Ny Minimum Wage Tax Credit, New York City Businesses Struggle To Keep Up After Minimum Wage Increase Wsj

Ny minimum wage tax credit Indeed lately is being hunted by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of this article I will discuss about Ny Minimum Wage Tax Credit.

- Figures From New York State Economic And Fiscal Outlook 2016 2017

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrsw Guexo8epawoolwaqorif3uftpbms5d4382pyfw5x8vsu2i Usqp Cau

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- How Much Do Nhl Players Really Make Part 2 Taxes Hockey Graphs

- 2

- 2018 Nanny Tax Responsibilities

Find, Read, And Discover Ny Minimum Wage Tax Credit, Such Us:

- Small Business Tax Credits The Complete Guide

- Minimum Wage Impacts Along The New York Pennsylvania Border Liberty Street Economics

- Contra Corner Lifting Workers Out Of Poverty The Earned Income Tax Credit Trumps The Minimum Wage Hands Down David Stockman S Contra Corner

- Figures From New York State Economic And Fiscal Outlook 2016 2017

- 2

If you are looking for Minimum Wage In California Year 2000 you've reached the perfect location. We ve got 104 images about minimum wage in california year 2000 adding pictures, photos, photographs, backgrounds, and much more. In such page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

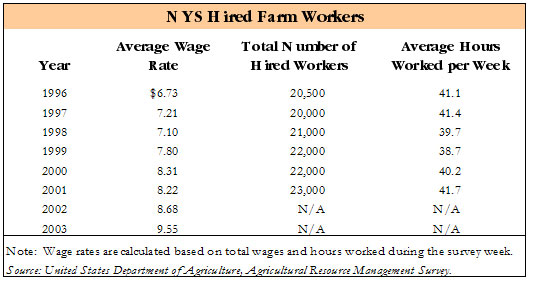

The credit is equal to the total number of hours worked by eligible employees during the taxable year for which they are paid the new york minimum wage multiplied by the applicable tax credit rate for that year.

Minimum wage in california year 2000. Over the next three years the minimum wage level will increase from 725 to 900 in three increments. An act to amend the tax law in relation to minimum wage reimbursement credit purpose. The new york state department of taxation and finance issued a memorandum monday providing detailed guidance on a newly implemented minimum wage reimbursement tax credit that incentivizes.

This bill expands the eligibility to receive the minimum wage reimburse ment credit to employers who pay the minimum wage plus fifty cents to certain employees and extends the credit to january 1 2022. Gallivan title of bill. The current applicable tax credit rate beginning on or after january 1 2016 and before january 1 2019 is 135.

New york state department of taxation and finance minimum wage reimbursement credit tax law article 1 section 38 and article 22 section 606aaa it 639 names as shown on return identifying number as shown on return a b c name of eligible employee social security number hours worked at the nys of eligible employee minimum wage rate. Relates to a minimum wage reimbursement credit. You can take a refundable credit of 125 if youre married file a joint return and have income of 250000 or less.

To claim the credit youll need to file either. The new york minimum wage tax credit new york offers millions of dollars worth of tax incentives every year for employers. Form it 639 minimum wage reimbursement credit if youre not a corporation.

The nyc school tax credit. See minimum wage reimbursement credit for detailed information about the credit and to access the credit forms. How the credit will be implemented.

Ez investment tax credit for the financial services industry employee training incentive program e tip tax credit employer compensation expense program ecep wage credit. Form ct 639 minimum wage reimbursement credit if youre a corporation. For example if.

Form ct 639 minimum wage reimbursement credit and its instructions form ct 639 i for corporations. The new york city school tax credit is available to new york city residents or part year residents who cant be claimed as dependents on another taxpayers federal income tax return.

Http Nysac Membershipsoftware Org Files Nysactaxwhitepaper 1 Pdf Minimum Wage In California Year 2000

More From Minimum Wage In California Year 2000

- Nys Minimum Wage Increase 2020

- Ny Minimum Wage Increase 2021

- La Quinta California Minimum Wage

- Raising Floridas Minimum Wage Amendment

- Ny Minimum Wage Server

Incoming Search Terms:

- New York Ny Dol Unemployment Insurance Compensation Extended Benefits Pua Peuc And 600 Fpuc Payment Eligibility And Certification Aving To Invest Ny Minimum Wage Server,

- Nyc S High Income Tax Habit Empire Center For Public Policy Ny Minimum Wage Server,

- Https Www Archkck Org File Dayforce Payroll Administrator Guide Part 1 Pdf Ny Minimum Wage Server,

- Tax Cuts Here S Everything You Need To Know Ny Minimum Wage Server,

- Minimum Wage Impacts Along The New York Pennsylvania Border Liberty Street Economics Ny Minimum Wage Server,

- What Is Exempt From Debt Collection New Economy Project Ny Minimum Wage Server,