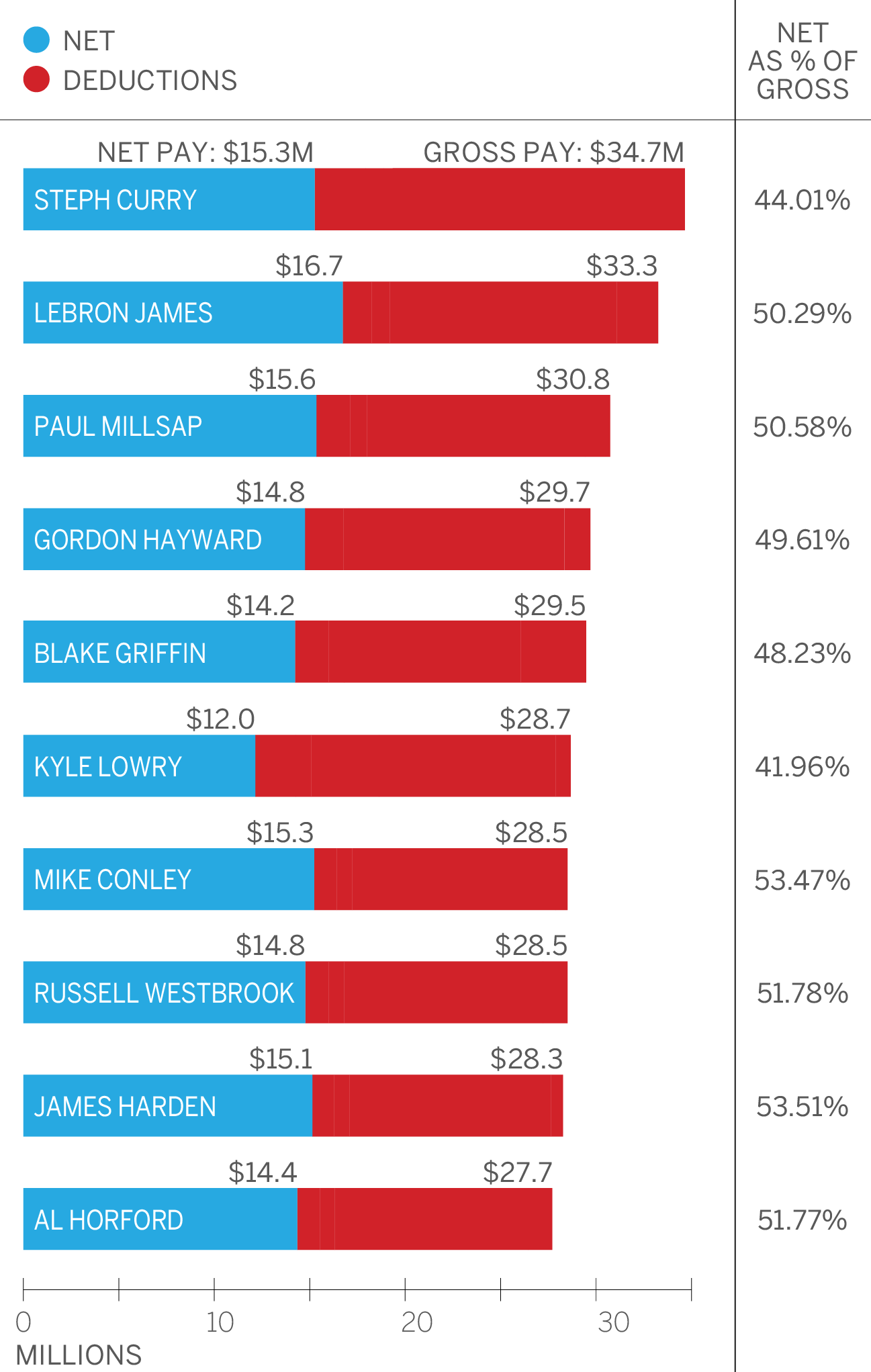

- Nba Player Salaries And Take Home Pay

- Https Assets Comptroller Texas Gov Ch313 1180 01180 772 2019 0815 Mca 205902 Gregoryportland Pdf

- Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy

Find, Read, And Discover Minimum Wage Texas After Taxes, Such Us:

- Cigna Sets 16 Minimum Wage From Proceeds Of U S Tax Overhaul Hartford Courant

- Who Pays 6th Edition Itep

- Here S How Much Money You Take Home From A 75 000 Salary Business Insider

- Federal Insurance Contributions Act Tax Wikipedia

- Beginner S Guide To Texas Rural Property Taxes

If you are looking for How Much Is Minimum Wage A Year you've come to the ideal place. We have 104 images about how much is minimum wage a year including images, photos, photographs, wallpapers, and more. In these page, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The calculator will automatically assume that the employer takes the maximum possible tip credit and calculate tip and cash wage earnings accordingly.

How much is minimum wage a year. Workers contribute 62 percent of wages to social security and 145 percent of wages to medicare. Living wage calculation for texas. The texas minimum wage was last changed in 2008 when it was raised 070 from 655 to 725.

You and your employer will each contribute 62 of your earnings for social security taxes and 145 of your earnings for. How much can i expect to bring in each month after taxes. 21427 43553 50795 62425 34969 42536 46862 53525 34969 48139.

Texas state minimum wage rate is 725 per hourthis is the same as the current federal minimum wage rate. Your average tax rate is 1724 and your marginal tax rate is 2965this marginal tax rate means that your immediate additional income will be taxed at this rate. These fica taxes reduce minimum wage pay by approximately 96 per month leaving 1160.

Minimum wage here is 725 an hour. Data are updated annually in the first quarter of the new year. City data forum us.

Maybe 20 hours a week at the most. The last time i worked a minimum wage job it was about 335 an hour 07 07 2010 0848 am br7or13. The state minimum wage is the same for all individuals regardless of how many dependents they may have.

These assume a 40 hour working week. Minimum wage salary after taxes how much income income tax user name. The minimum wage applies to most employees in texas with limited exceptions including tipped employees some student workers and other exempt occupations.

The minimum wage in texas means that a full time worker can expect to earn the following sums as a minimum before tax. Required annual income after taxes. This refers to the federal insurance contributions act the law that mandated the social security program.

Texas allows employers to credit up to 512 in earned tips against an employees wages per hour which can result in a cash wage as low as 213 per hour. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also withholds taxes from your pay. Forums texas el paso.

These assume a 40 hour working week. I dont know how much taxes are in texas but how much in a month will i earn. How much is minimum wage monthly in texas after taxes.

More From How Much Is Minimum Wage A Year

- California Minimum Wage For Exempt Employees 2020

- Legalization Of Marijuana And Crime Rates

- What Is Minimum Wage Designed For

- Minimum Wage Waiter Florida

- Minimum Wage Austin Texas 2019

Incoming Search Terms:

- Who Pays 6th Edition Itep Minimum Wage Austin Texas 2019,

- Payroll Tax Wikipedia Minimum Wage Austin Texas 2019,

- Cigna Sets 16 Minimum Wage From Proceeds Of U S Tax Overhaul Hartford Courant Minimum Wage Austin Texas 2019,

- Federal Tax Cuts In The Bush Obama And Trump Years Itep Minimum Wage Austin Texas 2019,

- State Income Tax Wikipedia Minimum Wage Austin Texas 2019,

- Here S How Much Money You Take Home From A 75 000 Salary Business Insider Minimum Wage Austin Texas 2019,