What Is Minimum Wage Tax Rate, Minimum Wage Missouri Labor

What is minimum wage tax rate Indeed recently is being sought by users around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the post I will discuss about What Is Minimum Wage Tax Rate.

- Train Law 2020 Income Tax Tables In The Philippines Pinoy Money Talk

- Iza World Of Labor The Minimum Wage Versus The Earned Income Tax Credit For Reducing Poverty

- Taxtips Ca Ontario Personal Income Tax Rates

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- How Scandinavian Countries Pay For Their Government Spending

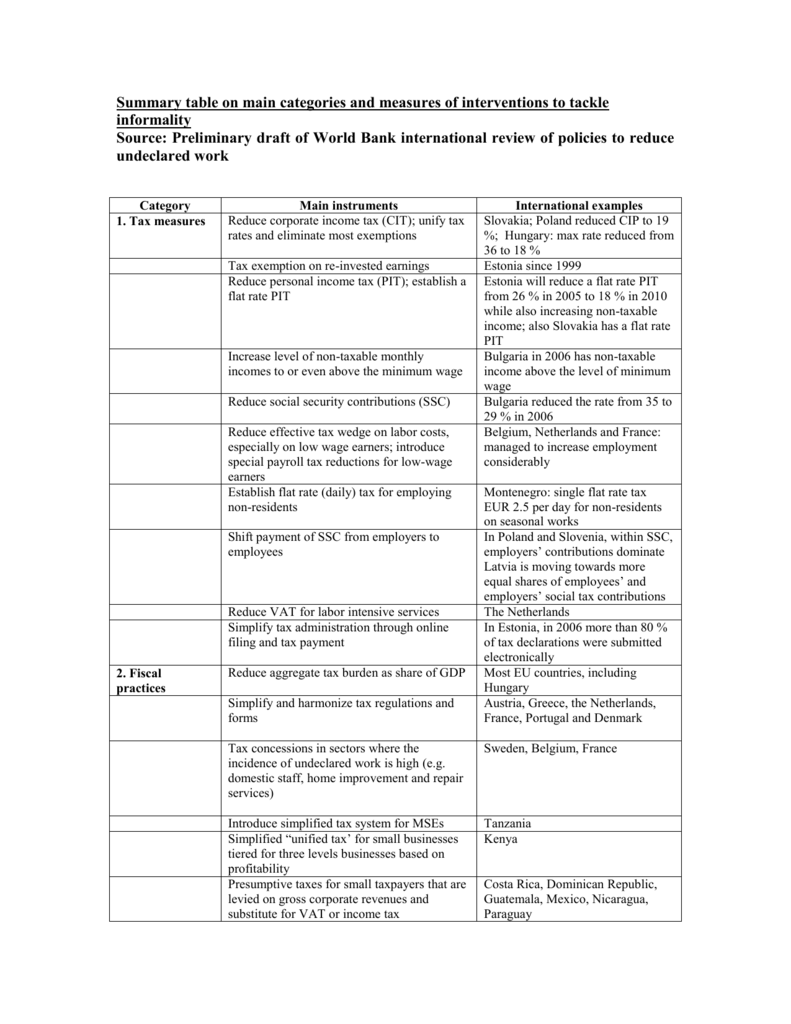

- Summary Table On Main Categories And Measures Of

Find, Read, And Discover What Is Minimum Wage Tax Rate, Such Us:

- How Scandinavian Countries Pay For Their Government Spending

- Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More

- New Income Tax Table 2020 Philippines

- Trump Bezos And Buffett Pay Lower Tax Rate Than Someone Making Minimum Wage Of 7 25 Ht Latestagecapitalism

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcriwhlvjc Yv7ft1obnpehjqtl7ucasb8amswzucnmgr9p3latd Usqp Cau

If you are searching for 2020 Minimum Wage Minnesota you've come to the ideal place. We have 104 graphics about 2020 minimum wage minnesota including pictures, photos, photographs, wallpapers, and much more. In these web page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

155 505 39 of taxable income above 584 200.

2020 minimum wage minnesota. 321 601 445 100. Current minimum wage rates. The minimum wage rate for training workers is.

205 901 321 600. The amount that you can earn before you start to pay the higher rate of tax is known as your standard rate cut off point. Based on a 40 hour work week this works out to an annual salary of 15600.

105 429 36 of taxable income above 445 100. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. 5092 plus 325 cents for each 1 over 45000.

51667 plus 45 cents for each 1 over. Once under the ordinary income tax system and again under the amt. 19 cents for each 1 over 18200.

The minimum wage the lowest hourly amount that an employee may be paid for their labor is determined by both state and federal labor laws in the united statesunder the federal fair labor standards act states and localities are permitted to set their own minimum wage rates which will take precedence over the federal minimum wage rate if they are higher. 445 101 584 200. Adult starting out and training.

As of 2015 this would mean that a single filer would be paying 10 percent federal income tax on the first 9075 and 15 percent on the remaining 6525. Resident tax rates 202021. Under their employment agreement have to do at least 60 credits a year of industry training.

1512 an hour before tax. There are some exceptions to the application of the minimum wage act 1983 and a small number of people with a disability hold an exemption permit from the minimum wage. Different types of minimum wage rates.

Tax on this income. The following rates were for the national minimum wage before the national living wage was introduced. See case studies for an example of how to calculate income using tax rates and the standard rate cut off point.

60480 before tax for a 40 hour week. The alternative minimum tax amt was created in the 1960s to prevent high income taxpayers from avoiding the individual income taxthis parallel tax income system requires high income taxpayers to calculate their tax bill twice. The remainder of your income is taxed at the higher rate of tax 40 in 2020.

The federal minimum wage is 750 per hour as of 2015. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. Taxes on directors fee consultation fees and all other income.

18 of taxable income. The rates were usually updated every october. Taxable income r rates of tax r 1 205 900.

67 144 31 of taxable income above 321 600. 37 062 26 of taxable income above 205 900. Different types of minimum wage rates has more information on the different types of minimum wage rates.

More From 2020 Minimum Wage Minnesota

- What Is The Minimum Wage In Denmark 2019

- Minimum Wage Kingston Ny

- Nyc Minimum Wage After Taxes

- What Is Minimum Wage Nz 2019

- Minimum Wage In Dublin California

Incoming Search Terms:

- Progressive Tax Rates Help Ease Tax Bite On Income Increases Minimum Wage Or Otherwise Don T Mess With Taxes Minimum Wage In Dublin California,

- Us Corporate Income Tax Now More Competitive Tax Foundation Minimum Wage In Dublin California,

- Short Term And Long Term Capital Gains Tax Rates By Income Minimum Wage In Dublin California,

- Sanders Is Not Proposing A 52 Percent Tax On Minimum Wage Incomes Fact Check Minimum Wage In Dublin California,

- Mike Bostock Graphs Federal Income Tax Brackets And Tax Rates And I Connect To Some General Principles Of Statistical Graphics Statistical Modeling Causal Inference And Social Science Minimum Wage In Dublin California,

- 45 An Increase In The Marginal Income Tax Rate Is Likely To A Increase The Quantity Homeworklib Minimum Wage In Dublin California,