California Minimum Wage Tipped Employees, Http Sdchamber Org Wp Content Uploads 2015 08 Ab 669 Daly Minimum Wage Pdf

California minimum wage tipped employees Indeed recently is being hunted by users around us, perhaps one of you. People now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of the post I will talk about about California Minimum Wage Tipped Employees.

- How Tipping Shortchanges Workers The Nation

- Minimum Wage Hike Would Boost Tipped Workers Pay Marketplace

- July 1 Minimum Wage Rates Affect Other California Prevailing Wage Rules

- Wpi Wage Watch Minimum Wage Tip And Overtime Developments May Edition Lexology

- Raising The Minimum Wage To 15 Is Critical To Growing New Jersey S Economy New Jersey Policy Perspective

- 4 Essential Tip Pooling Changes Omnibus Budget Bill 2018 Restaurant Consultant

Find, Read, And Discover California Minimum Wage Tipped Employees, Such Us:

- Is The Minimum Wage Different In California For Tipped Employees Law Office Of Payab Associates

- Workers In Majority Of U S States To See An Increase In Minimum Wage In 2020

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology

- The Minimum Wage Movement Is Leaving Tipped Workers Behind Fivethirtyeight

- How To Do Tip Pooling Among Your Employees Rules To Follow More

If you re searching for 2020 Minimum Wage Dol you've reached the perfect location. We ve got 104 images about 2020 minimum wage dol adding pictures, pictures, photos, wallpapers, and much more. In such web page, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

They do not affect an employees rights under california wage and hour laws.

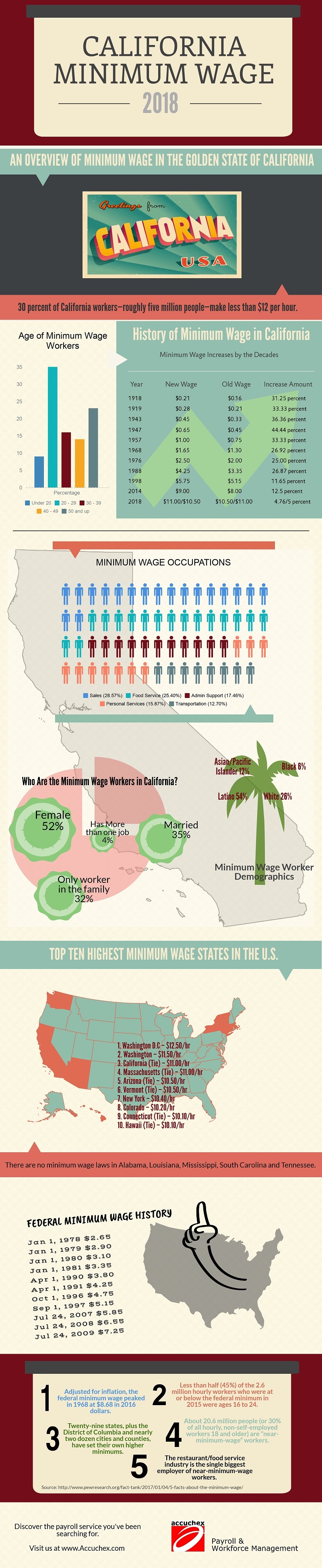

2020 minimum wage dol. Tips are considered the property of the employee who earned them and cannot therefore be treated as wages. State requires employers to pay tipped employees a minimum cash wage above the minimum cash wage required under the federal fair labor standards act 213hour arizona. In states that allow a tip credit a certain amount of received tips per hour may be credited against the minimum wage by an employer although the tipped employee must receive at least the minimum wage with combined.

Bartenders have a higher minimum cash wage 638 and so a lower tip credit 277 3 tip credit only applicable if the combined amount an employee receives from the employer and tips is at least 700 more than the minimum wage. Unlike under federal regulations in california an employer cannot use an employees tips as a credit towards its obligation to pay the minimum wage. Tipped employees are entitled to receive the full minimum wage before tips in california.

Under california tip law employees have the right to keep the tips they earnthis means that owners and most managers may not withhold or take a portion of tips. Employers must pay employees at least the california minimum wage for each hour worked in addition to any tips they may receive. The california minimum wage was last changed in 2008 when it.

California law requires that employees receive the minimum wage plus any tips left for them by patrons of the employers business. An employer who violates california tip law may be charged with a california misdemeanor crime. For local minimum wage regulations read our guide to california minimum wage 2 hotels and restaurants only.

You can find the current minimum wage in our article on california wage and hour laws tip pooling. You are entitled to be paid the higher state minimum wage. Labor code section 351.

California law does allow tip pooling though. Tips are also separate from wages. The minimum wage applies to most employees in california with limited exceptions including tipped employees some student workers and other exempt occupations.

Californias state minimum wage rate is 1300 per hourthis is greater than the federal minimum wage of 725.

More From 2020 Minimum Wage Dol

- Ny Minimum Wage 2020 Exempt

- California Minimum Wage Plan

- Wage Increases Minimum Wage 2020

- Federal Minimum Wage Bill 2019

- California Minimum Wage 2020 Form

Incoming Search Terms:

- Most Action To Raise Minimum Wage Is At State And Local Level Not In Congress Pew Research Center California Minimum Wage 2020 Form,

- New California Labor Laws What S Changing In Your Workplace Los Angeles Times California Minimum Wage 2020 Form,

- Minimum Wage Hike Would Boost Tipped Workers Pay Marketplace California Minimum Wage 2020 Form,

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology California Minimum Wage 2020 Form,

- Http Sdchamber Org Wp Content Uploads 2015 08 Ab 669 Daly Minimum Wage Pdf California Minimum Wage 2020 Form,

- Wpi Wage Watch Minimum Wage Tip And Overtime Developments May Edition Lexology California Minimum Wage 2020 Form,

/StateMinimumWageLegislation-c8edd859dde74814a6538680e3a216fd.png)