Minimum Wage In California Minus Taxes, Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Minimum wage in california minus taxes Indeed lately has been sought by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of the post I will discuss about Minimum Wage In California Minus Taxes.

- Nba Player Salaries And Take Home Pay

- Raising The Federal Minimum Wage To 15 By 2024 Would Lift Pay For Nearly 40 Million Workers Economic Policy Institute

- How Does The Deduction For State And Local Taxes Work Tax Policy Center

- How Does The Deduction For State And Local Taxes Work Tax Policy Center

- Https Inequality Stanford Edu Sites Default Files Millionaire Migration California Impact Top Tax Rates Pdf

- Estimated Income Tax Spreadsheet Mike Sandrik

Find, Read, And Discover Minimum Wage In California Minus Taxes, Such Us:

- Free California Payroll Calculator 2020 Ca Tax Rates Onpay

- The State And Local Income Tax Deduction On Federal Taxes

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- California Passed 15 An Hour Two Years Ago How S It Working

- Are Health Insurance Premiums Tax Deductible

If you re looking for What Is Minimum Wage Yearly Salary you've arrived at the right location. We ve got 104 graphics about what is minimum wage yearly salary including images, pictures, photos, backgrounds, and much more. In such page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

California S Workers Are Increasingly Locked Out Of The State S Prosperity California Budget Policy Center What Is Minimum Wage Yearly Salary

Although federal taxes are usually the largest single percentage deducted from your gross income other taxes are withheld each pay period.

What is minimum wage yearly salary. 52000 per working week. That would mean paying 188625 in federal taxes before. Like if i make 8 dollars an hour would that really only be 5 an hour when you.

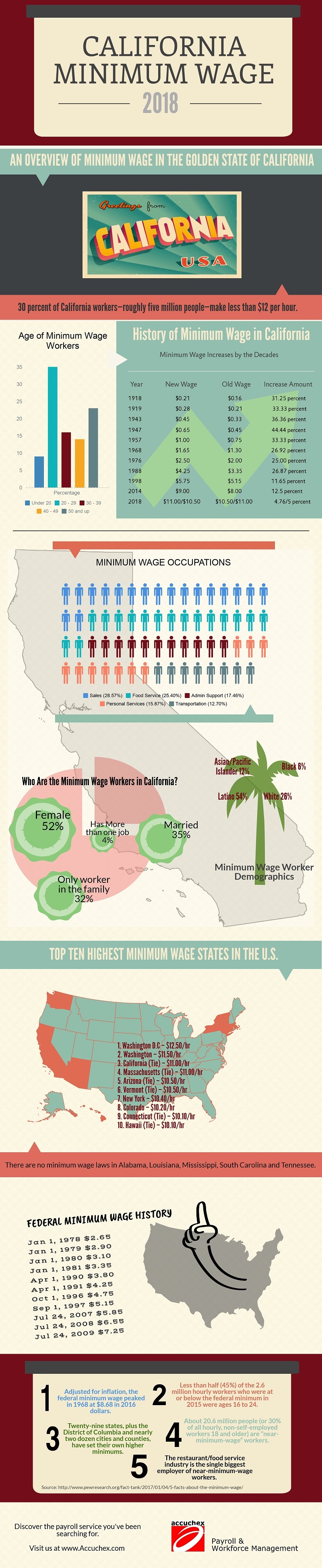

In california thats 8 an hour. Effective january 1 2017 the minimum wage for all industries will be increased yearly. These assume a 40 hour working week.

The federal minimum wage. In 2020 californias minimum wage is 1200 per hour for employees that work for employers with 25 or fewer employees and 1300 per hour for larger employers. Californias state minimum wage rate is 1300 per hourthis is greater than the federal minimum wage of 725.

You are entitled to be paid the higher state minimum wage. For instance low income families may qualify for the earned income tax credit eitc federally and the california eitc on their state tax return. The minimum wage in california means that a full time worker can expect to earn the following sums as a minimum before tax.

The california minimum wage was last changed in 2008 when it. Although there are some exceptions almost all employees in california must be paid the minimum wage as required by state law. The only answer i can give you is not much any more than that depends on many facts that i do not know.

The minimum wage applies to most employees in california with limited exceptions including tipped employees some student workers and other exempt occupations. In states with a higher rate such as oregon and washington minimum wage workers earn more than the national average. The minimum wage is the minimum hourly rate that nearly all california employees must be paid for their work by law.

These assume a 40 hour working week. My question for you is. For instance where are you.

What is the hourly wage in california if you include taxes. California minimum wage minus taxes. The minimum wage will vary depending on what state you are in or even what you do.

So i plan to get a job working at subway. The federal minimum wage is 750 per hour as of 2015. Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950.

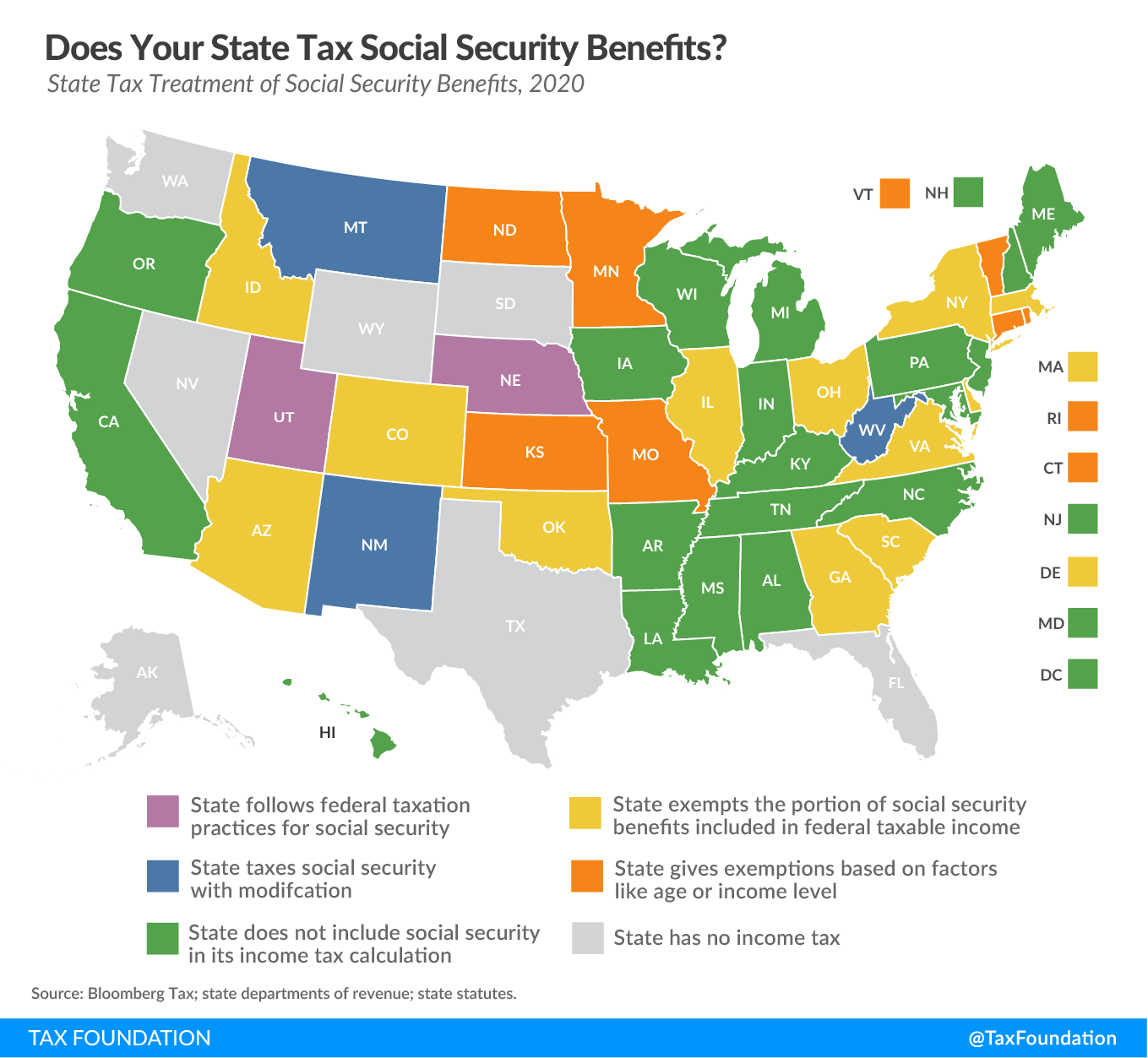

Based on a 40 hour work week this works out to an annual salary of 15600. If your child is attending college for the first time you may also be eligible for the american opportunity tax credit of up to 2500 per student. Social security is withheld at 62 percent of your income up to a certain amount and medicare taxes are 145 percent of your wages.

In california the applicable minimum wage depends on the size of the employer. Im assuming they pay minimum wage for the job im applying for. If you live in a state that collects state income tax it is deducted too.

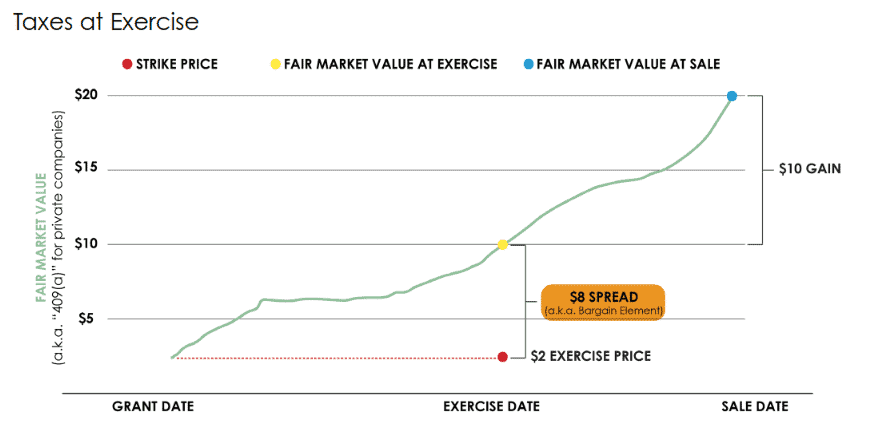

As of 2015 this would mean that a single filer would be paying 10 percent federal income tax on the first 9075 and 15 percent on the remaining 6525.

More From What Is Minimum Wage Yearly Salary

- What Is Minimum Wage Weekly

- Marijuana News Mass

- What Is The Minimum Wage Per Hour In The Philippines

- Marijuana News Wv

- Marijuana News Bnn

Incoming Search Terms:

- Gross Wages What Is It And How Do You Calculate It The Blueprint Marijuana News Bnn,

- California Voters Support Increasing Tobacco Tax Raising Minimum Wage The Sacramento Bee Marijuana News Bnn,

- Form 541 Schedule K 1 Beneficiary S Share Of Income Deductions Credits Etc Marijuana News Bnn,

- How Getting A Raise Affects Your Taxes Marijuana News Bnn,

- California S Tax System A Primer Marijuana News Bnn,

- How Doug Ford S Pledge Of Zero Income Tax Leaves Minimum Wage Earners Worse Off Cbc News Marijuana News Bnn,