What Is Minimum Wage With Tax, Minimum Wage Hike Or Tax Cut What S The Best Way To Get Money Into Low Income Earners Pockets The Spinoff

What is minimum wage with tax Indeed recently has been sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of the post I will talk about about What Is Minimum Wage With Tax.

- Minimum Wage And Tax Exemptions In The Philippines Duran And Duran Schulze Law

- What Can The Minimum Wage Buy You In Ireland Thejournal Ie

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- Increasing Both The Earned Income Tax Credit And The Minimum Wage Would Strengthen Wisconsin S Families Wisconsin Budget Project

- What S Hidden Under The 15 Minimum Wage Higher Taxes Rutgers Business School

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gct4werkwzh6p5ukwyy5u6yrdfb81seapgcvychrysktj Pu9kqp Usqp Cau

Find, Read, And Discover What Is Minimum Wage With Tax, Such Us:

- Minimum Wage Or Tax Increase Alberta Filipino Journal

- Infographic How Do Small Business Owners Feel About Minimum Wage Increases Score

- The Minimum Wage Ain T What It Used To Be The New York Times

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gct4werkwzh6p5ukwyy5u6yrdfb81seapgcvychrysktj Pu9kqp Usqp Cau

- Progressive Tax Rates Help Ease Tax Bite On Income Increases Minimum Wage Or Otherwise Don T Mess With Taxes

If you re looking for Ny Minimum Wage Lookup you've arrived at the perfect place. We ve got 104 graphics about ny minimum wage lookup including pictures, pictures, photos, backgrounds, and much more. In such webpage, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Other special taxes include the alternative minimum tax and social security and medicare on tips you didnt report to your employer or taxes on wages you received from an employer who didnt withhold these taxes from your pay.

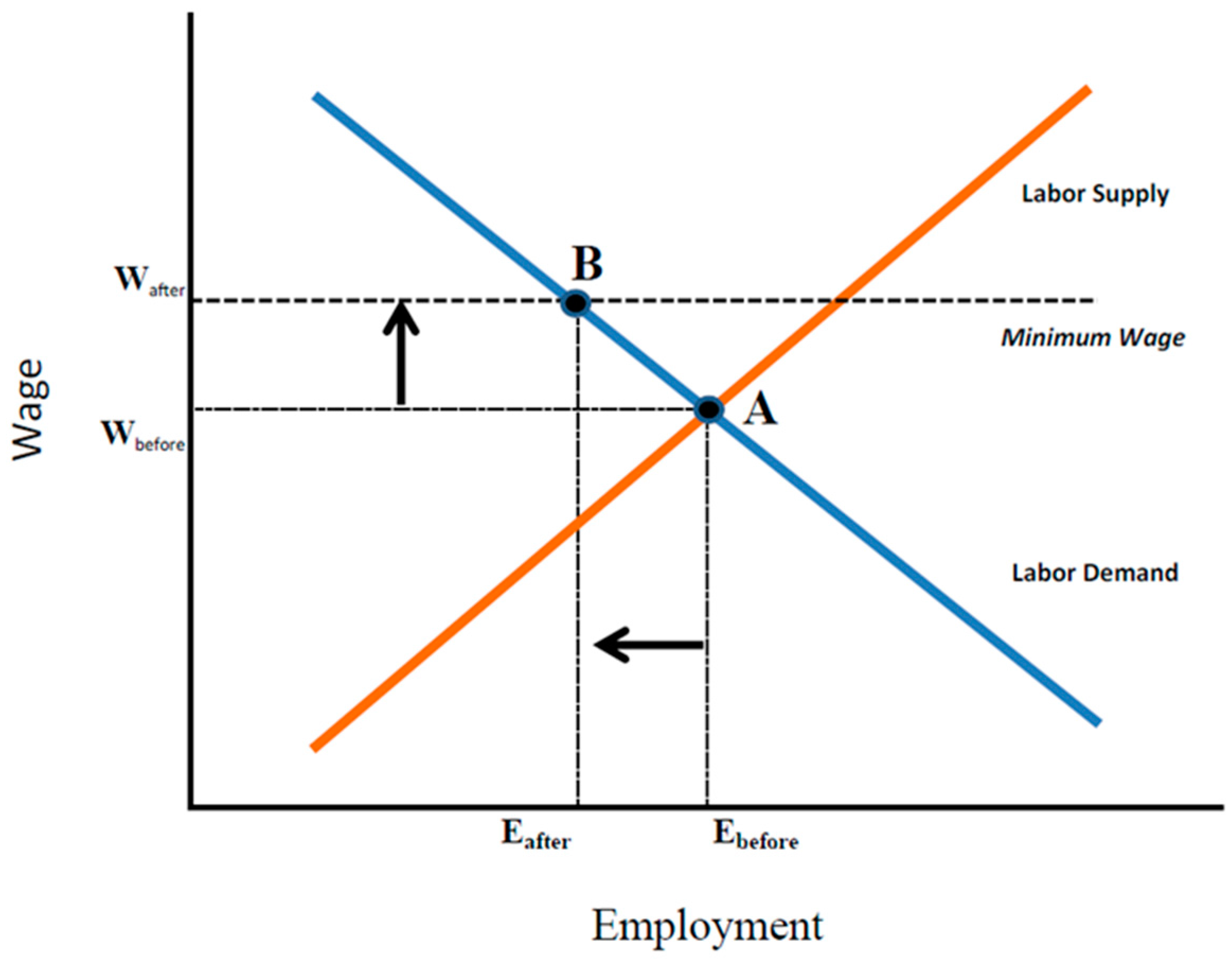

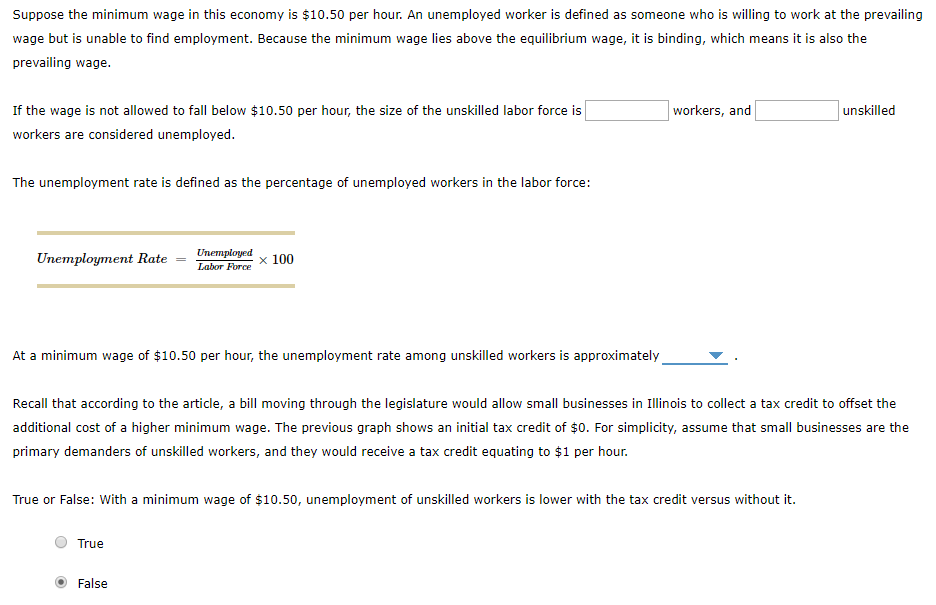

Ny minimum wage lookup. The federal minimum wage is 750 per hour as of 2015. Illinois minimum wage was last raised in 2010 to 825. The minimum income to pay taxes as a dependent varies based on the dependents marital status age whether or not they are blind and whether the income is considered earned or unearned both single and married dependents under the age of 65 who are not blind will need to file a tax return if unearned income also called passive income which includes social security payments trust fund.

If rate is equal to minimum wage then the same is exempted from withholding tax on compensation basic minimum wage and the corresponding holiday hazard overtime and night shift differential of such employee. Based on a 40 hour work week this works out to an annual salary of 15600. 481 a day inclusive of ecola.

More information about the calculations performed is available on the about page. Are 20 years or older. The hourly wage tax calculator uses tax information from the tax year 2020 to show you take home pay.

Current minimum wage rates. Like the medicare tax half the social security tax is paid by the employer and half by the employee62 of the employees compensation by each. Under their employment agreement have to do at least 60 credits a year of industry training.

1 and continue to increase the minimum in a series of steps until. The minimum wage rate for training workers is. Raising the wage to 15 an hour is estimated to impact 14 million illinoisans according to the illinois economic policy institute at the university of illinois.

For a daily paid employee simply compare the employee rate per day with the minimum wage of ncr eg. The house also voted to approve house bill 2541 which would increase the minimum wage from 1010 an hour today to 11 on jan. Eligible businesses can claim this credit by filing form il 941 illinois withholding income tax return and a new schedule.

They also include recapture taxes such as additional taxes on health savings accounts. As of 2015 this would mean that a single filer would be paying 10 percent federal income tax on the first 9075 and 15 percent on the remaining 6525. See where that hard earned money goes federal income tax social security and other deductions.

1512 an hour before tax.

More From Ny Minimum Wage Lookup

- What Is The Minimum Wage In Ohio 2020

- Minimum Wage Overtime Texas

- Legalization Of Marijuana In The Philippines Pros And Cons

- Minimum Wage In Jacksonville Florida 2016

- Federal Minimum Wage Since 2000

Incoming Search Terms:

- 15 Minimum Wage And The Earned Income Tax Credit Public Policy Interactions District Measured Federal Minimum Wage Since 2000,

- What You Need To Know Province Of British Columbia Federal Minimum Wage Since 2000,

- Minimum Wage Hike Or Tax Cut What S The Best Way To Get Money Into Low Income Earners Pockets The Spinoff Federal Minimum Wage Since 2000,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqnq9ep08usrs9 Nafqbvwakehgheprhpyqb58tylzitmnswfob Usqp Cau Federal Minimum Wage Since 2000,

- Trump Bezos And Buffett Pay Lower Tax Rate Than Someone Making Minimum Wage Of 7 25 Ht Latestagecapitalism Federal Minimum Wage Since 2000,

- Infographic How Do Small Business Owners Feel About Minimum Wage Increases Score Federal Minimum Wage Since 2000,