What Is Minimum Wage In Ohio After Taxes, 1

What is minimum wage in ohio after taxes Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of this post I will talk about about What Is Minimum Wage In Ohio After Taxes.

- Https Actohio Org Wp Content Uploads 2018 03 Act Ohio Prevailing Wage Guide Final Pdf

- How Much Do Incarcerated People Earn In Each State Prison Policy Initiative

- Employer Withholding

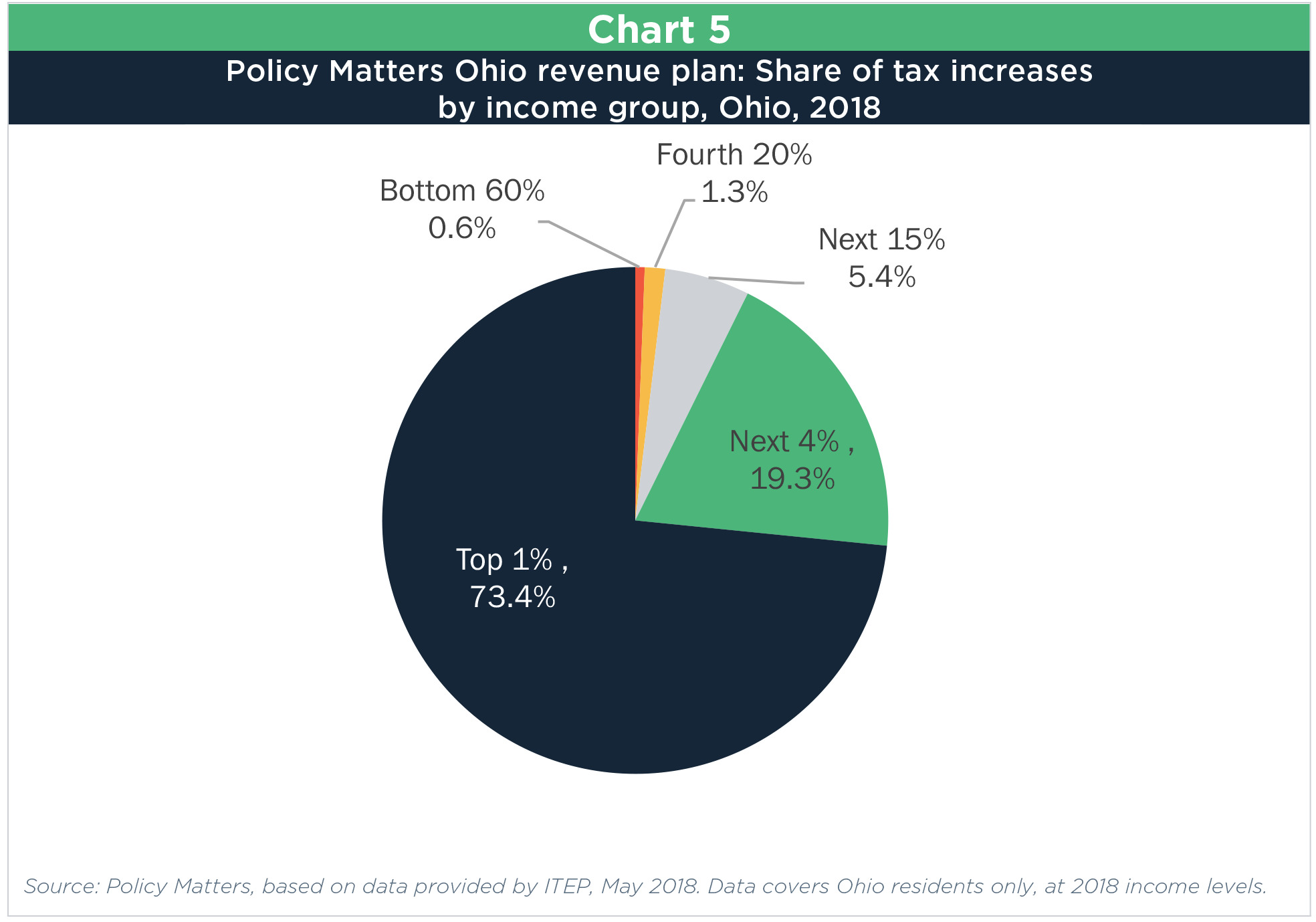

- Overhaul A Plan To Rebalance Ohio S Income Tax

- Https Www Co Warren Oh Us Wcoed Incentivesfactsheets Jrtc Guidelines Pdf

- Financial Incentives For Doing Business In Ohio Champaign Economic Partnership Cep Ohio

Find, Read, And Discover What Is Minimum Wage In Ohio After Taxes, Such Us:

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- Ohio Minimum Wage

- Profitable Giants Like Amazon Pay 0 In Corporate Taxes Some Voters Are Sick Of It The New York Times

- Forming An Llc In Ohio A Step By Step Guide

- Llc Ohio How To Start An Llc In Ohio Truic Guides

If you re searching for What Is The Minimum Wage In The Uk For A 16 Year Old you've reached the perfect place. We ve got 104 images about what is the minimum wage in the uk for a 16 year old adding images, photos, photographs, wallpapers, and much more. In these web page, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Do States That Charge State Taxes Tend To Have A Higher Minimum Wage Than States Without State Taxes Quora What Is The Minimum Wage In The Uk For A 16 Year Old

Ohio has a progressive income tax system with eight tax brackets.

What is the minimum wage in the uk for a 16 year old. New employers except for those in the construction industry will continue to pay at 27. The minimum wage in ohio is currently 730 for employees over 16. Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950.

Employee is any individual employed by an employer but does not included individuals employed. The minimum wage in ohio means that a full time worker can expect to earn the following sums as a minimum before tax. The minimum wage applies to most employees in ohio with limited exceptions including tipped employees some student workers and other exempt occupations.

The ohio minimum wage was last changed in 2008 when it was raised 170. The ohio 2020 state unemployment insurance sui tax rates will range from 03 to 94 up from the 2019 range of 03 to 92. Minimum fair wage standards employer is any governmental entity business association or person or group of persons acting in the interest of an employer in relation to an employee.

The 2020 sui taxable wage base reverts to 9000 down from 9500 for 2018 and 2019. These assume a 40 hour working week. There are more than 600 ohio cities and villages that add a local income tax in addition to the.

Your average tax rate is 1943 and your marginal tax rate is 3312this marginal tax rate means that your immediate additional income will be taxed at this rate. Full time minimum wage workers in ohio earn a total of 34200 per week and approximately 1778400 per year based on a 8 hour days and a 260 day work year before taxes. If you make 55000 a year living in the region of ohio usa you will be taxed 10688that means that your net pay will be 44312 per year or 3693 per month.

Overview of ohio taxes. Rates range from 0 to 4797. Ohios state minimum wage rate is 870 per hourthis is greater than the federal minimum wage of 725.

34800 per working week. You are entitled to be paid the higher state minimum wage. If youre only making minimum wage and only working part time they probably wont take out any federal or state withholding.

Workers in the state of washington trail close earning a minimum wage rate of 947 hourly. For under 16 it is the same as the federal minimum wage which is 725. For all filers the lowest bracket applies to income up to 21750 and the highest bracket only applies to income above 217400.

The federal poverty threshold for a household of two is 14570 per year. Ohio allows employers to credit up to 425 in earned tips against an employees wages per hour which can result in a cash wage as low as 430 per hour. These assume a 40 hour working week.

Minimum wage is always given before taxes.

More From What Is The Minimum Wage In The Uk For A 16 Year Old

- California Minimum Wage 2021 Salary Exempt

- Marijuana News Los Angeles

- Minimum Wage In Houston Texas 2020

- What Is The Minimum Wage In England 2020

- Biden Marijuana Legalization

Incoming Search Terms:

- W 2 Wages And Salaries Taxable Irs And State Income On A W2 Biden Marijuana Legalization,

- How Much Money A Family Of 4 Needs To Get By In Every Us State Biden Marijuana Legalization,

- How Much Do I Pay A Nanny Nanny Lane Biden Marijuana Legalization,

- Http Www Akronohio Gov Cms Resource Library Files Rules Rulesregs Pdf Biden Marijuana Legalization,

- Payroll Tax Wikipedia Biden Marijuana Legalization,

- Https Www Com Ohio Gov Documents Dico Minimum Wage Complaint Pdf Biden Marijuana Legalization,