What Is Minimum Wage In Oregon After Taxes, State Corporate Income Tax Rates And Brackets For 2020

What is minimum wage in oregon after taxes Indeed lately is being sought by consumers around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the article I will talk about about What Is Minimum Wage In Oregon After Taxes.

- Oregon Minimum Wage Hotel Tax Going Up July 1 Kgw Com

- 2

- Oregon S Minimum Wage Increases Next Month Kmvu Fox 26 Medford

- Minimum Wage Will Increase In Majority Of U S States In 2020

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- Oregon S Income Distribution Oregon Office Of Economic Analysis

Find, Read, And Discover What Is Minimum Wage In Oregon After Taxes, Such Us:

- Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

- Oregon S Minimum Wage To Increase Each Year Through 2022 Article Display Content Qualityinfo

- Minimum Wage Set To Increase Across Oregon Starting July 1

- Oregon S New Commercial Activity Tax The Cpa Journal

- Schools Plan Businesses Worry An Old Timber Town Prepares For Oregon S New Tax Opb

If you re looking for Minimum Wage In Houston Texas 2020 you've arrived at the ideal location. We ve got 104 images about minimum wage in houston texas 2020 including pictures, photos, pictures, backgrounds, and much more. In these page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

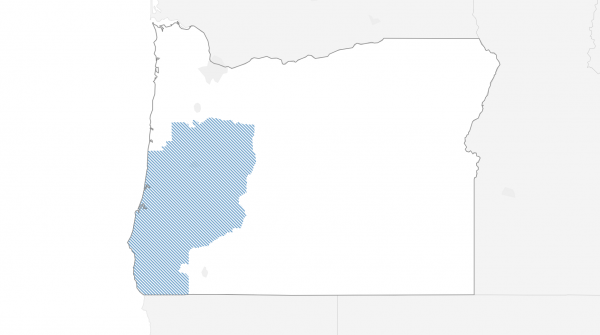

The minimum wage is 1150 per hour in non urban areas 1200 per hour in standard counties and 1325 per hour in the portland metro area.

Minimum wage in houston texas 2020. These rates are in effect from july 1 2020 to june 30 2021. Oregons state minimum wage rate is 1125 per hourthis is greater than the federal minimum wage of 725. The minimum wage in oregon means that a full time worker can expect to earn the following sums as a minimum before tax.

Oregons minimum wage depends on work location. In states with a higher rate such as oregon and washington minimum wage workers earn more than the national average. The minimum wage goes up every year.

45000 per working week. In addition to federal taxes oregon taxpayers have to pay state taxes. The minimum wage applies to most employees in oregon with limited exceptions including tipped employees some student workers and other exempt occupations.

Workers in the state of washington trail close earning a minimum wage rate of 947 hourly. Oregon has some of the highest tax burdens in the us. This minimum tax ranges from 150 for sales under 500000 to 100000 for sales.

Star broadcaster gets huge surprise during nfl halftime. Oregon workers must make minimum wage. Newly obtained 911 call adds fuel to falwell scandal.

These assume a 40 hour working week. The state uses a four bracket progressive state income tax which means that higher income levels correspond to higher state income tax rates. You are entitled to be paid the higher state minimum wage.

If i worked a 30 hour week before taxes id make 255 per week. Minimum wage oregon laws protect you at work every worker must be paid at least minimum wage. These assume a 40 hour working week.

Portland and nonurban counties have a different minimum wage. How much would this be after oregons income tax. Tip credits are illegal in oregon.

The oregon minimum wage was last changed in 2008 when it was raised. Oregon corporations that claim no net income or have net losses must still pay minimum taxes based on total sales. Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950.

The next increase is on july 1 2021. There are exceptions but they are uncommon. These rates range from 500 to 990.

How much of this 850 goes to income tax. Oregons minimum wage starting this month is 850 an hour.

More From Minimum Wage In Houston Texas 2020

- Washington State Minimum Wage 2020 Effective Date

- Minimum Wage Target Texas

- What Is Minimum Wage Mean

- California Minimum Wage By County 2020

- Legalization Of Weed Social Issue

Incoming Search Terms:

- State Income Tax Wikipedia Legalization Of Weed Social Issue,

- Minimum Wage Hike New Transportation Tax Education Laws Come July 1 Legalization Of Weed Social Issue,

- 2 Legalization Of Weed Social Issue,

- A Portrait Of Oregon S Minimum Wage Workers Oregon Center For Public Policy Legalization Of Weed Social Issue,

- Opinion The Real Impact Of Universal Preschool And A Tax On The 5 Street Roots Legalization Of Weed Social Issue,

- Taxation In The United States Wikipedia Legalization Of Weed Social Issue,