Nevada Minimum Wage 2020 Tipped Employees, The Minimum Wage Loophole That S Screwing Over Waiters And Waitresses Mother Jones

Nevada minimum wage 2020 tipped employees Indeed recently has been sought by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of the article I will discuss about Nevada Minimum Wage 2020 Tipped Employees.

- Federal Labor Law Updates For January 2020 Tryhris

- Tipped Workers Get A Raise The Pew Charitable Trusts

- Guide To Minimum Wage Rates And Laws By State

- Minimum Wage In The United States Wikipedia

- 2020 Federal And State Minimum Wage Rates

- Minimum Wage Rate Will Not Increase In 2018 For Nevada Workers

Find, Read, And Discover Nevada Minimum Wage 2020 Tipped Employees, Such Us:

- Denver City Council Considers 15 Plus Minimum Wage Govdocs

- Minimum Wage In The United States Wikipedia

- Nevada 2016 Minimum Wage And Daily Overtime Bulletins Released Compliance Poster Company

- 2020 Federal And State Minimum Wage Rates

- July 2020 Minimum Wage Increases Onpay

If you are searching for California Minimum Wage Map you've reached the ideal place. We ve got 104 graphics about california minimum wage map including pictures, pictures, photos, backgrounds, and much more. In such web page, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

11 us virgin islands.

California minimum wage map. Facts about the minimum wage. Posted april 1 2020. The minimum wage applies to most employees in nevada with limited exceptions including tipped employees some student workers and other exempt occupations.

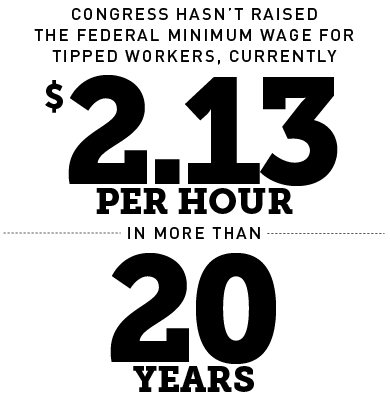

Pursuant to article 15 section 16a of the constitution of the state of nevada and assembly bill ab 456 the following minimum wage rates shall apply to all employees in the state of nevada unless otherwise exempted. In states that allow a tip credit a certain amount of received tips per hour may be credited against the minimum wage by an employer although the tipped employee must receive at least the minimum wage with combined. You are entitled to be paid the higher state minimum wage.

Posted july 1 2019. External links minimum wage 2020 annual bulletin. 825 825 none none none 32500 none 03 54 300 no none 2020 nevada wage and tax facts minimum wage minimum wage.

State of nevada minimum wage 2020 annual bulletin. Pursuant to article 15 section 16a of the constitution of the state of nevada and assembly bill 456 the following minimum wage rates ab shall apply to all employees in the state of nevada unless otherwise exempted. In some states employers must pay tipped employees the full state minimum wage before tips.

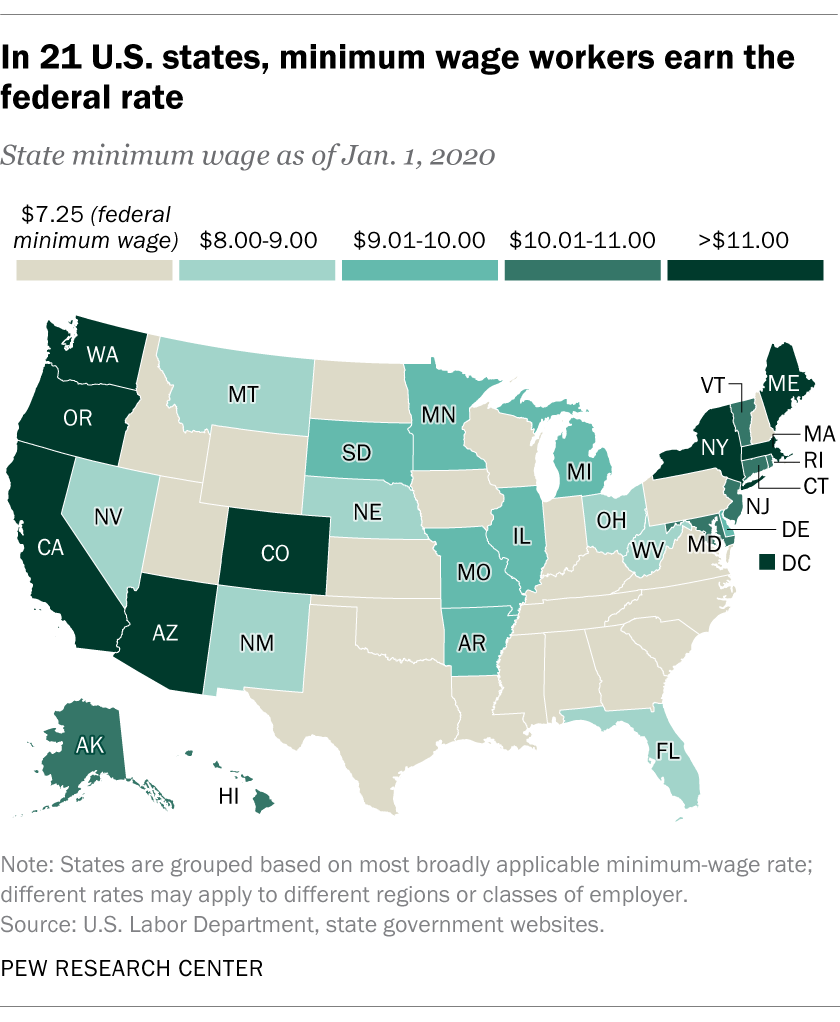

Tipped employees are guaranteed to earn the minimum wage when tips are included. Moreover on july 1 2020 the illinois minimum wage will further increase to 1000 per hour and the nevada minimum wage will increase to 900 or 800 per hour depending on whether an employer offers health benefits. Georgia has a state minimum wage law but it does not apply to tipped employees.

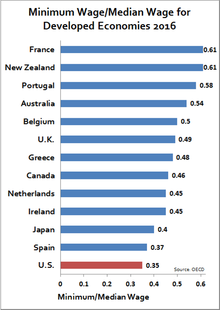

State laws differ as to whether the employer must pay the full minimum wage itself or may count an employees tips toward its minimum wage obligation. To help your organization stay aware of the latest labor law paycor has created a breakdown of tipped minimum wage requirements by state for 2020. The minimum wage in nevada is 725 if the employer provides health benefits.

Nevadas state minimum wage rate is 825 per hourthis is greater than the federal minimum wage of 725. Tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit. Otherwise the minimum wage is 825.

The state minimum wage rates may be increased annually based upon changes in the cost of living index which would in turn increase the minimum cash wage for tipped employees. Note that in two aforementioned states arizona and illinois local minimum wage rates may apply see above. The tipped wage is the base wage for employees who earn tips such as servers and bartenders.

State of nevada minimum wage 2019 annual bulletin.

More From California Minimum Wage Map

- Marijuana Legalization Bill Hawaii

- New York Minimum Wage

- Us Federal Minimum Wage 2021

- Us Minimum Wage History Graph

- Ny Minimum Wage Increase

Incoming Search Terms:

- Colorado S Minimum Wage Increased To 12 With Start Of New Year The Fort Morgan Times Ny Minimum Wage Increase,

- New Year New Minimum Rates State By State Minimum Wage Updates For 2020 Ogletree Deakins Ny Minimum Wage Increase,

- Michigan Minimum Wage Workers Got A Raise On Jan 1 But They Won T See 12 Hour Until 2030 Michigan Advance Ny Minimum Wage Increase,

- Federal Labor Law Updates For January 2020 Tryhris Ny Minimum Wage Increase,

- Ohio Tip Pooling And Tip Credit Laws Tipmetric Software 2020 By Restaurant Tip Laws Medium Ny Minimum Wage Increase,

- Raising The Minimum Wage To 12 By 2020 Would Lift Wages For 35 Million American Workers Economic Policy Institute Ny Minimum Wage Increase,

/2020-federal-state-minimum-wage-rates-2061043-final-d82d14b0792c49c8a7b85e3666d8b6b2.png)