What Is The Minimum Wage In Ohio For Waitresses, Waiters And Waitresses

What is the minimum wage in ohio for waitresses Indeed recently is being sought by users around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of this post I will talk about about What Is The Minimum Wage In Ohio For Waitresses.

- Minimum Wage Law Federal State And Local Minimum Wage Rates

- Kentucky S Real Minimum Wage Is Higher Than You Think But You Still Can T Live On It

- Manufacturing A High Wage Ohio

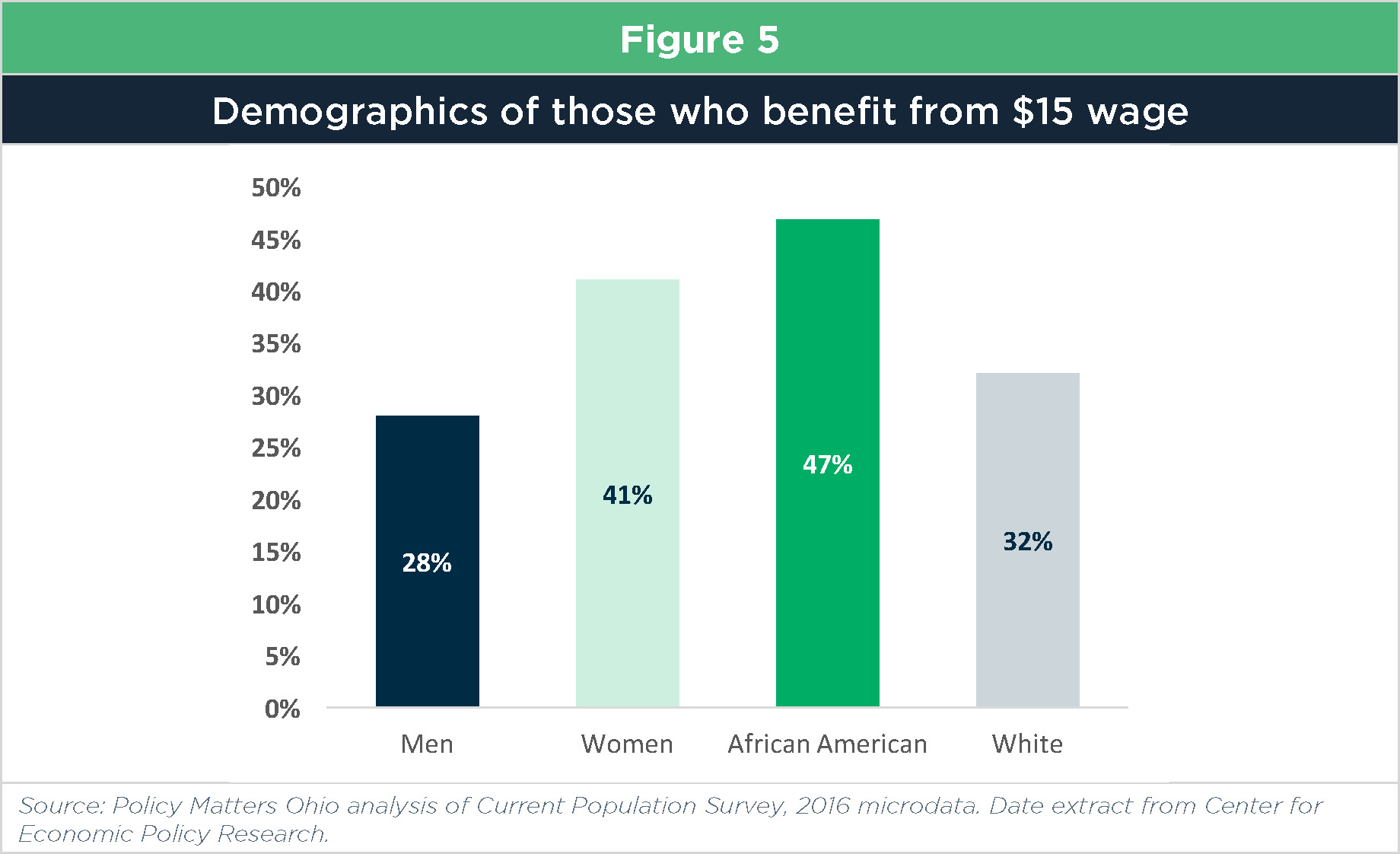

- Minimum Wage Hike Would Boost Ohio Workers

- Https Www Com Ohio Gov Documents Dico 2019minimumwageposter Pdf

- State Minimum Wage Rate For Ohio Sttminwgoh Fred St Louis Fed

Find, Read, And Discover What Is The Minimum Wage In Ohio For Waitresses, Such Us:

- Ohio Minimum Wage Lacks Purchase Power From 1968

- 2020 State Minimum Wage Updates Govdocs

- Ohio Minimum Wage For Tipped Employees Paycheck Warriors

- Ohio Minimum Wage For Tipped Employees Paycheck Warriors

- 2020 State Minimum Wage Updates Govdocs

If you re looking for Marijuana Legalization Nc 2020 you've arrived at the ideal place. We have 104 graphics about marijuana legalization nc 2020 including pictures, photos, pictures, wallpapers, and more. In these page, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

They dont have to actually pay that as tips count as part of a waitresses wages.

Marijuana legalization nc 2020. For employers with fewer than 10 full time employees at any one location who have gross annual sales of 100000 or less the basic minimum rate is 200 per hour. For tipped employees the minimum cash wage became 213 per hour with a maximum tip credit rate of 302 per hour. Ohios 2018 minimum wage is currently 830 per hour for non tipped employees and 415 per hour for tipped employees.

The minimum wage in ohio is 870 for 2020. Non tipped employees such as workers at fast food restaurants must earn at least 730 per hour. However combined with tips you must make the federal minimum of at least 725 per hour.

Tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit. According to the ohio department of commerces bureau of labor and worker safety ohio employees who receive tips including waiters waitresses and bartenders must earn a minimum wage of 365 per hour. Because the state minimum wage is currently higher than the federal rate ohio employees are entitled to earn the state wage.

Special minimum wage rates such as the ohio waitress minimum wage for tipped employees may apply to certain workers. For these employees the state wage is tied to the federal minimum wage of 725 per hour which requires an act of congress and the presidents signature to change. But if the tips dont make up the difference the restaurant has to pay enough more so the earnings equal minimum wage at least.

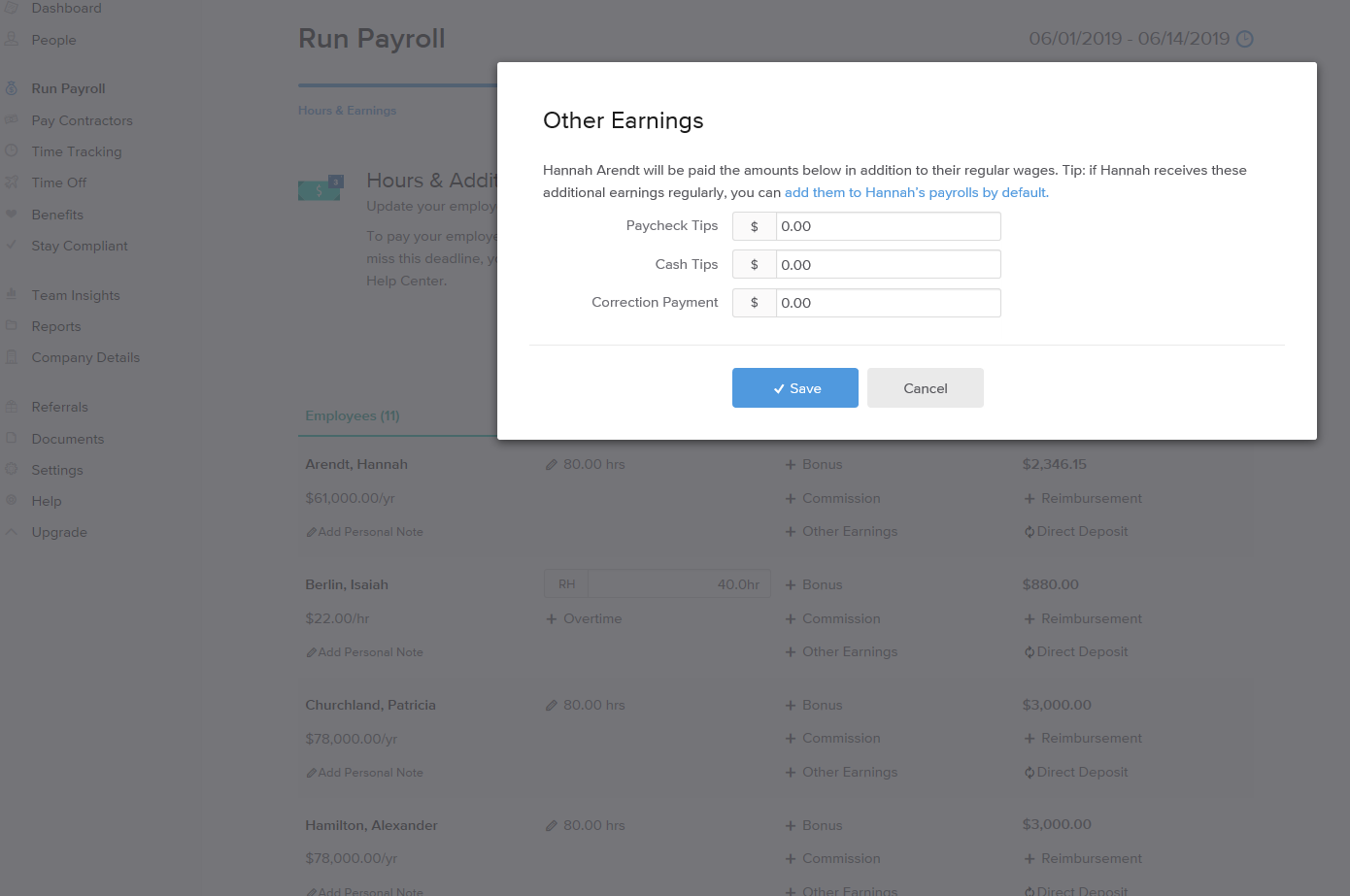

1 2020 to 870 an hour for non tipped employees and 435 an hour for tipped employees. Your employer would need to make up the difference. In states that allow a tip credit a certain amount of received tips per hour may be credited against the minimum wage by an employer although the tipped employee must receive at least the minimum wage with combined.

Learn more for the most recent minimum wage poster for employers. Under federal law and in most states employers can pay tipped employees less than the minimum wage as long as employees earn enough in tips to make up the difference. The minimum wage for tipped employees in ohio is 350 to 365.

Current federal minimum wage is 655 per hour. A full time minimum wage worker in ohio working 40 hours a week 52 weeks a year will earn 6960 per day 34800 per week and 1809600 per year 1.

More From Marijuana Legalization Nc 2020

- What Is Minimum Wage Part Time

- Michigan Minimum Wage 2020 Under 18

- Michigan Minimum Wage 2018

- Minimum Wage Colorado Yearly

- Virginia Minimum Wage 2020 Poster

Incoming Search Terms:

- State Of Working Ohio 2017 Virginia Minimum Wage 2020 Poster,

- Minimum Wage Increases 2017 A Complete Guide To State City Law Virginia Minimum Wage 2020 Poster,

- Some Tipped Restaurant Workers Say Don T Raise Our Minimum Wage Michigan Thecentersquare Com Virginia Minimum Wage 2020 Poster,

- How Much Do Waiters And Bartenders Make Virginia Minimum Wage 2020 Poster,

- Twenty Three Years And Still Waiting For Change Why It S Time To Give Tipped Workers The Regular Minimum Wage Economic Policy Institute Virginia Minimum Wage 2020 Poster,

- Sen Sherrod Brown Calls For 15 Federal Minimum Wage Virginia Minimum Wage 2020 Poster,