What Is Minimum Wage Earner In Philippines, P13 Wage Increase Takes Effect In Central Visayas Sunstar

What is minimum wage earner in philippines Indeed recently has been sought by users around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of this post I will discuss about What Is Minimum Wage Earner In Philippines.

- Minimum Wage Earner Under The Train Law Ebv Law Office

- Ultimate Guide On How To Fill Out Bir Form 2316 Fullsuite

- Chapter 1 What Is A Minimum Wage 1 5 What Is Included In A Minimum Wage

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqnq9ep08usrs9 Nafqbvwakehgheprhpyqb58tylzitmnswfob Usqp Cau

- Philippines One Of The Worst Countries To Live For Minimum Wage Earners Philstar Com

- New Metro Manila Minimum Wage Set At P500 To P537

Find, Read, And Discover What Is Minimum Wage Earner In Philippines, Such Us:

- Ecop On National Minimum Wage Impossible Philstar Com

- Philippine The Minimum Wage Under The Aquino Administration Infographic Job Market Monitor

- Proposed Wage Hike Will Benefit Only 16 Of Phl Workforce Ecop

- P25 Minimum Wage Hike Granted To Metro Manila Workers Philstar Com

- 2

If you are searching for Ny Minimum Wage Tipped Employees you've come to the right location. We ve got 104 images about ny minimum wage tipped employees adding pictures, photos, pictures, backgrounds, and more. In these web page, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

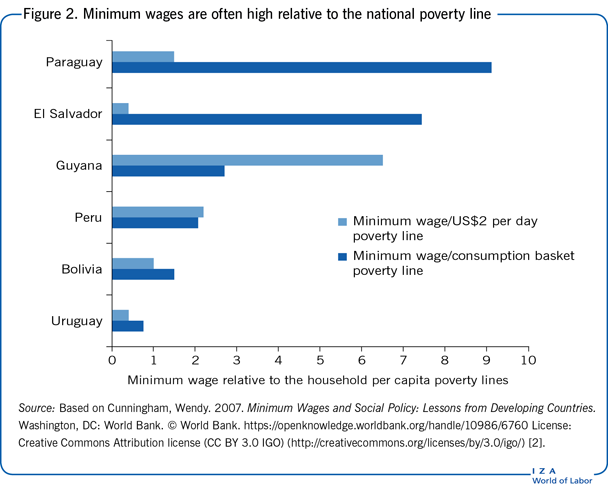

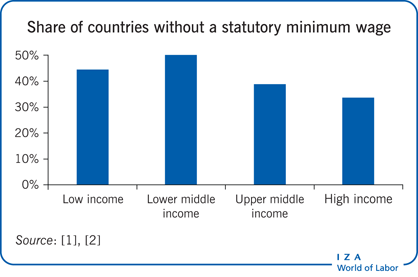

Iza World Of Labor Introducing A Statutory Minimum Wage In Middle And Low Income Countries Ny Minimum Wage Tipped Employees

Minimum Wage Earners Must Get The Pay And Benefits They Deserve Alvarez Ikot Ph Ny Minimum Wage Tipped Employees

Since 1990 a total of 273 wage orders have been issued.

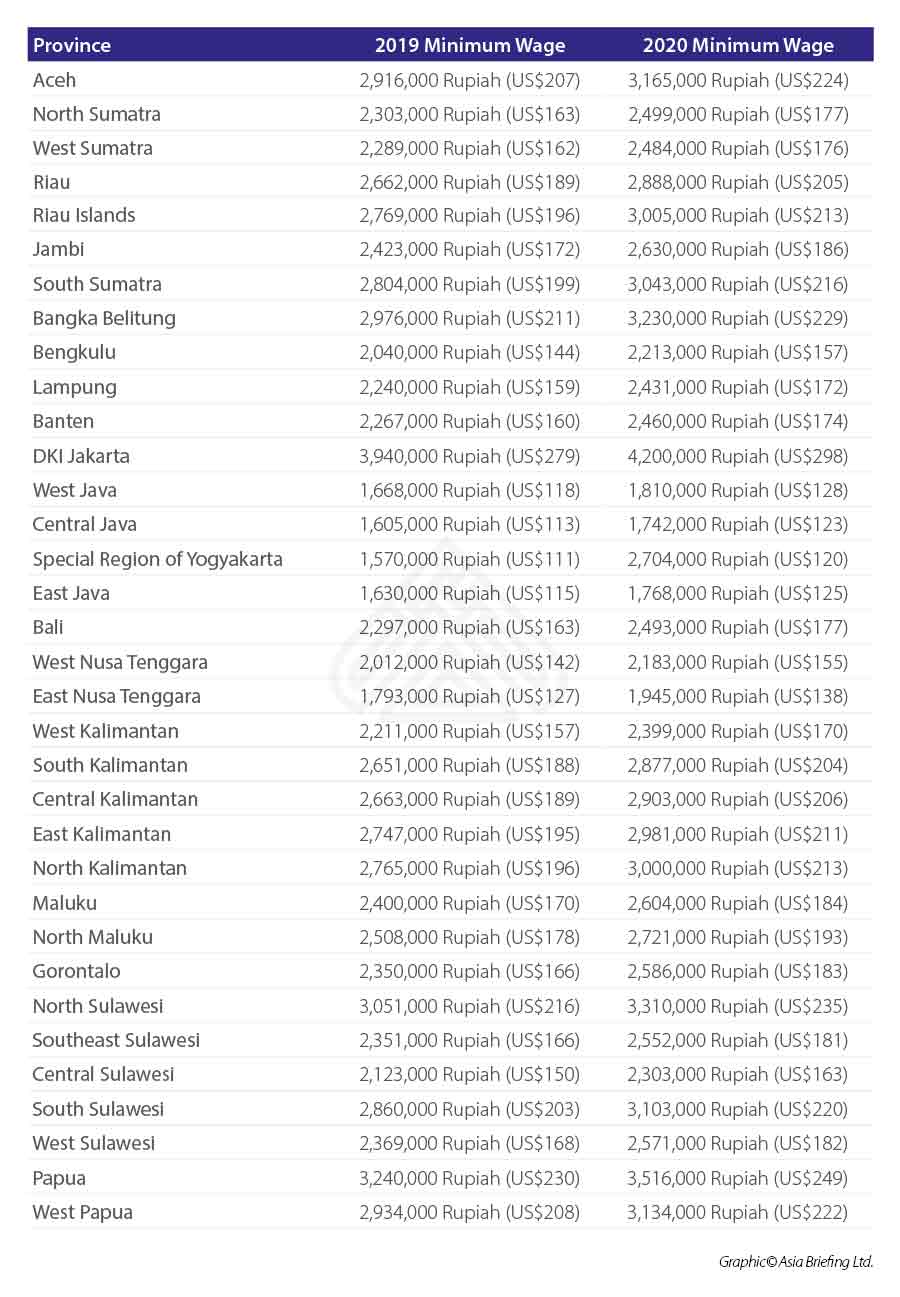

Ny minimum wage tipped employees. Minimum wages in philippines remained unchanged at 537 phpday in 2019 from 537 phpday in 2018. However there have been times when the grant of bonuses have. Minimum wage rates in the philippines vary in every region with a regional tripartite wages and productivity board rtwpb in each of them to monitor economic activities and adjust minimum wages based on the regions growth rate unemployment rate and other factors.

At this time the minimum wage in the philippines is p8900. Minimum wage earner refers to a worker in the private sector paid the statutory minimum wage or to an employee in the public sector with compensation income of not more than the statutory minimum wage in the non agricultural sector where heshe is assigned. Because of this no deductions will be made from their pay on the basis of income tax.

As of april 2015 the minimum wage of non agricultural workers in metro manila is php 481 and php 444 for agricultural workers. Minimum wage earners shall be exempt from the payment of income tax based on their statutory minimum wage rates. Tax rules for minimum wage earners.

While the regional boards determine minimum wage rates applicable per region by province and industry. How does philippines minimum wage compare to the minimum wage in other countries. International currency is a measure of currency based on the value of the united states dollar in 2009.

The holiday pay overtime pay night shift differential pay and hazard pay received by such earner are likewise exempt. In pampanga the current minimum wage is p349 per day if the employer has assets worth p30 million or more or p342 per day if the employer has assets less than p30 million. The nwpc advises the president and congress with regard to wages income and productivity.

From the bureau of internal revenues bir rr 8 2018. Minimum wages in philippines averaged 31413 phpday from 1989 until 2019 reaching an all time high of 537 phpday in 2018 and a record low of 89 phpday in 1989. In early 2018 nwpc released an updated summary of regional daily minimum.

What is a bonus. A new law passed in 2008 exempts minimum wage earners from paying income taxes. Bonus is the amount granted for employees industry and loyalty which is generally discretional.

Minimum wage is based on a work week of 40 hours or 8 hours per day. Philippines minimum wage was last changed in 2 jun 2016.

More From Ny Minimum Wage Tipped Employees

- Legalization Of Marijuana Fox News

- 2020 Minimum Wage Kentucky

- Minimum Wage California Unincorporated

- Legalizing Weed Help Economy

- Legalization Of Marijuana Disagree

Incoming Search Terms:

- Filipinos Have It Wrong Minimum Wage Should Include Being Able To Own A Home Not Just Being Able To Buy Three Meals A Day Philippines Legalization Of Marijuana Disagree,

- Minimum Wage Earners Must Get The Pay And Benefits They Deserve Alvarez Ikot Ph Legalization Of Marijuana Disagree,

- Minimum Wages In Asean How Are They Calculated Legalization Of Marijuana Disagree,

- Minimum Wage Developments Across Emerging Asia Asia Business News Legalization Of Marijuana Disagree,

- Undergrad Thesis Legalization Of Marijuana Disagree,

- Family Living Wage Ibon Foundation Legalization Of Marijuana Disagree,