Federal Minimum Wage Exemptions, Fair Labor Standards Act Of 1938 Wikipedia

Federal minimum wage exemptions Indeed lately is being hunted by consumers around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of this post I will talk about about Federal Minimum Wage Exemptions.

- Https Crsreports Congress Gov Product Pdf If If11282

- Minimum Wage Workers In Pennsylvania 2017 Mid Atlantic Information Office U S Bureau Of Labor Statistics

- 2020 Minimum Wage Guide Resourceful Compliance

- Washington Employers Prepare For Significant Salary Increase To Meet Overtime Exemptions

- Minimum Wage In Louisiana 2020 Louisiana Minimum Wage

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology

Find, Read, And Discover Federal Minimum Wage Exemptions, Such Us:

- 15 Minimum Wage Mayor Murray

- New York State Minimum Wage Archives Astron Solutions

- Minimum Wage Tipped And Exempt Employee Pay In 2020 A Rates Only Update Lexology

- Fair Labor Standards Act Of 1938 Wikipedia

- Minimum Wage Workers In North Carolina 2016 Southeast Information Office U S Bureau Of Labor Statistics

If you are searching for Marijuana News In Elko County you've arrived at the right location. We have 102 graphics about marijuana news in elko county including images, photos, pictures, wallpapers, and much more. In these web page, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Many states also have minimum wage laws.

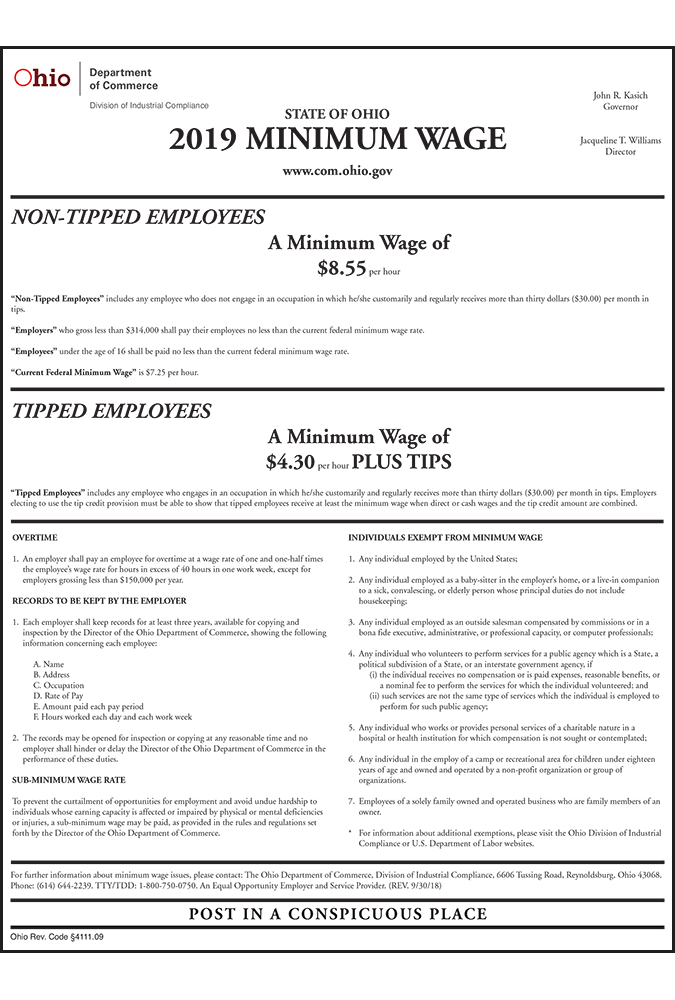

Marijuana news in elko county. Employers may pay tipped labor a minimum of 213 per hour as long as the hour wage plus tip income equals at least the minimum wage. However section 13a1 of the flsa provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive administrative professional and outside sales employees. Tipped employees employees who receive at least 30 or more per month in tips like waitresses or delivery drivers can be paid as little as 213 per hour in cash as long as tis bring their total earnings to 725 in.

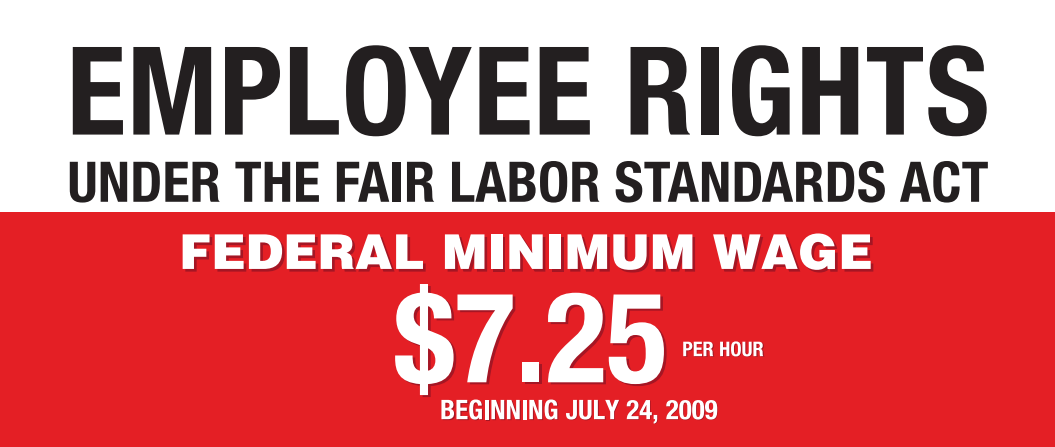

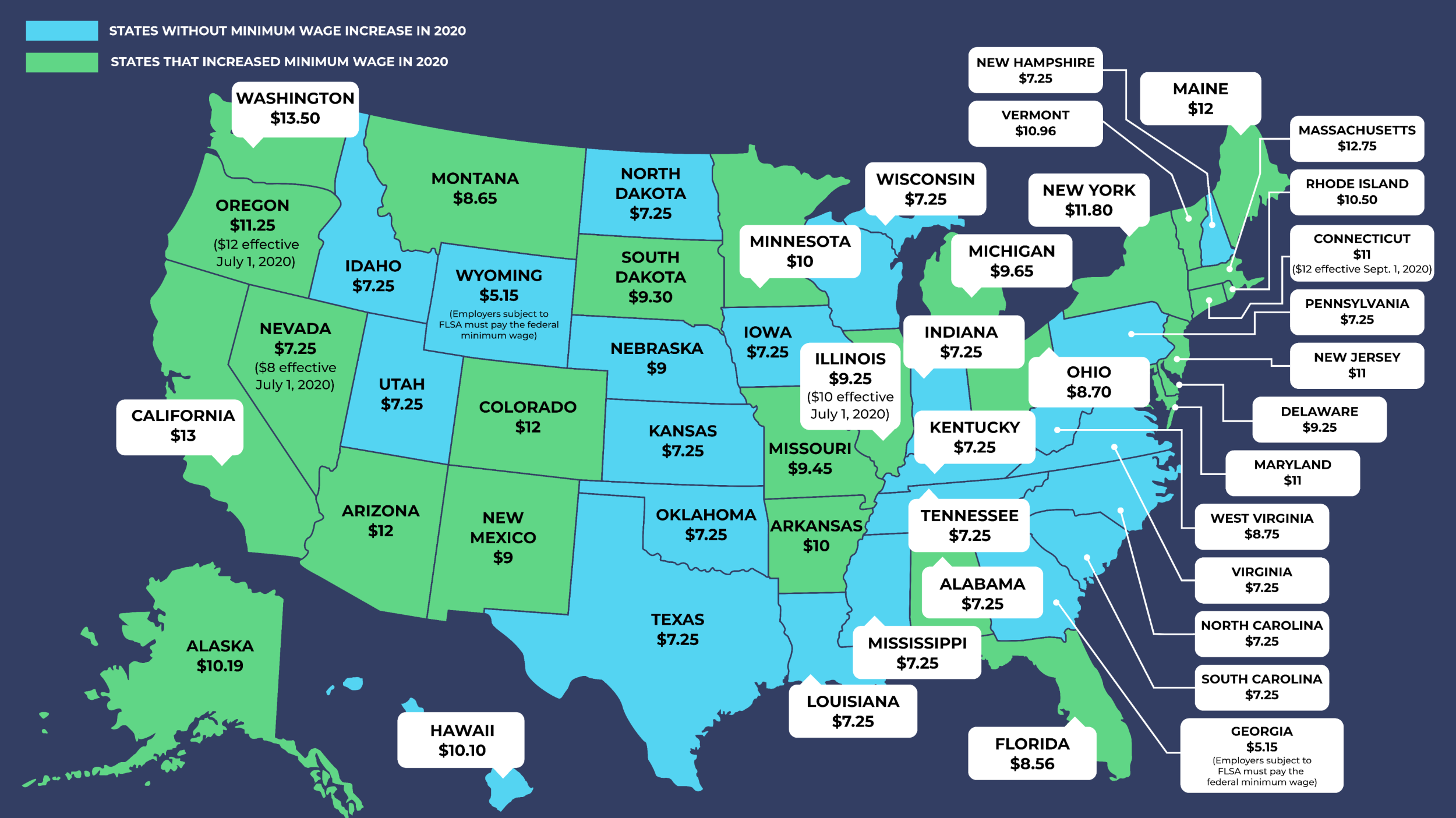

Under the fair labor standards act flsa the federal minimum wage for covered nonexempt employees is 725 per hour effective july 24 2009. The table below lists the current prevailing 2020 minimum wage rates for every state in the united states. Who is exempt from the federal minimum wage.

Section 13a1 and section 13a17 also exempt certain computer employees. If your job is listed as exempt from minimum wage law then your employer is not required by law to pay you at or over federal or state minimum wage. Five states however dont have a state mandated minimum wage so they must adhere to the federal statute.

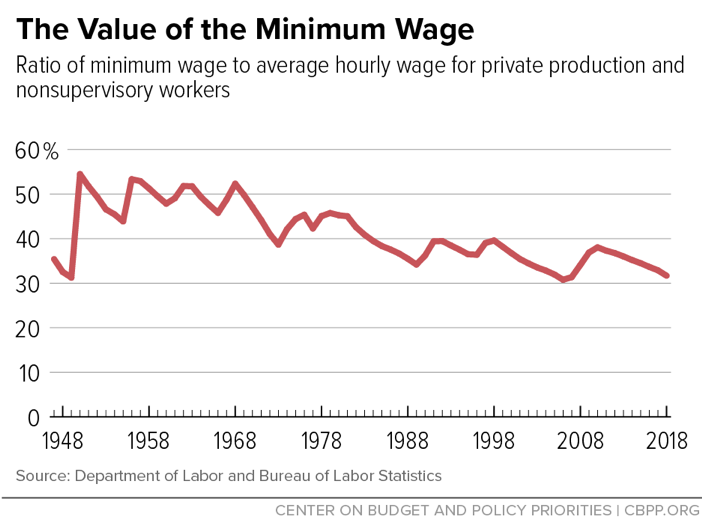

The federal minimum wage in the united states was reset to its current rate of 725 per hour in july 2009. Territories such as american samoa are exemptsome types of labor are also exempt. Persons under the age of 20 may be paid 425 an hour for.

Click any state for details about the minimum wage exemptions and other state labor laws. Where an employee is subject to both the state and federal minimum wage laws the employee is entitled to the higher minimum wage rate. The fair labor standards act includes a variety of exemptions to the federal minimum wage and other labor laws like overtime pay.

Executive administrative and professional employees including teachers. The federal department of labor has published the following list of exceptions to minimum wage and overtime wage laws. You can find a list of highest and lowest minimum wage rates here.

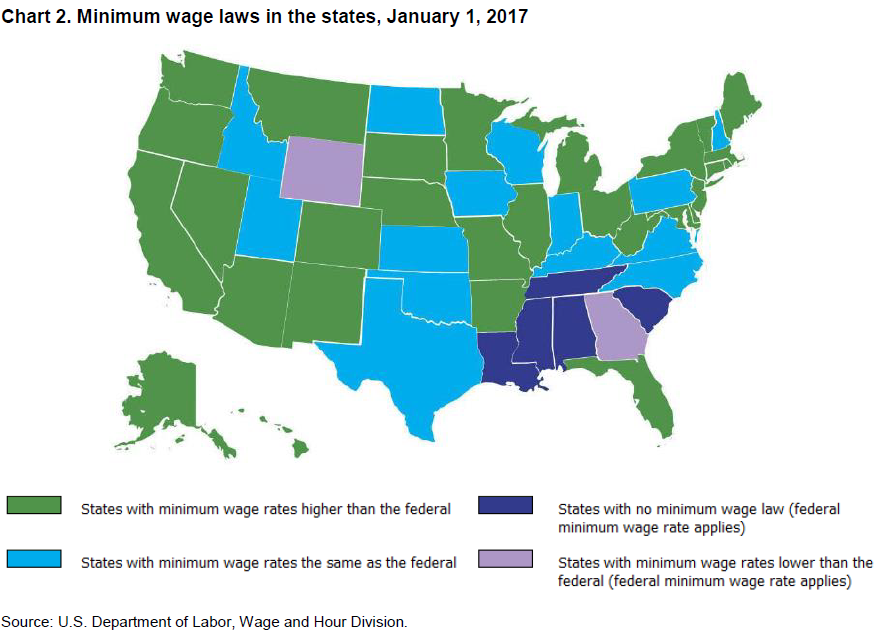

A total of 29 states plus dc guam and the virgin islands have minimum wage rates higher than the federal minimum wage and many of them have scheduled annual adjustments to raise wages. Bill is a partner at franczek pc. Exemptions from both minimum wage and overtime pay.

What is the federal minimum wage. Some states also bumped their exempt. Under the flsa non exempt employees must be paid the minimum wage or higher.

The minimum wage rate is the lowest hourly pay that can be awarded to workers also known as a pay floor. The fair labor standards act flsa determines the minimum wage for employees in private and public sectors in both federal and state governments. 2020 minimum wage rates by state.

More From Marijuana News In Elko County

- Legalization Of Marijuanas Philippines Position Paper

- Minimum Wage In 2020 Dollars

- How Many States Legalized Medical Marijuanas States 2020

- Marijuana Legalization At Federal Level

- What Is Minimum Wage Bc

Incoming Search Terms:

- Fair Labor Standards Act Of 1938 Wikipedia What Is Minimum Wage Bc,

- Who Makes Minimum Wage Pew Research Center What Is Minimum Wage Bc,

- Minimum Wage Missouri Labor What Is Minimum Wage Bc,

- Minimum Wage Workers In Missouri 2012 Mountain Plains Information Office U S Bureau Of Labor Statistics What Is Minimum Wage Bc,

- Fair Labor Standards Act Understanding Its Requirements What Is Minimum Wage Bc,

- Http Www Dol Gov Whd Overtime Fs17o Technicians Pdf What Is Minimum Wage Bc,