California Minimum Wage Salary Exempt, New Salary Requirements Hit California Employers

California minimum wage salary exempt Indeed lately has been hunted by users around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of the article I will talk about about California Minimum Wage Salary Exempt.

- New York And California Minimum Exempt Salary Obligations In Effect Pr Council

- Exempt Vs Non Exempt Employees Guide To California Law 2020

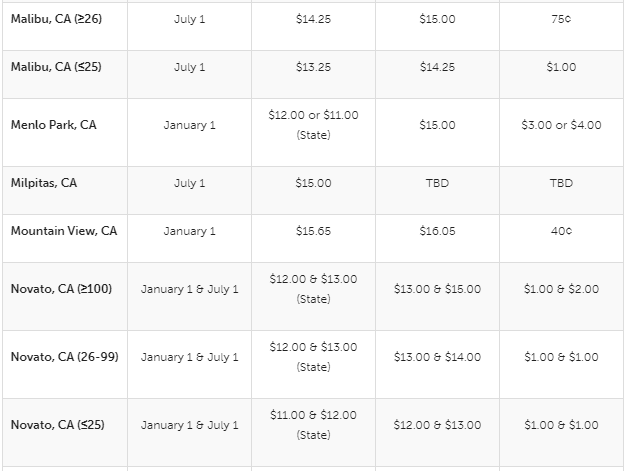

- Higher Minimum Wages In Many Local Cities And Counties Across California Effective July 1 2019 California Employment Law Report

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology

- New York And California Minimum Exempt Salary Obligations In Effect Pr Council

- 3

Find, Read, And Discover California Minimum Wage Salary Exempt, Such Us:

- Exempt Employee Salary Threshold Rises Across The United States In 2018

- Colorado Officially Increases The Minimum Salary Threshold For Exempt Employees And Makes Changes For Non Exempt Employees Too Wage And Hour Defense Blog

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcq5kulx7bd5mftibvode4nhv0vv Bwltskfiqsrg42y1pdsnd4p Usqp Cau

- California Employers Association 2020 Exemption Updates Check Your Employee Compensation

- Https Www Lightgablerlaw Com Pdf Articles 16 Correcting Wage And Hour Misclassification Errors Pdf

If you re looking for Florida Minimum Wage 2020 Ballot you've arrived at the ideal place. We have 104 graphics about florida minimum wage 2020 ballot including pictures, photos, photographs, backgrounds, and much more. In these web page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

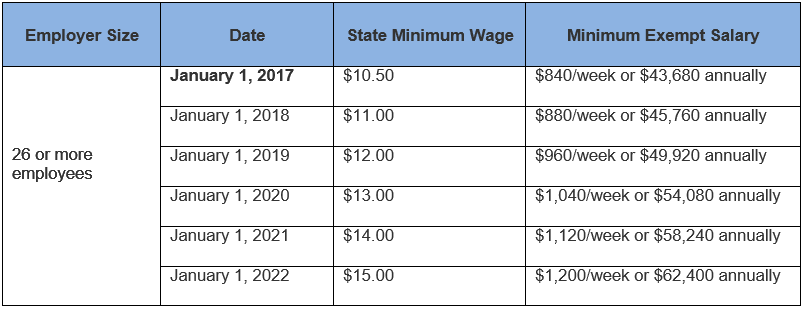

Effective january 1 2017 the minimum wage for all industries will be increased yearly.

Florida minimum wage 2020 ballot. This means that the minimum salary for exempt employees in california will also be increasing annually. On january 1 2020 californias statewide minimum. When the minimum wage increases as it will on january 1 2020 so does the exempt salary threshold.

Exempt employees in california generally must earn a minimum monthly salary of no less than two times the state minimum wage for full time employment. California employers should take note of the following changes to state and local minimum wage laws set to take effect on january 1 2020 and will impact both nonexempt and exempt employees. Although there are some exceptions almost all employees in california must be paid the minimum wage as required by state law.

Each year on january 1st from 2017 and 2023 the minimum wage is set to increase. A new year means new changes to californias minimum wage laws. California law has a minimum salary test that employees must meet before they can be classified as exempt from wage and hour laws overtime breaks lunches along with a duties test.

Californias minimum wages and exempt salary thresholds increase in 2020 sb 3 enacted in the 2015 2016 legislative session sets forth a schedule for minimum wage increases through 2023. California law requires employers to pay non. Simply paying an employee a salary does not make them exempt nor does it change any requirements for compliance with wage and hour laws.

California state minimum wage. 1 2020 for employers with 26 employees or more the minimum wage will increase from 12 per hour to 13 per hour and the exempt annual. To qualify as an exempt employee california requires that an employee must be primarily engaged in the duties that meet the test of the exemption and earns a monthly salary equivalent to no less than two times the state minimum wage for full time employment labor code section 515.

According to the department of industrial relations for the state of california the minimum wage is 12 an hour for employers with 25 employees or less and 13 an hour for employers with 26 employees or more. This will increase the minimum salary requirement for exempt workers each year based on the following schedule. Californias threshold is currently 4576000 annualized for employers with 25 employees or less and 4992000 for employers with 26 employees or more.

Importantly californias minimum wage is set to increase every year on january 1 st until 2023. Non exempt employees are required to make at least minimum wage. This calculation gives us a monthly salary that is equal to twice the state minimum wage for full time employment17.

California Minimum Wage Increases Will Affect Exempt Salaries Too Wage And Hour Defense Blog Florida Minimum Wage 2020 Ballot

More From Florida Minimum Wage 2020 Ballot

- Federal Minimum Wages History

- California Minimum Wage Orange County 2020

- National Minimum Wage South Africa 2020 Per Month

- Minimum Wage July 2020 California

- Marijuana News Tennessee

Incoming Search Terms:

- California S Minimum Wage Other Pay Rates Increase Jan 1 2019 California Hospital Association Marijuana News Tennessee,

- Review California Employee Wages And Salaries For 2021 Marijuana News Tennessee,

- Https Www Ssf Net Home Showdocument Id 17508 Marijuana News Tennessee,

- Minimum Wage In The United States Wikipedia Marijuana News Tennessee,

- Exempt Employee Salary Threshold Rises Across The United States In 2018 Marijuana News Tennessee,

- How Will The California Minimum Wage Increase Impact Your Hoa Marijuana News Tennessee,