California Minimum Wage After Taxes, Mandate Individual Health Insurance Tax Penalty California

California minimum wage after taxes Indeed recently has been hunted by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of the post I will talk about about California Minimum Wage After Taxes.

- How To Make Six Figures A Year And Still Not Feel Rich 200 000 Edition

- California Drivers To Pay Highest Gas Tax In The Country Marketplace

- California Sales Tax Rate Rates Calculator Avalara

- 2019 Ontario Budget Giving Parents Flexible And Affordable Child Care Choices

- Solved Problem 4 Transfer Pricing Argone Division Of Cal Chegg Com

- Minimum Wage Hike Would Have Benefitted More People Than Tax Credit Report Ipolitics

Find, Read, And Discover California Minimum Wage After Taxes, Such Us:

- Securing And Protecting Education Funding In California Policy Analysis For California Education

- Minimum Wage Changes In California On 7 1 Datatech

- The 2020 Changes To California Health Insurance Ehealth

- Cupertino City Mandated Minimum Wage Poster

- Income Tax Return Filing Ten Rules You Must Follow While Filing Income Tax Returns

If you are searching for What Is The Minimum Wage Ny you've arrived at the right place. We ve got 104 graphics about what is the minimum wage ny adding pictures, pictures, photos, wallpapers, and much more. In these web page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Or the rate of change in the averages of the most recent july 1 to june 30 inclusive the period over the.

What is the minimum wage ny. That is what you are taxed on that is what your employer reports on his quarterly reports and what he charges to wages. For january 1 2024 and thereafter the california minimum wage is automatically adjusted using a methodology tied to the consumer price index. The minimum wage in california means that a full time worker can expect to earn the following sums as a minimum before tax.

If it were a full time job then you would get about 16000 a year. The federal minimum wage. The minimum wage will vary depending on what state you are in or even what you do.

Although there are some exceptions almost all employees in california must be paid the minimum wage as required by state law. The methodology for further increases essentially applies an increase over the prior minimum wage that is equal to the lesser of. From january 1 2017 to january 1 2022 the minimum wage will increase for employers employing 26 or more employees.

Your take home pay is just that you get paid 9hr in calif. If that was your only source of income than after taking the standard deduction on your tax return and getting your personal exemptions then the tax owed would be little or none. These assume a 40 hour working week.

Effective january 1 2017 the minimum wage for all industries will be increased yearly. While californias state minimum wage is 1300 per hour san diego has set its own higher minimum wage rate that applies to employees of all companies who work within san diego. And it remains that rate for 1 12 yrs.

You are entitled to be paid the higher state minimum wage. Workers in the state of washington trail close earning a minimum wage rate of 947 hourly. Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950.

In states with a higher rate such as oregon and washington minimum wage workers earn more than the national average. The minimum wage applies to most employees in california with limited exceptions including tipped employees some student workers and other exempt occupations. These assume a 40 hour working week.

For instance where are you. The california minimum wage was last changed in 2008 when it. A minimum wage increase is currently scheduled in san diego but until the effective date of tbd the state minimum wage rate of 1300 will apply.

1 employee a has reached the ui taxable wage limit of 7000 for the year. The employer will no longer pay ui taxes on this individual for the remainder of the year. 52000 per working week.

However they will continue to pay taxes for other employees until they individually reach the 7000 limit for the year. Californias state minimum wage rate is 1300 per hourthis is greater than the federal minimum wage of 725.

More From What Is The Minimum Wage Ny

- What Is Minimum Wage Per Year Uk

- Legalization Of Weed Mn

- What Is The Minimum Wage In Canada 2020

- What Is Minimum Wage Annual Income

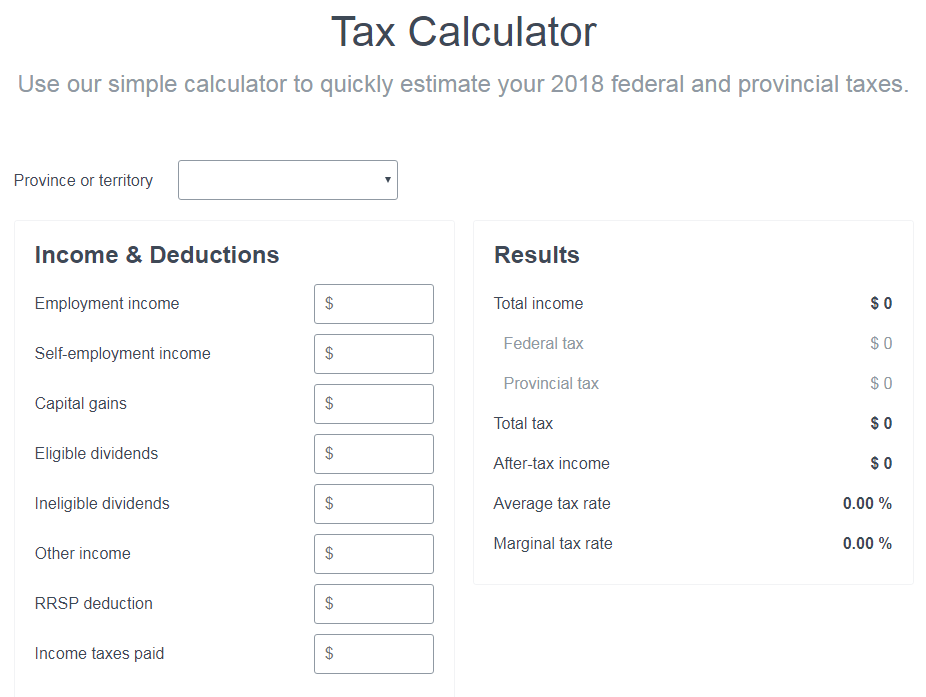

- Minimum Wage Calculator After Tax

Incoming Search Terms:

- 2020 State Individual Income Tax Rates And Brackets Tax Foundation Minimum Wage Calculator After Tax,

- Mountain View Minimum Wage Local Ordinance Supplemental Poster Minimum Wage Calculator After Tax,

- Sask Ndp Commits To 15 Per Hour Minimum Wage Bringing Back Film Tax Credit Cbc News Minimum Wage Calculator After Tax,

- Ftb Pub 1032 Tax Information For Military Personnel California Minimum Wage Calculator After Tax,

- California Sales Tax Rate Rates Calculator Avalara Minimum Wage Calculator After Tax,

- Income Tax Return Filing Ten Rules You Must Follow While Filing Income Tax Returns Minimum Wage Calculator After Tax,