Michigan Minimum Wage 2020 After Taxes, State Of Michigan Taxes H R Block

Michigan minimum wage 2020 after taxes Indeed lately has been hunted by users around us, perhaps one of you. People now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this article I will talk about about Michigan Minimum Wage 2020 After Taxes.

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- Minimum Wage Will Increase In Majority Of U S States In 2020

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctuwzbmddqgjvhzuyp0rgguylylxkblpgexoxchmnuq5yrlaan6 Usqp Cau

- Public Policy Response To The Covid 19 Outbreak In Michigan Unemployment Insurance Mlpp

- Michigan Supreme Court Rebukes County That Seized Home Over 8 41 Tax Debt Reason Com

Find, Read, And Discover Michigan Minimum Wage 2020 After Taxes, Such Us:

- Michigan Workers Compensation Rates 2020

- Health Insurance Marketplace Calculator Kff

- Public Policy Response To The Covid 19 Outbreak In Michigan Unemployment Insurance Mlpp

- States That Do Not Tax Earned Income

- Michigan Applies For Extra 300 Per Week In Unemployment Benefits

If you are looking for What Is The Minimum Wage Rate In Massachusetts you've reached the perfect location. We ve got 104 graphics about what is the minimum wage rate in massachusetts adding images, photos, pictures, backgrounds, and more. In such webpage, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Snyder S Michigan Business Taxes Fall Burden Shifts To Residents Bridge Michigan What Is The Minimum Wage Rate In Massachusetts

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/CHMLUHHV7JDSZISOQJ5NWAHBQY.jpg)

Michigan Workers Making Minimum Wage Get Slight Raise In 2020 What Is The Minimum Wage Rate In Massachusetts

Michigans minimum wage workers.

What is the minimum wage rate in massachusetts. The minimum wage in michigan means that a full time worker can expect to earn the following sums as a minimum before tax. Covid 19 updates for withholding tax. Minimum wage increase for michigan employees takes effect march 29.

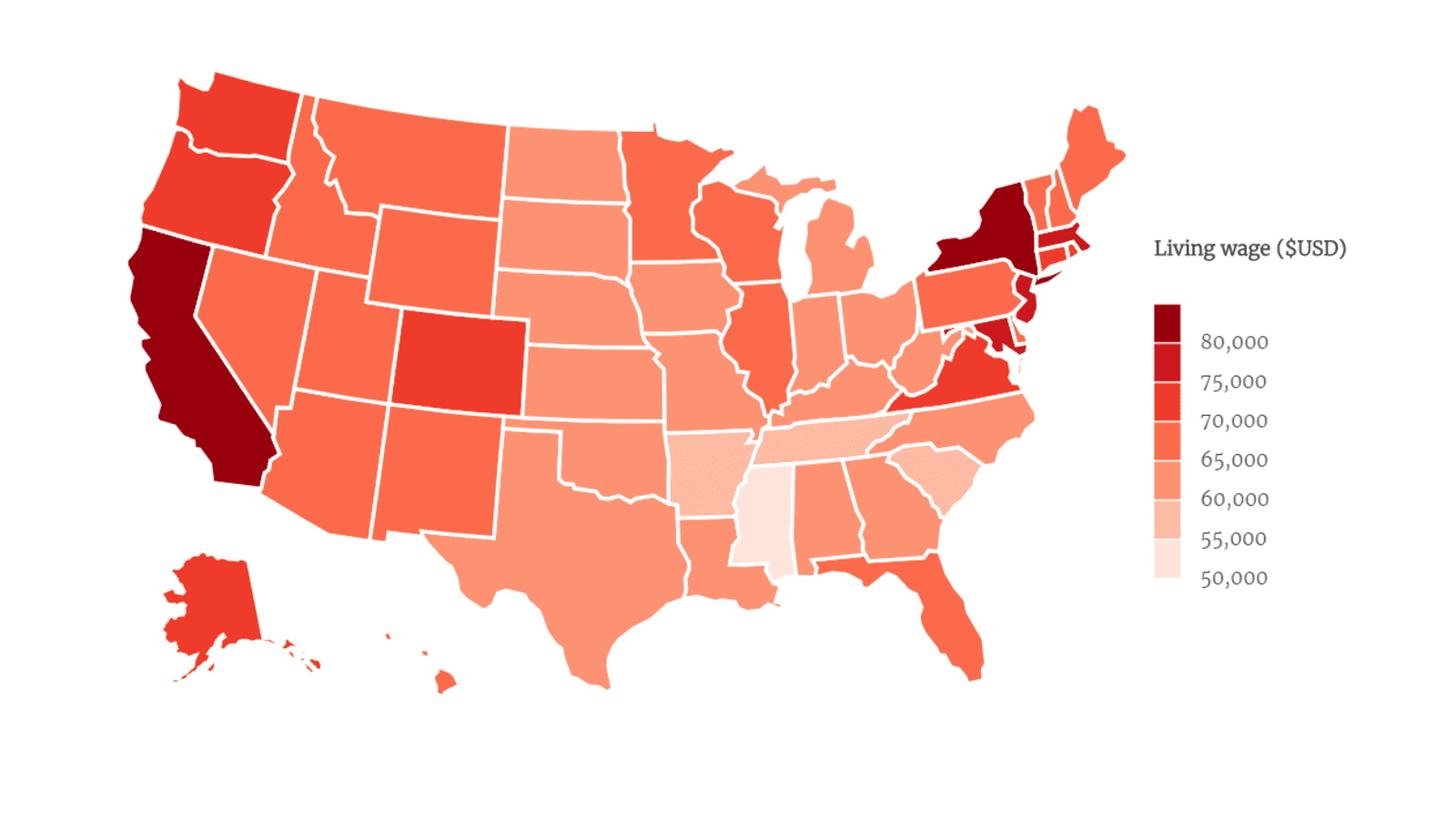

State of michigan 2020 withholding tax return february and march monthly periods and first quarter return period filing deadline is may 20 2020. These assume a 40 hour working week. A full time minimum wage worker in michigan working will earn 38600 per week or 2007200 per year.

Your 2019 tax returns are due on july 15 2020 and we recommend turbotax because its 100 free to file for most people. If you make 55000 a year living in the region of michigan usa you will be taxed 11647that means that your net pay will be 43353 per year or 3613 per month. It is generally illegal to pay workers less than 925 per hour right now and this threshold will be raised to 12 per hour over the next four years and adjusted for inflation annually after that.

Michigans minimum wage rate as of f 2020 is 965 per hour. Extensions offered for filing deadlines are not applicable to accelerated withholding tax payments. 38600 per working week.

Taxes site withholding tax. Right now the minimum wage is 945 in 2019. Mediainfoatmichigangov march 20 2019 effective march 29 2019 michigans minimum wage will increase from 925 to 945 per houra copy of the improved workforce opportunity wage act public act 337 of 2018 and related resources including the required.

Your average tax rate is 2118 and your marginal tax rate is 3390this marginal tax rate means that your immediate additional income will be taxed at this rate. In 2020 on their unemployment insurance taxes. But when making a decision this important you probably want some hard numbers so im going to give them to you.

After supporters of hiking the minimum wage collected enough signatures to put their issue before voters state legislators approved the increase. Lara communications 517 335 lara 5272 email. As of 2018 michigan tax payers pay a flat income tax rate of 425 percent.

In michigan the 2020 minimum wage rate will increase but only by a little bit. I ts that time of year when people begin wondering whether they need to file a federal income tax return. Michigan will increase its minimum wage for both tipped and non.

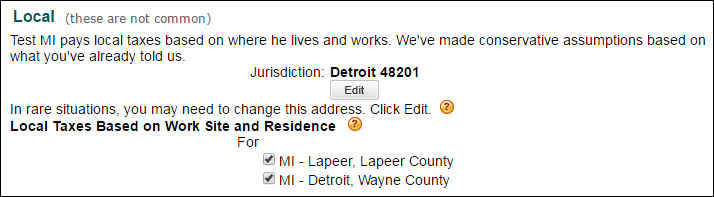

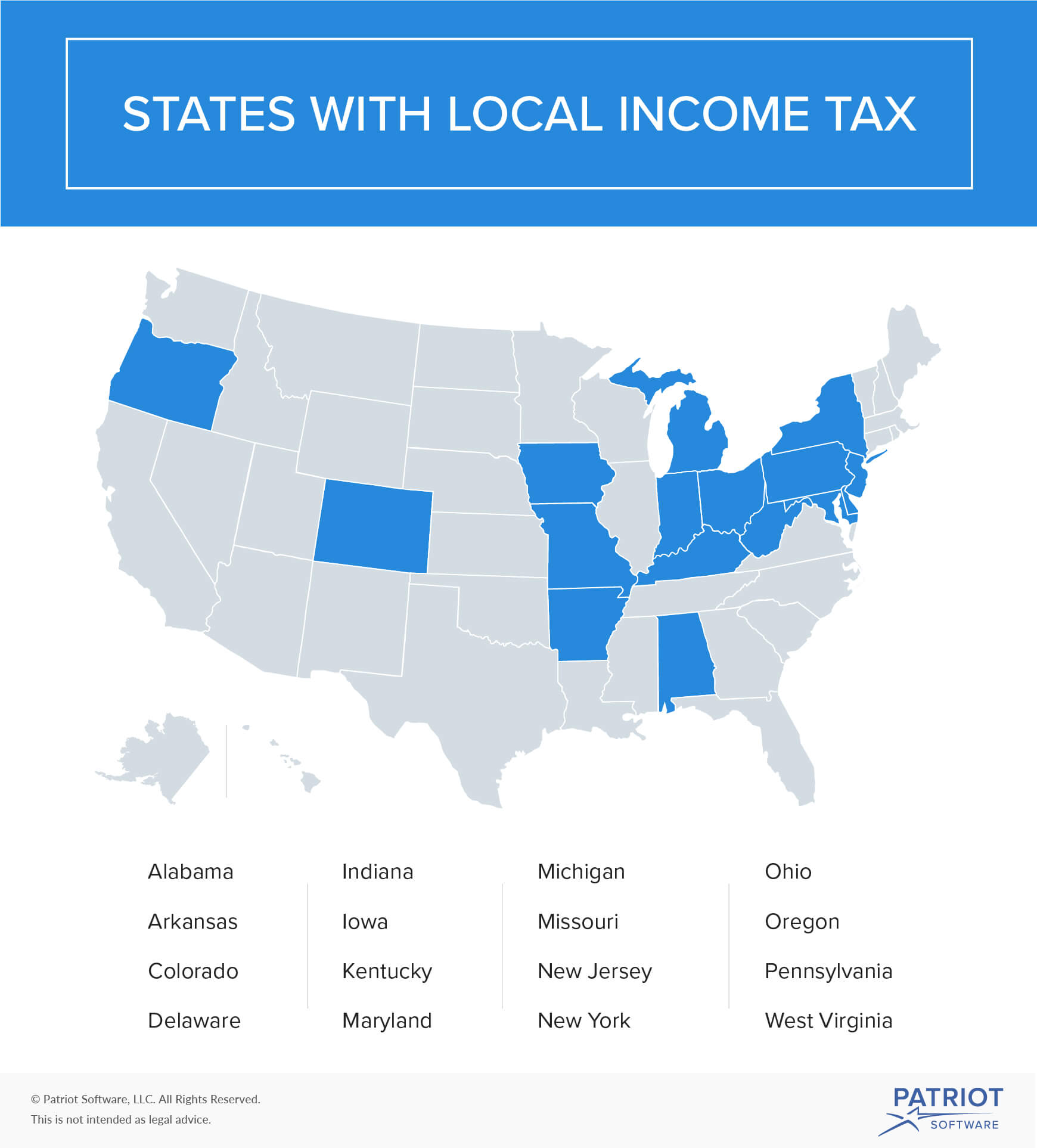

The unemployment insurance tax is expected to drop by 65 217 per employee annually in 2020 after the. Some cities including detroit and saginaw also charge a city income tax which can boost your total tax obligations.

More From What Is The Minimum Wage Rate In Massachusetts

- Washington Minimum Wage 2020 Poster

- Legalization Of Weed Nj

- Minimum Wage Increase 2020 Ri

- Minimum Wage Poster Florida 2019

- What Is Minimum Wage Earner

Incoming Search Terms:

- Minimum Wage Michigan Restaurant Lodging Association What Is Minimum Wage Earner,

- Publication 970 2019 Tax Benefits For Education Internal Revenue Service What Is Minimum Wage Earner,

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities What Is Minimum Wage Earner,

- What Percentage Of Lottery Winnings Would Be Withheld In Your State What Is Minimum Wage Earner,

- The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Magazine What Is Minimum Wage Earner,

- Michigan S Minimum Wage Will Increase January 1 2020 What Is Minimum Wage Earner,

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)