How Much Is Minimum Wage In Ohio After Taxes, Minimum Wage Buying Power In Ohio Is Shifting

How much is minimum wage in ohio after taxes Indeed recently has been hunted by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this post I will talk about about How Much Is Minimum Wage In Ohio After Taxes.

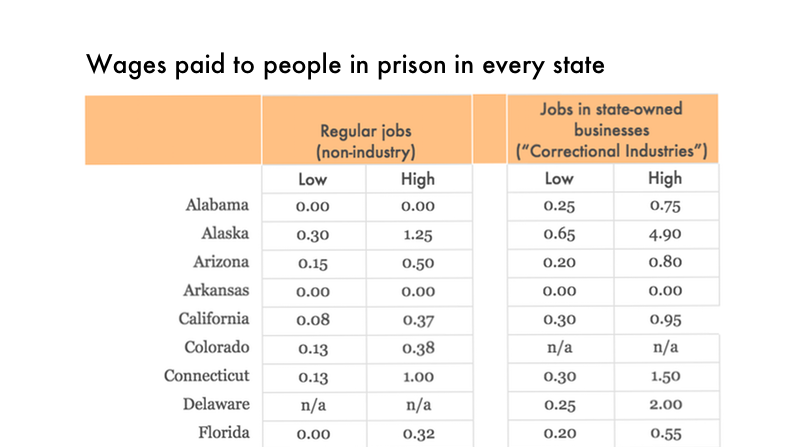

- Tipped Minimum Wage Federal Rate And Rates By State Chart

- New Year New Laws What S Changing In Ohio Wkyc Com

- Http Www Ci Miamisburg Oh Us Index2 Php Option Com Docman Task Doc View Gid 489 Itemid 119

- Tens Of Thousands Of Ohioans Told To Repay Unemployment

- Ohio To Repeal Pink Tax Raise Minimum Wage In 2020

- Federal Tax Cuts In The Bush Obama And Trump Years Itep

Find, Read, And Discover How Much Is Minimum Wage In Ohio After Taxes, Such Us:

- Ohio To Repeal Pink Tax Raise Minimum Wage In 2020

- State Minimum Wage Rate For Ohio Sttminwgoh Fred St Louis Fed

- Spotlight On Ohio Local Taxes Local Taxes Local Tax Compliance

- 4owdwjgmiy3ezm

- Blighted Dayton Ohio Block Revitalized By Bevy Of Tax Credits Novogradac

If you re searching for Minimum Wage Nj 15 you've reached the right place. We ve got 104 images about minimum wage nj 15 including pictures, photos, pictures, backgrounds, and more. In these webpage, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

These assume a 40 hour working week.

Minimum wage nj 15. 34800 per working week. Just because the state wide ohio minimum wage rate for 2021 is 880 doesnt exactly mean that every employee in ohio will be paid this wage rate there are some exceptions to this law. These assume a 40 hour working week.

The ohio 2020 state unemployment insurance sui tax rates will range from 03 to 94 up from the 2019 range of 03 to 92. The minimum wage applies to most employees in ohio with limited exceptions including tipped employees some student workers and other exempt occupations. If youre only making minimum wage and only working part time they probably wont take out any federal or state withholding.

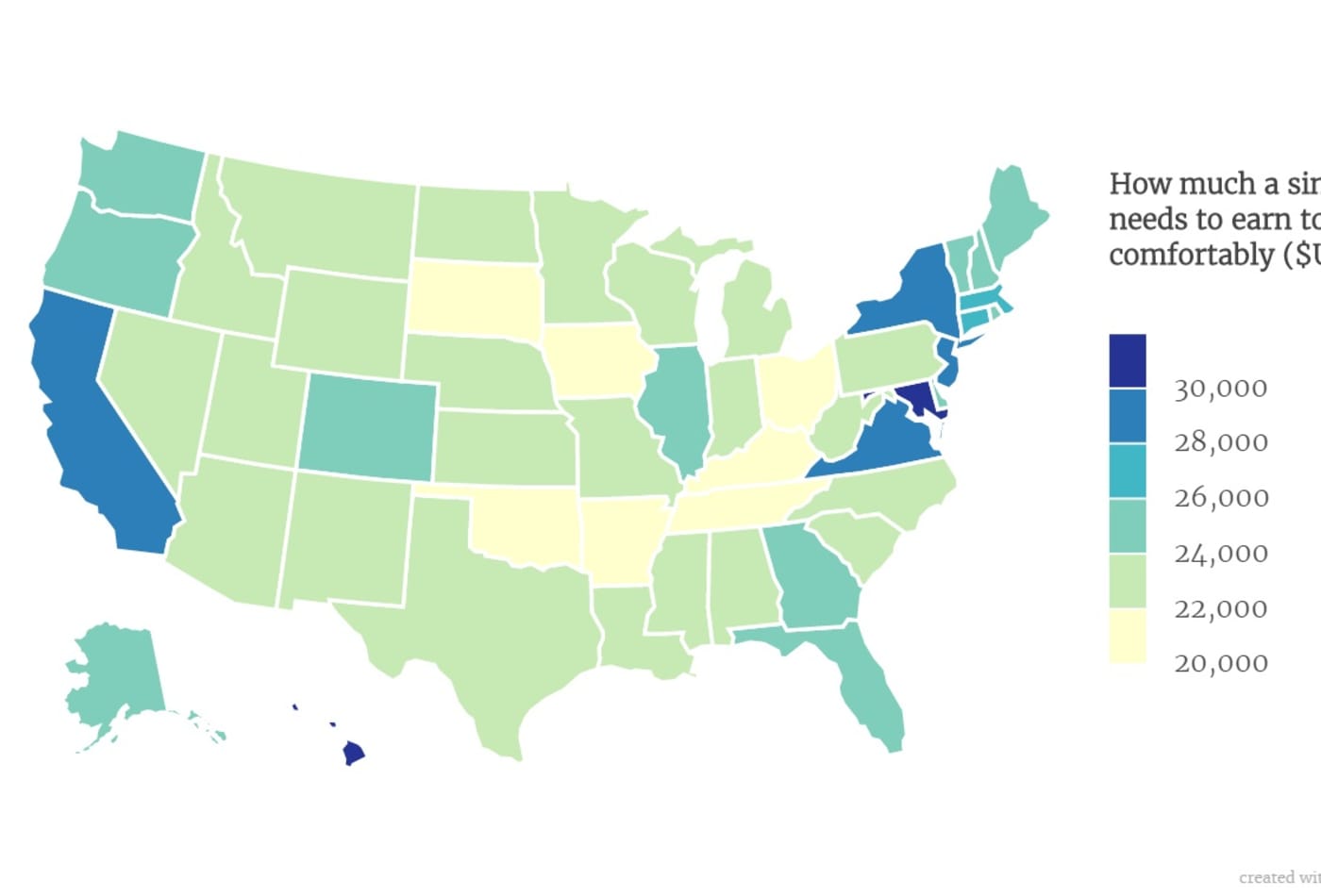

The ohio minimum wage was last changed in 2008 when it was raised 170. Workers in the state of washington trail close earning a minimum wage rate of 947 hourly. The minimum wage in ohio means that a full time worker can expect to earn the following sums as a minimum before tax.

Overview of ohio taxes. Rates range from 0 to 4797. There are more than 600 ohio cities and villages that add a local income tax in addition to the.

Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950. New employers except for those in the construction industry will continue to pay at 27. Data are updated annually in the first quarter of the new year.

Ohios state minimum wage rate is 870 per hourthis is greater than the federal minimum wage of 725. 19548 41664 49867 61323 31994 39140 43555 49068 31994 46293. The pay increase is based on the consumer price index voted.

For all filers the lowest bracket applies to income up to 21750 and the highest bracket only applies to income above 217400. In states with a higher rate such as oregon and washington minimum wage workers earn more than the national average. Minimum wage is always given before taxes.

The 2020 sui taxable wage base reverts to 9000 down from 9500 for 2018 and 2019. Living wage calculation for ohio. Ohios minimum wage is set to rise in january 2020 one of 26 states in the country raising the minimum wage in the coming new year.

For under 16 it is the same as the federal minimum wage which is 725. Tipped workers are able to receive a minimum wage of 440 per hour but the tips they gather each month must equal the official minimum wage rate of 880. The state minimum wage is the same for all individuals regardless of how many dependents they may have.

1 2020 and for 14 and 15 year olds the minimum wage is 725 per hour. Required annual income after taxes. Ohio has a progressive income tax system with eight tax brackets.

More From Minimum Wage Nj 15

- Ny Minimum Wage 2019

- 2020 Minimum Wage Pennsylvania

- Legalization Of Weed Essay Conclusion

- Marijuana Legalization Indiana 2020

- 2020 Minimum Wage South Carolina

Incoming Search Terms:

- 2019 Wage And Tax Guide Portal Primepay 2020 Minimum Wage South Carolina,

- Overhaul A Plan To Rebalance Ohio S Income Tax 2020 Minimum Wage South Carolina,

- 2020 State Individual Income Tax Rates And Brackets Tax Foundation 2020 Minimum Wage South Carolina,

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities 2020 Minimum Wage South Carolina,

- 2019 12 28 Franklin Oh Daily News News Break 2020 Minimum Wage South Carolina,

- How Do State And Local Individual Income Taxes Work Tax Policy Center 2020 Minimum Wage South Carolina,