Minimum Wage Calculator Ohio, How To Calculate Amount Of Unemployment In Ohio 9 Steps

Minimum wage calculator ohio Indeed recently is being hunted by consumers around us, perhaps one of you. People are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of the article I will discuss about Minimum Wage Calculator Ohio.

- Exploring The Minimum Wage Your Voice Ohio

- Universal Living Wage Wage Calculator

- County Employment And Wages In Ohio First Quarter 2020 Midwest Information Office U S Bureau Of Labor Statistics

- What Does A Living Wage Look Like In The U S It Depends On Where You Live

- Zippia Report What S The Minimum Living Wage In Ohio Dayton Business Journal

- Recent Graduates You Can Negotiate Your Salary Too Khristopher J Brooks

Find, Read, And Discover Minimum Wage Calculator Ohio, Such Us:

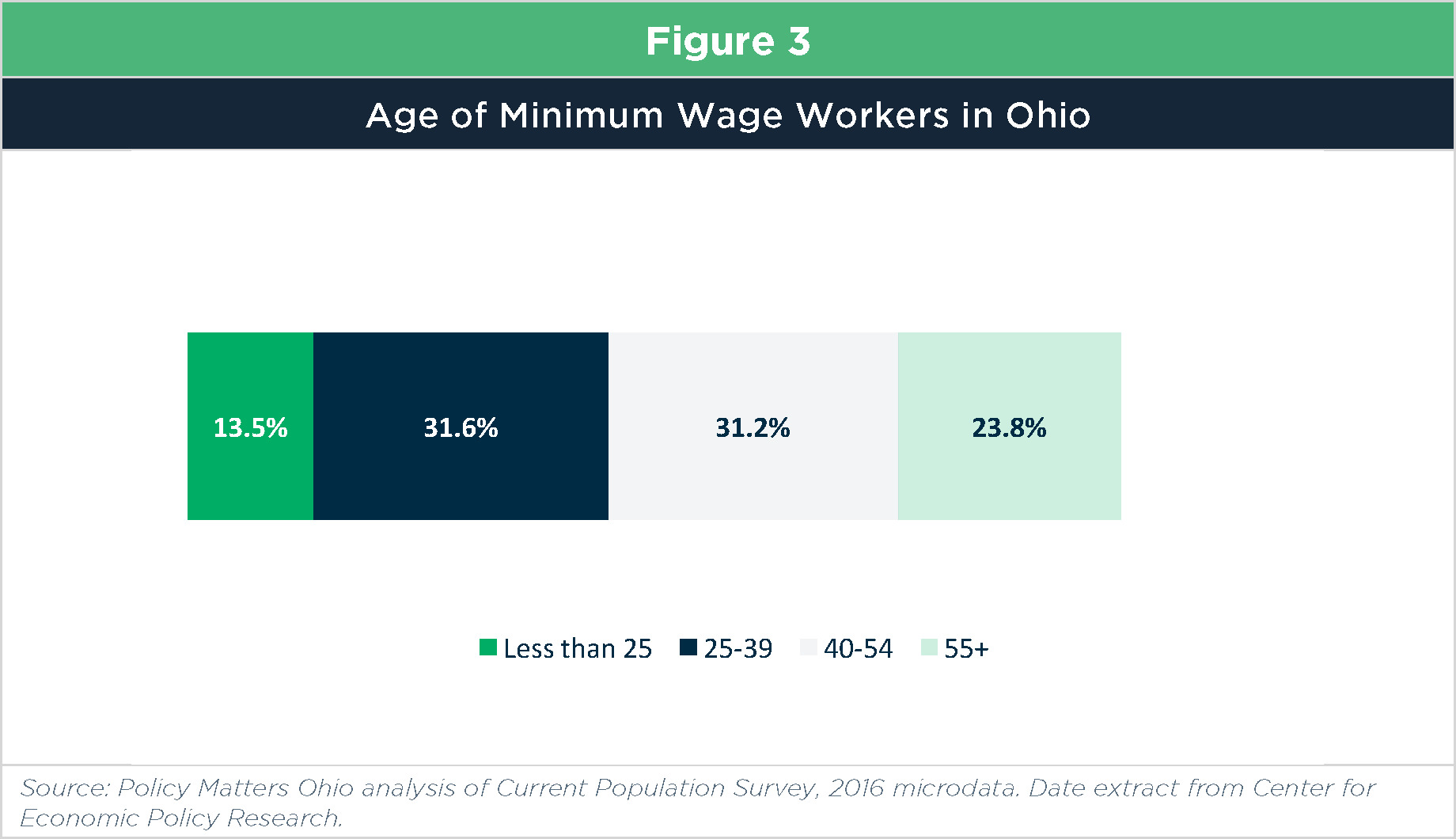

- Minimum Wage Hike Would Boost Ohio Workers

- Https Actohio Org Wp Content Uploads 2018 03 Act Ohio Prevailing Wage Guide Final Pdf

- Getting By In Ohio The 2013 Basic Family Budget

- Poverty Speaks Climbing Out Of Poverty The Center For Community Solutions

- Ohio Minimum Wage To Increase January 1 2020

If you re looking for Marijuana News Ga you've reached the ideal location. We ve got 104 graphics about marijuana news ga including pictures, pictures, photos, backgrounds, and much more. In such webpage, we also provide number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

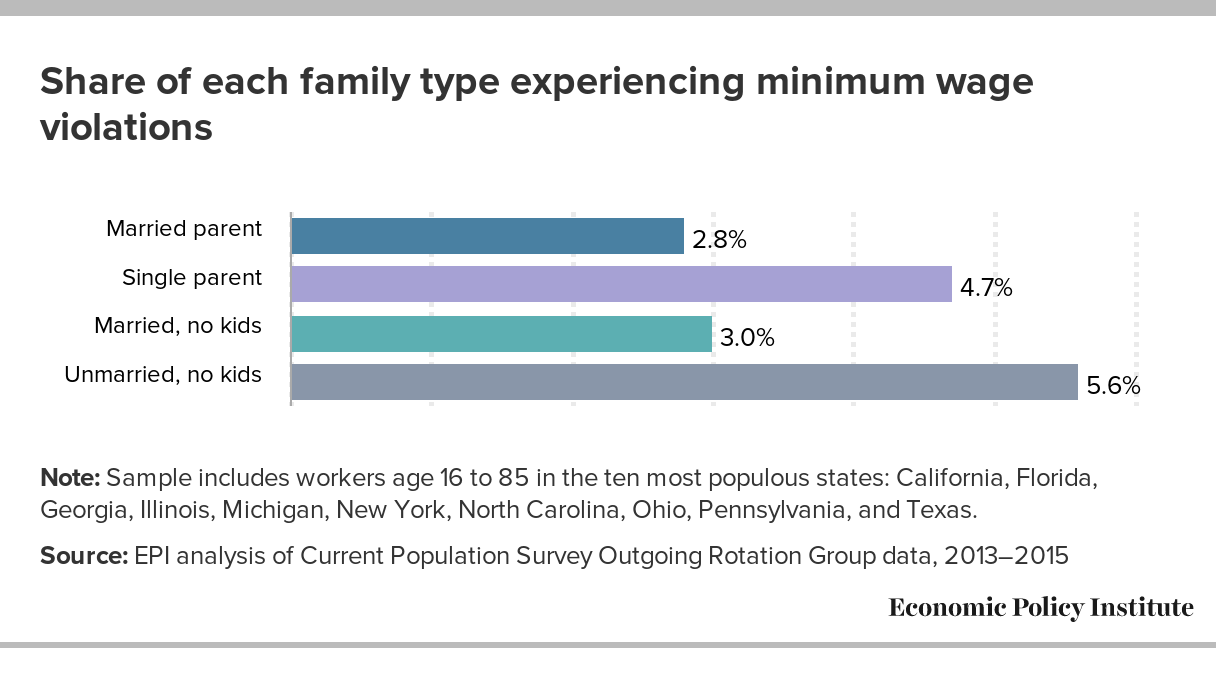

Employers Steal Billions From Workers Paychecks Each Year Survey Data Show Millions Of Workers Are Paid Less Than The Minimum Wage At Significant Cost To Taxpayers And State Economies Economic Policy Marijuana News Ga

See where that hard earned money goes federal income tax social security and other deductions.

Marijuana news ga. Ohio allows employers to credit up to 425 in earned tips against an employees wages per hour which can result in a cash wage as low as 430 per hour. The hourly wage tax calculator uses tax information from the tax year 2020 to show you take home pay. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

Rates range from 0 to 4797. Use our calculator to discover the ohio minimum wage. Cincinnati area office us dept.

For instance as of january 1 2015 there were more than 25 states that started paying a level greater than the minimum mandated. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Ohio has a progressive income tax system with eight tax brackets.

Federal government allows a nationwide minimum wage per hour of 725 while depending by each states policy employers may be requested to pay higher rates. Ohios state minimum wage rate is 870 per hourthis is greater than the federal minimum wage of 725. More information is available at.

The ohio minimum wage was last changed in 2008 when it was raised 170. There are legal minimum wages set by the federal government and the state government of ohio. Wages per month are calculated as 433 times if a weekly wage is defined.

The calculator will automatically assume that the employer takes the maximum possible tip credit and calculate tip and cash wage earnings accordingly. You are entitled to be paid the higher state minimum wage. The ohio minimum wage is the lowermost hourly rate that any employee in ohio can expect by law.

For all filers the lowest bracket applies to income up to 21750 and the highest bracket only applies to income above 217400. Overview minimum wages in usa. Overview of ohio taxes.

The assumption is the sole provider is working full time 2080 hours per year. More information about the calculations performed is available on the about page. Of labor wage hour division 550 main street room 10 409 cincinnati oh 45202 5208 phone.

Starting july 2009 the us. The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living. It is calculated as 433 times the standard hours per week if an hourly wage is given.

The minimum wage applies to most employees in ohio with limited exceptions including tipped employees some student workers and other exempt occupations.

More From Marijuana News Ga

- Legalization Of Weed Thesis

- Il Minimum Wage 2020 Under 18

- Federal Minimum Wage Exemptions

- Marijuanas Legalized States 2020 Map

- What Is The Minimum Wage For Florida

Incoming Search Terms:

- How To Calculate Amount Of Unemployment In Ohio 9 Steps What Is The Minimum Wage For Florida,

- Progress Report Minimum Wage What Is The Minimum Wage For Florida,

- Universal Living Wage Wage Calculator What Is The Minimum Wage For Florida,

- Ohio Minimum Wage Lacks Purchase Power From 1968 What Is The Minimum Wage For Florida,

- How Much Do Incarcerated People Earn In Each State Prison Policy Initiative What Is The Minimum Wage For Florida,

- Ohio Overtime Laws 2020 Mansell Law Employment Attorneys What Is The Minimum Wage For Florida,