California Minimum Wage With Tips, California Paycheck Compensation Laws

California minimum wage with tips Indeed recently has been hunted by consumers around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of the article I will discuss about California Minimum Wage With Tips.

- California Minimum Wage Laws In 2020 And The Future Workplace Rights Law

- Minimum Wage

- Cupertino Ca Minimum Wage Poster Compliance

- Minimum Wage For Businesses Consumer Business

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology

- An Update On The Minimum Wage Calnonprofits

Find, Read, And Discover California Minimum Wage With Tips, Such Us:

- California Cupertino Minimum Wage

- Sonoma Minimum Wage City Of Sonoma

- Things To Know By Chris Tedesco On Calchamber Human Resources Fun Facts Good To Know

- California Petaluma Minimum Wage

- Los Altos Minimum Wage Local Ordinance Supplemental Poster

If you re looking for How Much Is Minimum Wage In Ohio you've arrived at the ideal place. We have 104 graphics about how much is minimum wage in ohio adding images, pictures, photos, wallpapers, and much more. In such page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

In april of 2016 california governor jerry brown made national headlines when he signed the states 15 per hour minimum wage bill into law putting california on the leading edge of raising worker pay.

How much is minimum wage in ohio. Current minimum wage in california. As of january 1 2020 the minimum wage in california is. Employers must pay them the states standard minimum wage.

The california minimum wage was last changed in 2008 when it. Labor code 351. Minimum wage for servers in california is the same as it is elsewhere in the state regardless of the fact that waiters and waitresses receive tips.

The minimum wage applies to most employees in california with limited exceptions including tipped employees some student workers and other exempt occupations. From january 1 2017 to january 1 2022 the minimum wage will increase for employers employing 26 or more employees. Tips dont count toward minimum wage for servers in california.

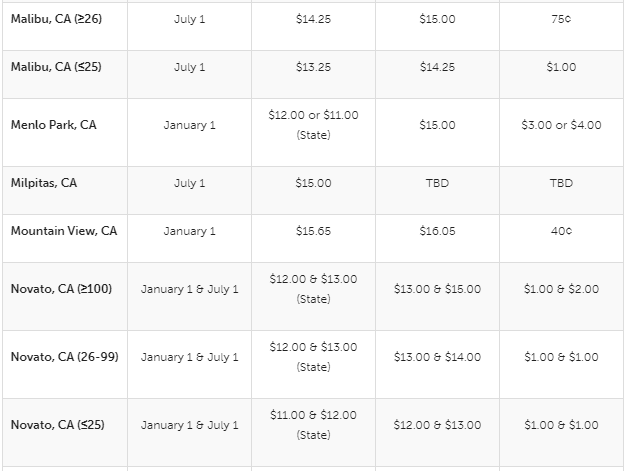

However california does not allow employers to take tip credits. California law does allow tip pooling though. 1200 for employers with 25 or fewer employees or.

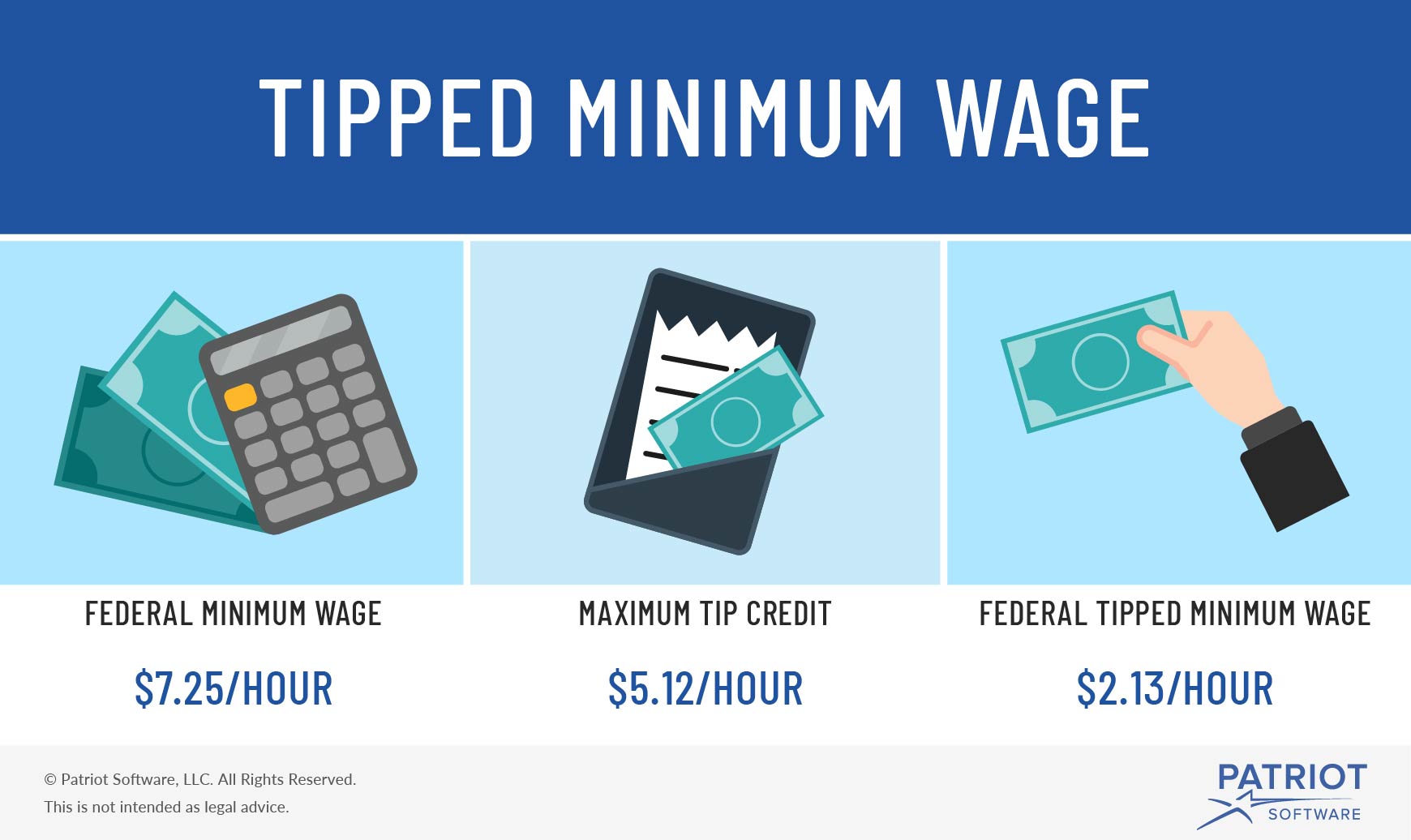

You are entitled to be paid the higher state minimum wage. 1300 for employers with 26 or more employees. The federal minimum tip wage is combined with a tip credit to reach the federal minimum wage.

Under california law unlike the federal fair labor standards act an employer cannot count an employees tips toward meeting minimum wage. Effective january 1 2017 the minimum wage for all industries will be increased yearly. Employers must pay employees at least the california minimum wage for each hour worked in addition to any tips they may receive.

In states that allow a tip credit a certain amount of received tips per hour may be credited against the minimum wage by an employer although the tipped employee must receive at least the minimum wage with combined. Under the law californias minimum wage is currently scheduled to gradually increase until it hits the 15 per hour mark on january 1st 2023. 2 if your employer violates minimum wage laws you can recover the money you are owed in a wage and hour lawsuit.

1 it is illegal for california employers to pay employees less than the minimum wage. Californias state minimum wage rate is 1300 per hourthis is greater than the federal minimum wage of 725. Although there are some exceptions almost all employees in california must be paid the minimum wage as required by state law.

Tipped employees such as waitresses and bartenders may sometimes be paid a cash wage that is lower than the prevailing minimum wage through a system known as a tip credit. What you need to know about minimum wage for servers in california. If you add the 512 per hour plus the minimum tipped wage of 213 you reach the federal minimum wage of 725 an hour.

More From How Much Is Minimum Wage In Ohio

- Legalization Of Marijuana Federal Vs State

- Minimum Wage Fenix Tx Lyrics

- California Minimum Wage Tipped Employees

- Chicago Minimum Wage 2020 Poster

- Nyc Minimum Wage Budget

Incoming Search Terms:

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology Nyc Minimum Wage Budget,

- Minimum Wage Study City Of Sonoma Nyc Minimum Wage Budget,

- How Hard Is Your Server Working To Earn Minimum Wage Fivethirtyeight Nyc Minimum Wage Budget,

- New Minimum Wage Rates July 1 A Guide For Employers Nyc Minimum Wage Budget,

- Tips And Gratuity Nyc Minimum Wage Budget,

- Los Altos Minimum Wage Local Ordinance Supplemental Poster Nyc Minimum Wage Budget,