What Is Minimum Wage In Pa After Taxes, What Is The Real Value Of 100 In Your State Tax Foundation

What is minimum wage in pa after taxes Indeed recently has been hunted by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of the article I will talk about about What Is Minimum Wage In Pa After Taxes.

- Https Www Phila Gov Media 20190911092742 Job Creation Tax Credit Jctc Application Packet 2019 Fillable Pdf

- 2020 State Individual Income Tax Rates And Brackets Tax Foundation

- Minimum Wage Impacts Along The New York Pennsylvania Border Liberty Street Economics

- Celery Software Update 2020 Tax Wage Table En Social Premiums Aruba Curacao Sint Maarten Bes Updates Blog

- Pa Legislative Leaders Agree On 34b State Budget Plan More For Schools No New Taxes And No Minimum Wage Hike Pennlive Com

- Us Corporate Income Tax Now More Competitive Tax Foundation

Find, Read, And Discover What Is Minimum Wage In Pa After Taxes, Such Us:

- Minimum Wage Impacts Along The New York Pennsylvania Border Liberty Street Economics

- Pennsylvania Pa Department Of Labor And Industry Enhanced Unemployment Benefits Lost Wages Assistance Lwa Pua Peuc And 600 Fpuc Back Payments Aving To Invest

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- What Are Employee And Employer Payroll Taxes Ask Gusto

If you re looking for California Minimum Wage Labor Code you've arrived at the perfect location. We have 104 graphics about california minimum wage labor code including pictures, pictures, photos, backgrounds, and much more. In these web page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950.

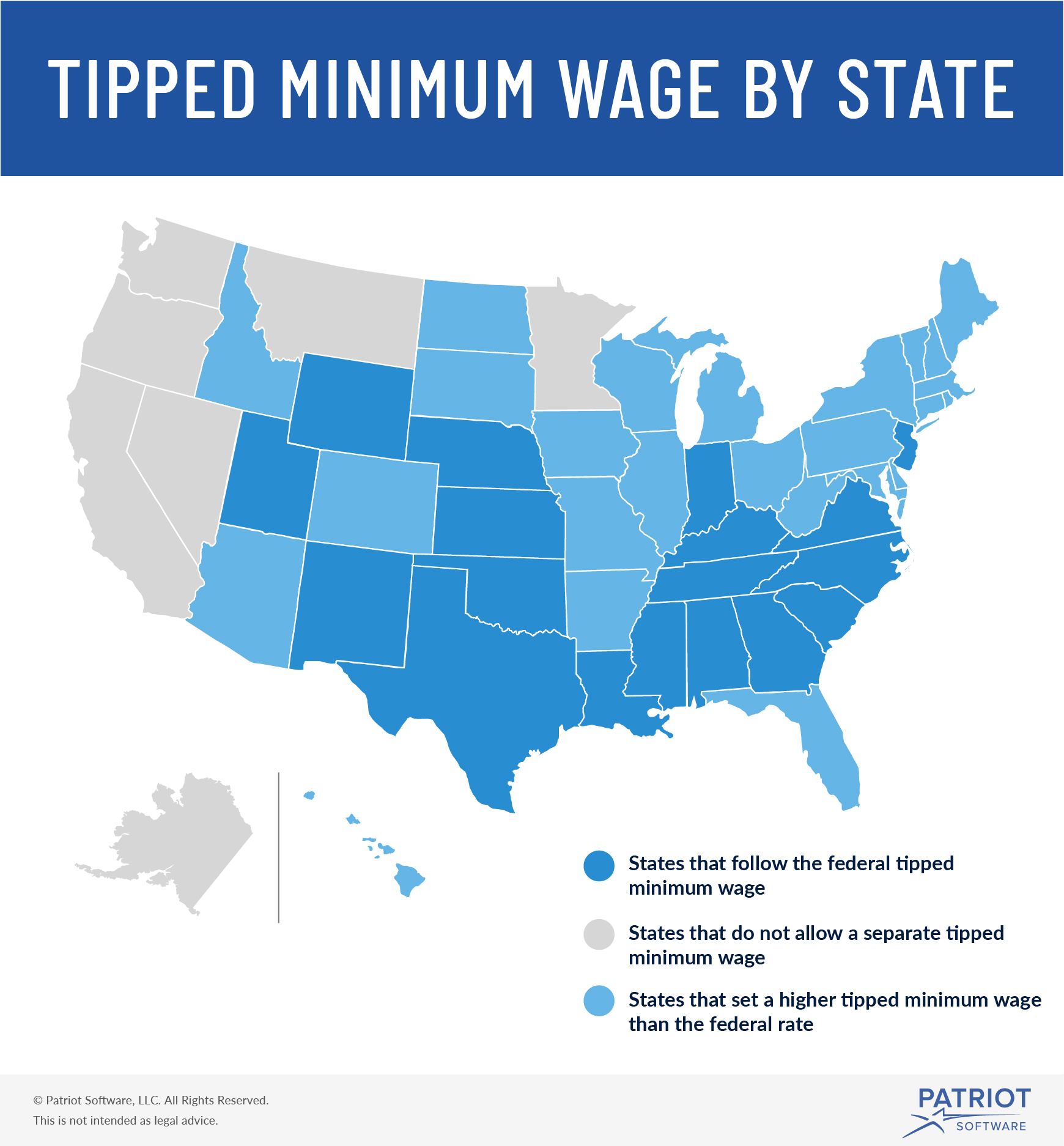

California minimum wage labor code. The pennsylvania minimum wage was last changed in 2008 when it was raised 010 from 715 to 725. Pennsylvania is one of just eight states that has a flat income tax rate and of those states it has the lowest rate. Pennsylvanias state minimum wage rate is 725 per hourthis is the same as the current federal minimum wage rate.

Just like federal income taxes your employer will withhold money to cover this state income tax. These assume a 40 hour working week. The minimum wage applies to most employees in pennsylvania with limited exceptions including tipped employees some student workers and other exempt occupations.

On july 1 2020 the wage. The minimum wage in pennsylvania is the same so pennsylvania employees are entitled to earn 725 an hour. 29000 per working week.

Workers in the state of washington trail close earning a minimum wage rate of 947 hourly. The minimum wage in pennsylvania means that a full time worker can expect to earn the following sums as a minimum before tax. In states with a higher rate such as oregon and washington minimum wage workers earn more than the national average.

These assume a 40 hour working week. Currently the federal minimum wage is 725 an hour.

More From California Minimum Wage Labor Code

- Minimum Wage California In 2020

- What Is Minimum Wage In Palm Springs California

- How Much Is Minimum Wage For A 15 Year Old

- What Is The Minimum Wage Rate At The Time This Episode Aired

- What Is Minimum Wage In Ontario

Incoming Search Terms:

- How Much Do Nhl Players Really Make Part 2 Taxes Hockey Graphs What Is Minimum Wage In Ontario,

- Minimum Wage Impacts Along The New York Pennsylvania Border Liberty Street Economics What Is Minimum Wage In Ontario,

- How Much Does It Cost Or Save Workers To Commute Across State Lines What Is Minimum Wage In Ontario,

- Map Shows What A Living Wage Would Be In Every Us State What Is Minimum Wage In Ontario,

- State Corporate Income Tax Rates And Brackets For 2020 What Is Minimum Wage In Ontario,

- Https Www Revenue Pa Gov Formsandpublications Formsforindividuals Pit Documents 2018 2018 Pa 40in Pdf What Is Minimum Wage In Ontario,

.jpg)