What Is The Minimum Wage To Pay Tax, Income Tax Slabs Here Are The Latest Income Tax Slabs And Rates

What is the minimum wage to pay tax Indeed lately is being sought by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of the post I will discuss about What Is The Minimum Wage To Pay Tax.

- Pin By Davo And Reno On His Personal Posts Paid Leave Love You So Much Minimum Wage

- Pdf Making Work Pay Combining The Benefits Of The Earned Income Tax Credit And The Minimum Wage

- How Doug Ford S Pledge Of Zero Income Tax Leaves Minimum Wage Earners Worse Off Cbc News

- What S Hidden Under The 15 Minimum Wage Higher Taxes Rutgers Business School

- Income Tax Return Filing Ten Rules You Must Follow While Filing Income Tax Returns

- Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Find, Read, And Discover What Is The Minimum Wage To Pay Tax, Such Us:

- Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

- Pdf Making Work Pay Combining The Benefits Of The Earned Income Tax Credit And The Minimum Wage

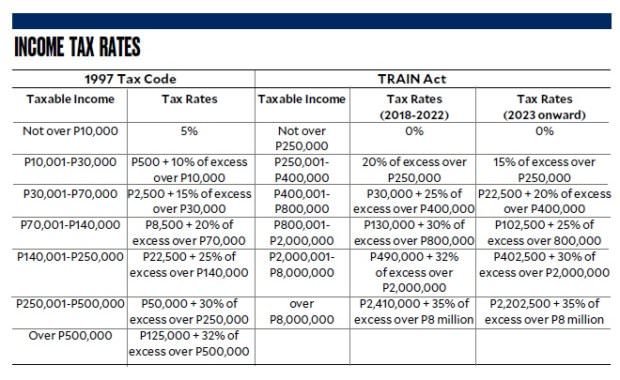

- Income Tax Slabs Here Are The Latest Income Tax Slabs And Rates

- Minimum Wage And Tax Evasion Theory And Evidence Sciencedirect

- Paying Us Expat Taxes As An American Abroad Myexpattaxes

If you re searching for California Minimum Wage Effects you've reached the ideal place. We have 104 images about california minimum wage effects including pictures, pictures, photos, backgrounds, and much more. In these page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

If rate is equal to minimum wage then the same is exempted from withholding tax on compensation basic minimum wage and the corresponding holiday hazard overtime and night shift differential of such employee.

California minimum wage effects. Australian residents must declare their worldwide income. At the moment she can give up 55 of her 36750 weekly pay packet and get childcare vouchers instead bringing her cash pay down to 31250 but still above the minimum wage rate of 872 per hour and saving her tax of 11 and nic of 660 a total of 1760 each week. But when making a decision this important you probably want some hard numbers so im going to give them to you.

When untaxed non wage pay is converted to taxable wages workers pay higher taxes without necessarily making more money. When in doubt i say go ahead and file. After you have worked for them for 6 months.

For a daily paid employee simply compare the employee rate per day with the minimum wage of ncr eg. This tax has a maximum capthe wage baseof 137700 in earnings for 2020. 60480 before tax for a 40.

The usual tax thresholds apply to those who earn either national minimum wage or national living wage. You can earn up to 12500 this tax year without having to pay income tax on your earnings. Includes national minimum wage rates keeping pay records and pay rights.

Find out more in working in singapore and taxes. All individuals who receive payments whether in the form of cash or benefits in kind for any service rendered in or any form of employment from singapore need to pay income tax unless specifically exempted under the income tax act. Different types of minimum wage rates.

Your 2019 tax returns are due on july 15 2020 and we recommend turbotax because its 100 free to file for most people. The minimum wage rate for starting out workers is. 1512 an hour before tax.

Your current employer must pay you the adult minimum wage. What income you pay tax on. I ts that time of year when people begin wondering whether they need to file a federal income tax return.

Worldwide income if you have certain study and training support loans. The most underappreciated minimum wage tradeoff is a tax increase on the poor which for some people would exceed 2000. Current minimum wage rates.

Foreign residents must declare either. Your pay tax and the national minimum wage. 481 a day inclusive of ecola.

The social security tax rate was reduced to 104 for 2011 and 2012 with the employer paying 62 and employees paying 42 but it went back up to 124 in 2013.

More From California Minimum Wage Effects

- Legalization Of Marijuanas Philippines Pdf

- Minimum Wage Metro Manila 2020

- Arizona Minimum Wage Increase 2022

- What Is The Minimum Wage For 2020

- Minimum Wage In California In 1995

Incoming Search Terms:

- How Much Money Do You Have To Make To Not Pay Taxes Minimum Wage In California In 1995,

- Singapore Personal Income Tax Guide How To File And Pay Your Personal Income Tax Ya 2020 Minimum Wage In California In 1995,

- What Are Payroll Taxes And Who Pays Them Tax Foundation Minimum Wage In California In 1995,

- The Regional Income Tax Agency Rita Minimum Wage In California In 1995,

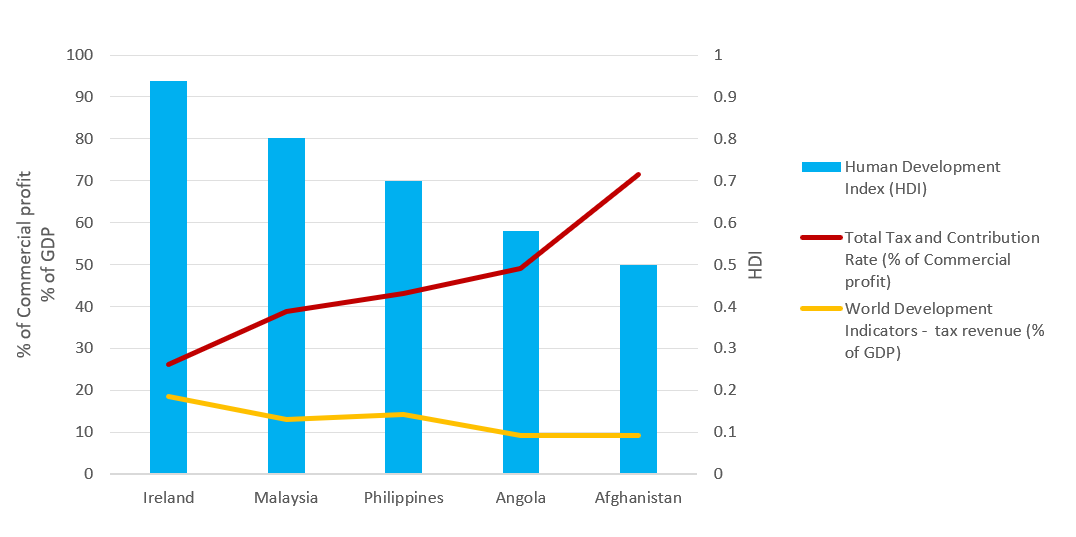

- Why It Matters In Paying Taxes Doing Business World Bank Group Minimum Wage In California In 1995,

- Pdf The Effects Of Social Security Taxes And Minimum Wages On Employment Evidence From Turkey Minimum Wage In California In 1995,