Minimum Wage To Qualify For Unemployment Texas, Frequently Asked Questions About Unemployment Benefits During The Covid 19 Pandemic Texas Riogrande Legal Aid Trla Free Legal Services

Minimum wage to qualify for unemployment texas Indeed lately has been hunted by users around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the article I will talk about about Minimum Wage To Qualify For Unemployment Texas.

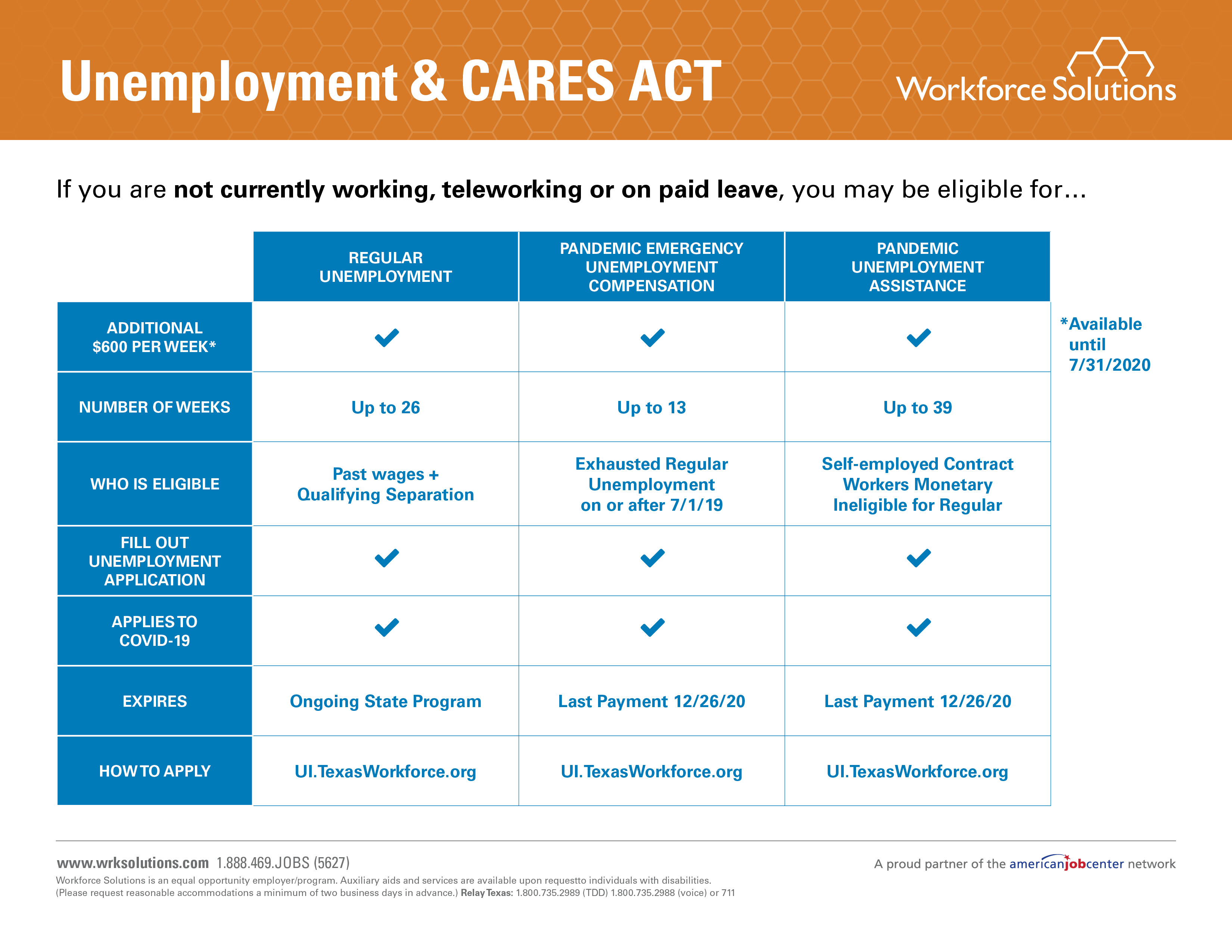

- Coronavirus Stimulus Bill S Unemployment Insurance Plan Explained Vox

- Understanding 2020 Us Federal Minimum Wage Laws Workest

- Texas Minimum Wage 2020 Minimum Wage Org

- Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

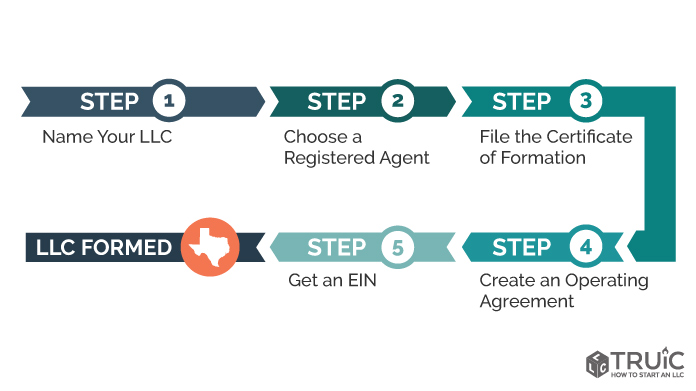

- How To Apply For Unemployment In Texas 10 Steps With Pictures

- Updated Even More Of Your Texas Unemployment Questions Answered Wfaa Com

Find, Read, And Discover Minimum Wage To Qualify For Unemployment Texas, Such Us:

- How Uber Lyft Driver S Apply For Unemployment Benefits In Texas The Rideshare Geek

- How To File For Unemployment Archives Fileunemployment Org

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsbxeqi2 J5whbk5gpzvo Hfm12svffricjpwsst9g2gtiexwo Usqp Cau

- How To Apply For Unemployment In Texas 10 Steps With Pictures

- Covid 19 Layoffs Reduced Hours May Qualify For Texas Unemployment Aid

If you are looking for 2020 Federal Minimum Hourly Wage you've arrived at the perfect location. We ve got 104 graphics about 2020 federal minimum hourly wage adding images, photos, photographs, wallpapers, and more. In such webpage, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

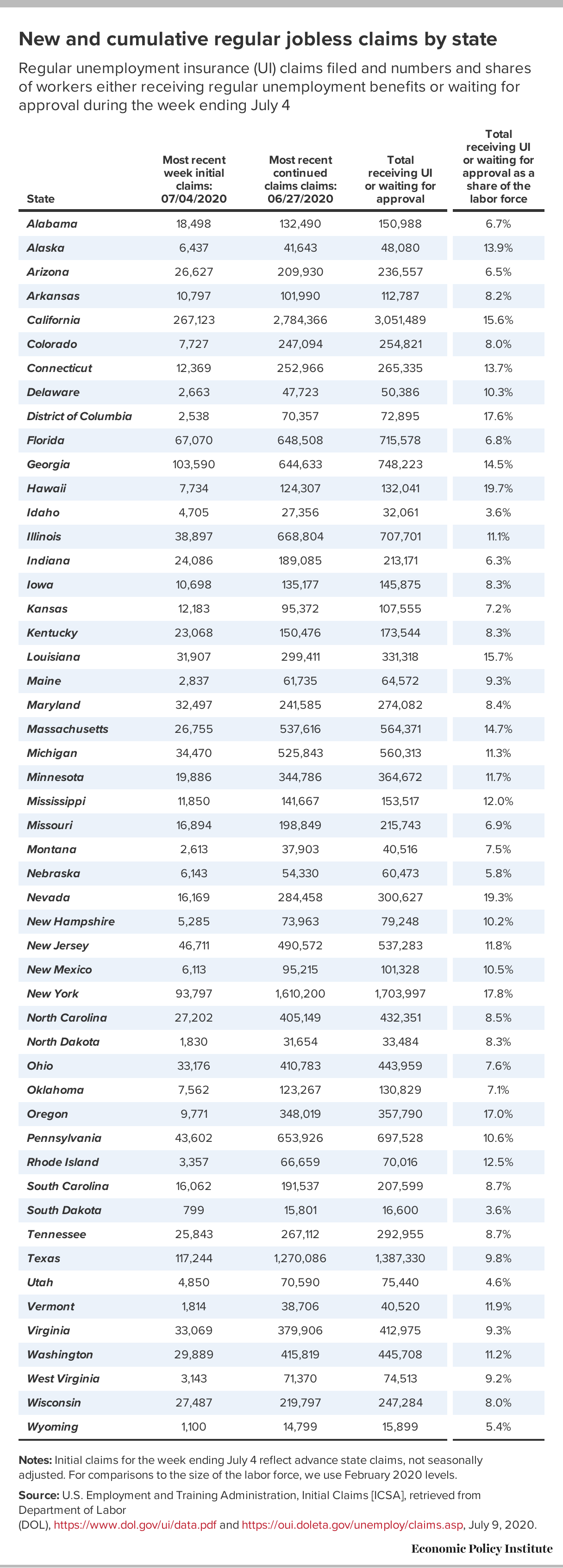

Extending The 600 Weekly Unemployment Boost Would Support Millions Of Workers See Updated State Unemployment Data Economic Policy Institute 2020 Federal Minimum Hourly Wage

The paying state will process your unemployment benefits application according to the rules of that state.

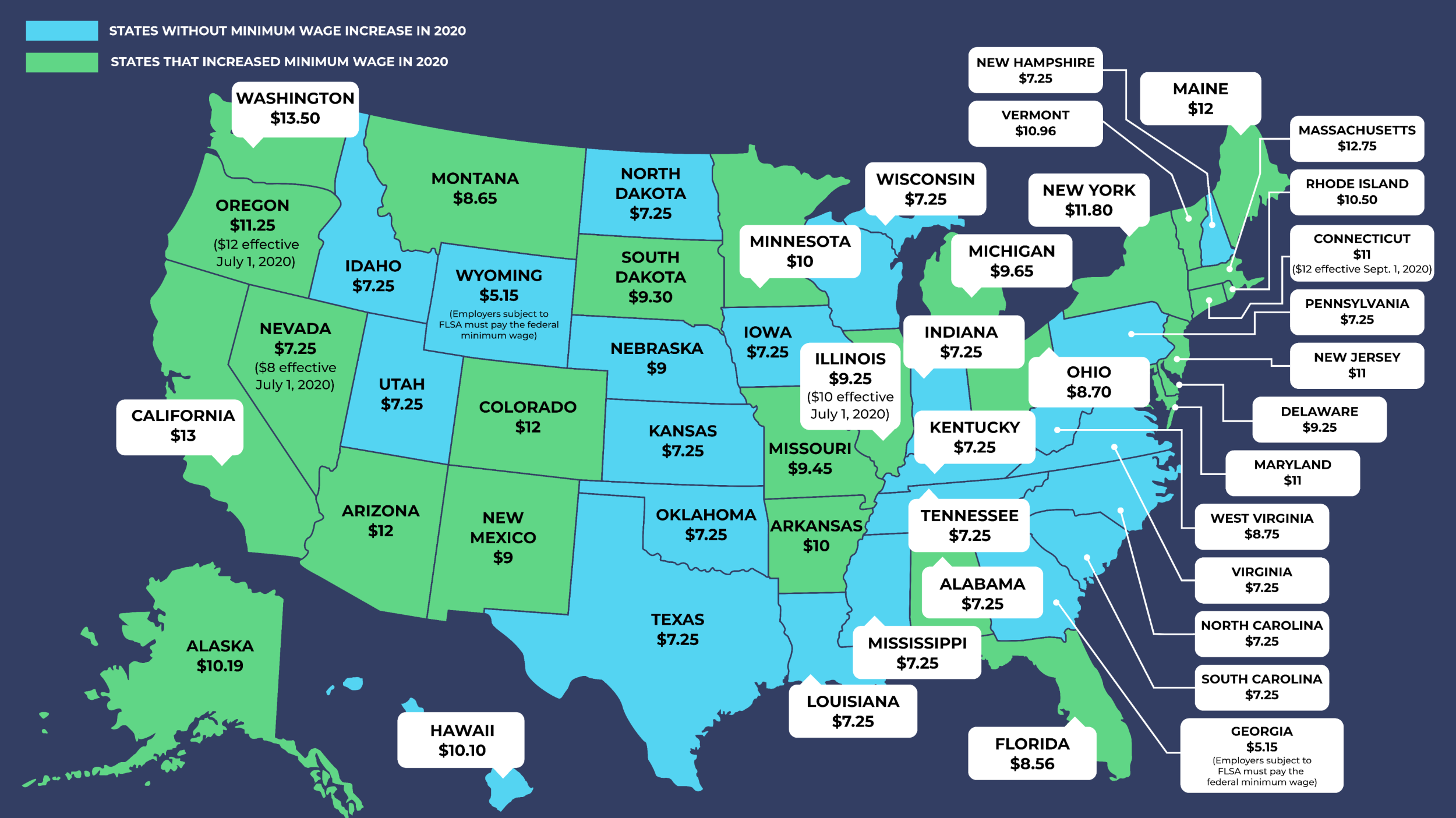

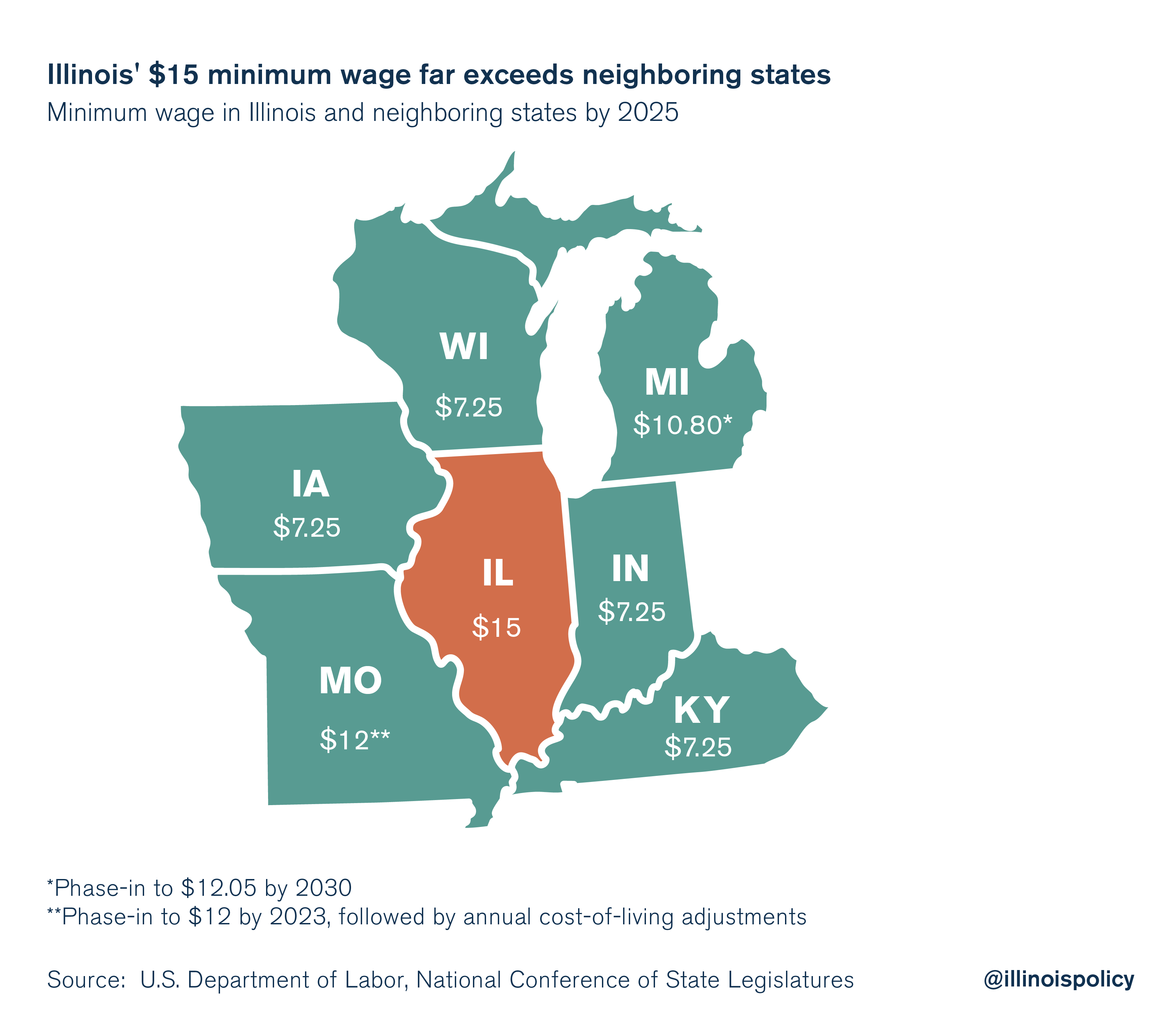

2020 federal minimum hourly wage. Texas is much like most other states that require that you earn a specified minimum amount during your base period for unemployment to make sure you are eligible for unemployment benefits. This notification is required for some employers such as all employers subject to the texas payday law as well as whose employees are entitled to apply for unemployment benefits. The minimum wage applies to most employees in texas with limited exceptions including tipped employees some student workers and other exempt occupations.

The texas unemployment law and payday law is a texas unemployment law poster provided for businesses by the texas workforce commission. Your earnings during your base period will be used to work out your weekly payment. Effective july 24 2009 the federal minimum wage is 725 per hour.

The texas minimum wage act does not prohibit employees from bargaining collectively with their employers for a higher wage. The texas minimum wage was last changed in 2008 when it was raised 070 from 655 to 725. For these workers the base period is the earlier four of the five complete calendar quarters before the illness or injury took place.

This poster makes a single change to the texas payday law poster. Briefly the four primary requirements are that you are able to work you are available to work you are searching for work. Though the eligibility requirements to receive unemployment benefits in texas are not unnecessarily stringent there are some things youll need to know in order to successfully receive texas unemployment benefits if youre out of work.

Texas adopts the federal minimum wage rate. In texas as in every other state employees who are temporarily out of work through no fault of their own may qualify to collect unemployment benefits. Texas state minimum wage rate is 725 per hourthis is the same as the current federal minimum wage rate.

The paying state asks the other states to transfer your wage records. You must be able to show that you earned wages in at least two of the four calendar quarters that make up your base period. The paying state can then determine if you earned enough wages after combining wages from other states to qualify for benefits under that states laws.

The minimum weekly unemployment benefit in texas is 69 and the maximum is 521. Municipality minimum wage laws. As of january 2020 texas did not allow cities or counties to set minimum wage hourly rates different from the state minimum wage.

The eligibility rules prior earnings requirements benefit amounts and other details vary from state to state howeverhere are the basic rules for collecting unemployment in texas.

More From 2020 Federal Minimum Hourly Wage

- Legalization Of Marijuana Mississippi

- What Is Minimum Wage Per Hour Uk

- California Minimum Wage Orange County 2020

- Minimum Wage In Duarte California

- Legalization Of Marijuana Views

Incoming Search Terms:

- Minimum Wage Workers In Texas 2017 Southwest Information Office U S Bureau Of Labor Statistics Legalization Of Marijuana Views,

- Unemployment Insurance Is Failing Workers During Covid 19 Here S How To Strengthen It Legalization Of Marijuana Views,

- Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids Legalization Of Marijuana Views,

- Https S27147 Pcdn Co Wp Content Uploads 2015 03 Barriers To Access For Low Wage Pdf Legalization Of Marijuana Views,

- Coronavirus Stimulus New Unemployment Requirements Make It Tougher For Workers To Qualify Legalization Of Marijuana Views,

- Minimum Wage In The United States Wikipedia Legalization Of Marijuana Views,

/https://static.texastribune.org/media/files/a22c7645b46d0e7b757350259a2bfe5d/Texas%20Workforce%20MG%20TT%2002.jpg)