What Is Minimum Wage In California After Taxes, How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What is minimum wage in california after taxes Indeed recently has been hunted by consumers around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of the post I will talk about about What Is Minimum Wage In California After Taxes.

- Low Income Health Insurance In California Health For California

- State Income Tax Wikipedia

- Tip Gratuity Laws In California The Ultimate Guide 2020

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- Los Altos Minimum Wage Poster

- Tax Relief For Low Income And Minimum Wage Workers Ontario Ca

Find, Read, And Discover What Is Minimum Wage In California After Taxes, Such Us:

- Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy

- Ultimate 2014 Guide To Payroll Tax And Limits Infographic

- California Paycheck Calculator Smartasset

- Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips

- California Minimum Wage Labor Laws Ca

If you re looking for Federal Minimum Wage Of you've reached the perfect location. We have 104 graphics about federal minimum wage of adding images, pictures, photos, backgrounds, and more. In such webpage, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Californias state minimum wage rate is 1300 per hourthis is greater than the federal minimum wage of 725.

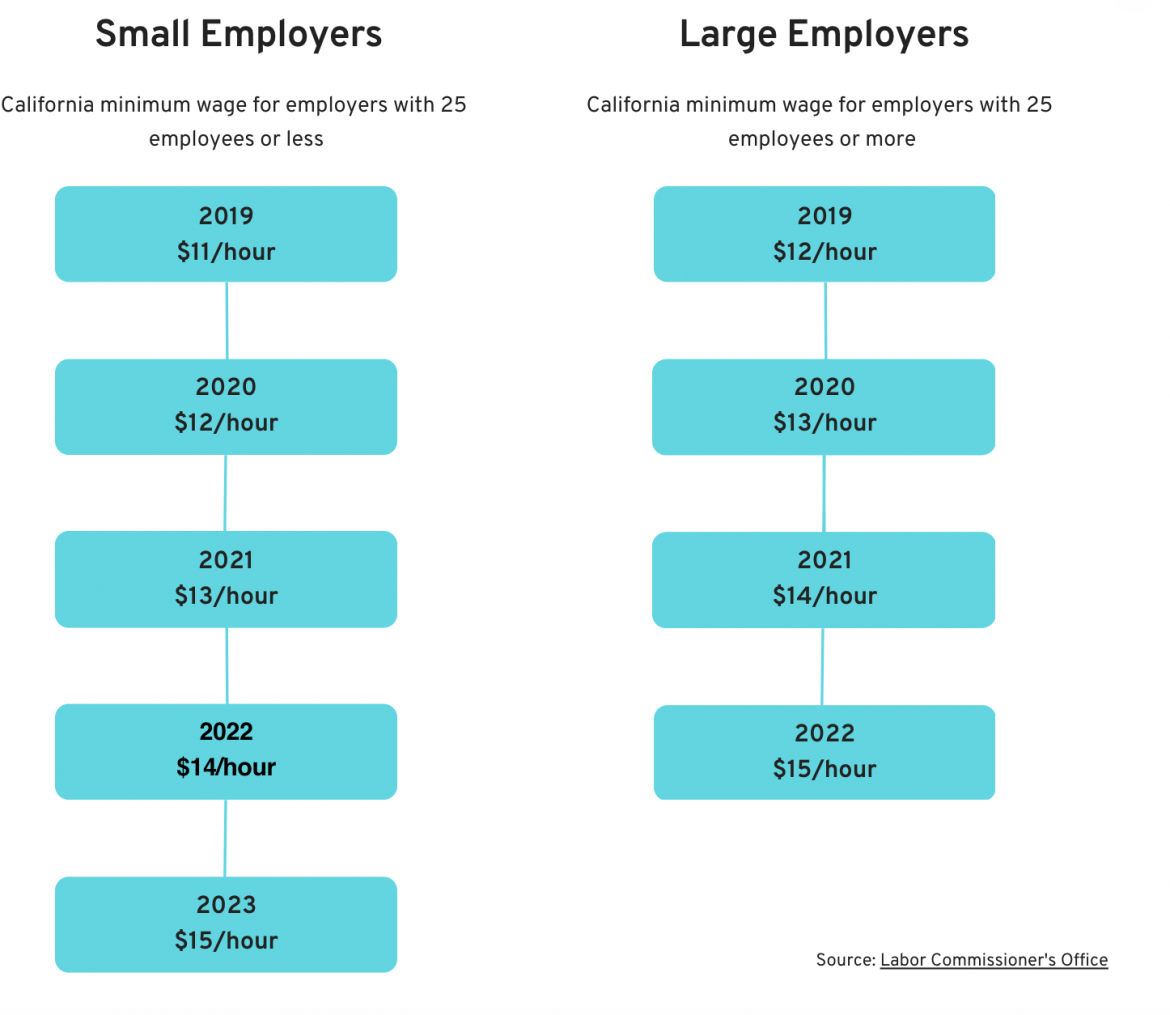

Federal minimum wage of. These assume a 40 hour working week. In california the applicable minimum wage depends on the size of the employer. The minimum wage in california means that a full time worker can expect to earn the following sums as a minimum before tax.

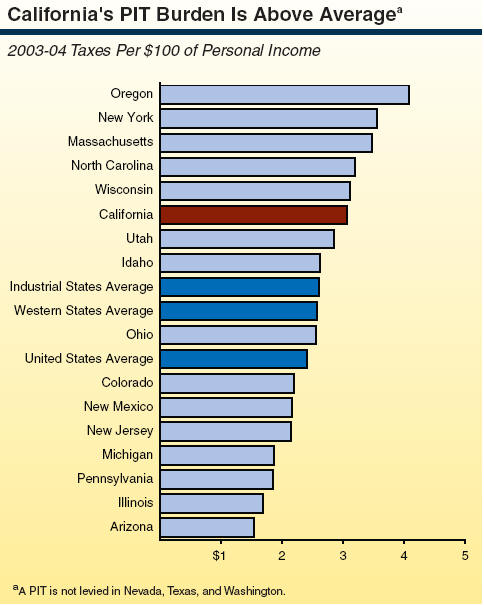

Californias 2020 income tax ranges from 1 to 133. That is what you are taxed on that is what your employer reports on his quarterly reports and what he charges to wages. This page has the latest california brackets and tax rates plus a california income tax calculator.

52000 per working week. In california thats 8 an hour. Effective january 1 2017 the minimum wage for all industries will be increased yearly.

Like if i make 8 dollars an hour would that really only be 5 an hour when you count the taxes they took off. From january 1 2017 to january 1 2022 the minimum wage will increase for employers employing 26 or more employees. So i plan to get a job working at subway.

In 2020 californias minimum wage is 1200 per hour for employees that work for employers with 25 or fewer employees and 1300 per hour for larger employers. In states with a higher rate such as oregon and washington minimum wage workers earn more than the national average. California income tax rate.

What is the hourly wage in california if you include taxes. As of july 1 the minimum wage in calif. The minimum wage applies to most employees in california with limited exceptions including tipped employees some student workers and other exempt occupations.

Workers in the state of washington trail close earning a minimum wage rate of 947 hourly. The california minimum wage was last changed in 2008 when it. My question for you is.

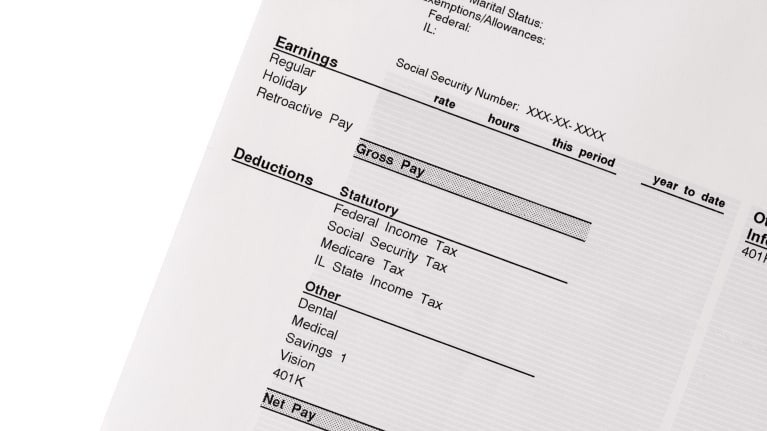

These assume a 40 hour working week. Census bureau number of cities that have local income taxes. But unless youre getting paid under the table your actual take home pay.

Your job probably pays you either an hourly wage or an annual salary. Your average tax rate is 2072 and your marginal tax rate is 3765this marginal tax rate means that your immediate additional income will be taxed at this rate. Median household income in california.

Your take home pay is just that you get paid 9hr in calif. Im assuming they pay minimum wage for the job im applying for. The minimum wage is the minimum hourly rate that nearly all california employees must be paid for their work by law.

If you make 55000 a year living in the region of california usa you will be taxed 11394that means that your net pay will be 43606 per year or 3634 per month. Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950. And it remains that rate for 1 12 yrs.

Although there are some exceptions almost all employees in california must be paid the minimum wage as required by state law.

More From Federal Minimum Wage Of

- Minimum Wage In California 2020 Bay Area

- Virginia Marijuana Legalization News

- South Korea Minimum Wage 2020

- What Is Minimum Wage In Uk Hourly

- Legalize Marijuana Zip Up Hoodies

Incoming Search Terms:

- How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center Legalize Marijuana Zip Up Hoodies,

- Scv News Tax Credits Aid Californians Now Minimum Wage Hike Set For 2021 Scvnews Com Legalize Marijuana Zip Up Hoodies,

- 2019 Ontario Budget Giving Parents Flexible And Affordable Child Care Choices Legalize Marijuana Zip Up Hoodies,

- Minimum Wage Hike Would Have Benefitted More People Than Tax Credit Report Ipolitics Legalize Marijuana Zip Up Hoodies,

- California S Corporate Income Tax Rate Could Rival The Federal Rate Tax Foundation Legalize Marijuana Zip Up Hoodies,

- Minimum Wage Changes In California On 7 1 Datatech Legalize Marijuana Zip Up Hoodies,

/california-state-taxes-amongst-the-highest-in-the-nation-3193244-finalv2-8a746a2ad14c4fba8d21382f812c7c76.png)