Minimum Wage Uk 2020 After Tax, 18 000 After Tax 2020 Income Tax Calculator

Minimum wage uk 2020 after tax Indeed recently has been sought by users around us, maybe one of you personally. People are now accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the article I will talk about about Minimum Wage Uk 2020 After Tax.

- What Is The Real Living Wage Living Wage Foundation

- Government Announces Pay Rise For 2 8 Million People Gov Uk

- Low Pay Commission Gov Uk

- Income Tax Calculator United Kingdom Salary After Taxes

- National Minimum Wage Act 1998 Wikipedia

- 18 000 After Tax 2020 Income Tax Calculator

Find, Read, And Discover Minimum Wage Uk 2020 After Tax, Such Us:

- 55000 After Tax 2019

- Tax Calculator Uk Tax Calculators

- What Is The National Minimum Wage Low Incomes Tax Reform Group

- National Minimum Wage And Living Wage Calculator For Workers Gov Uk

- How Is Tax Calculated Explained Example Rates Simplified 2018 Calculator

If you re searching for Global News Marijuana Legalization you've arrived at the perfect place. We ve got 104 images about global news marijuana legalization adding images, photos, photographs, wallpapers, and much more. In such web page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The average monthly net salary in the uk is around 1 730 gbp with a minimum income of 1 012 gbp per month.

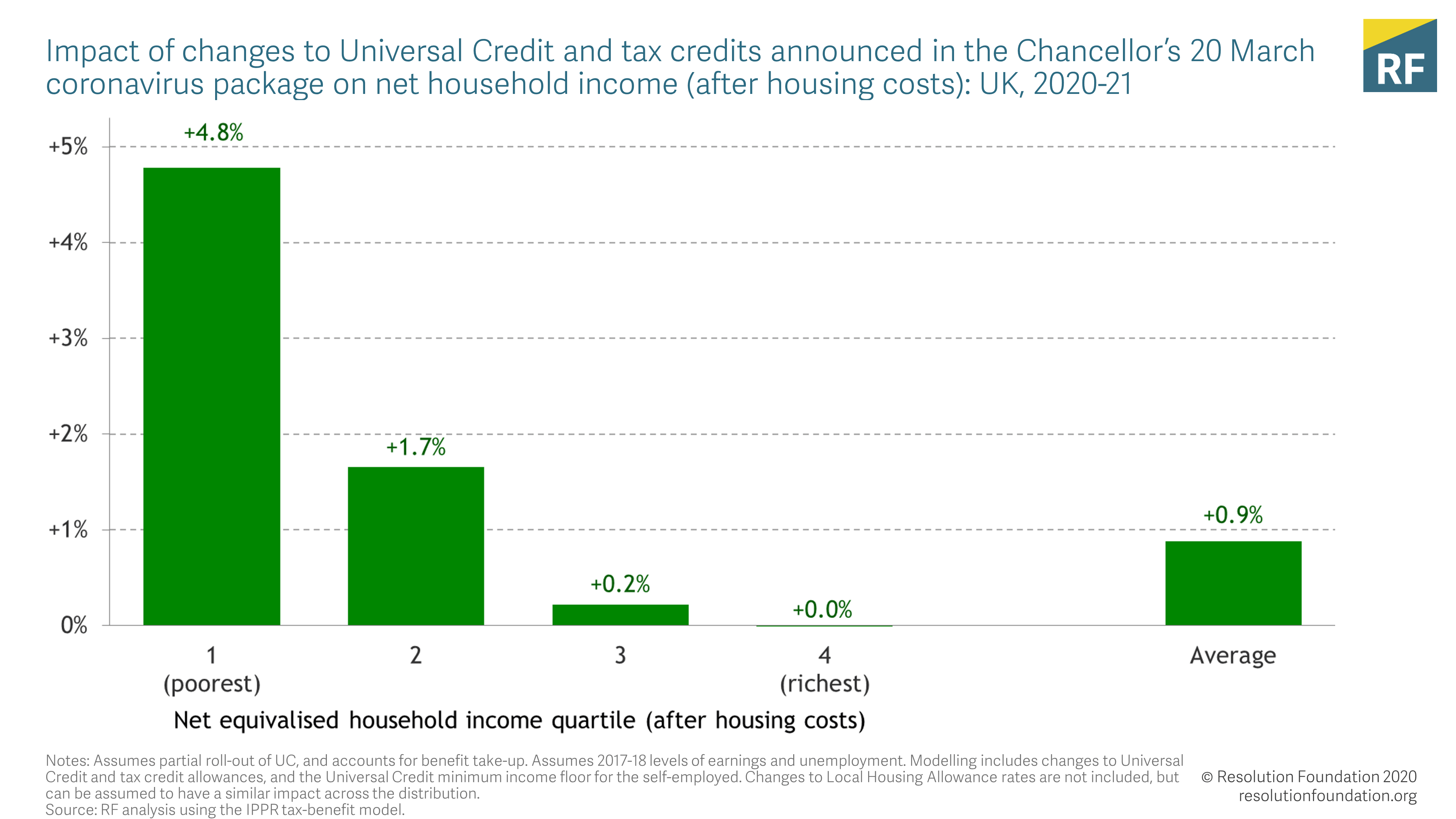

Global news marijuana legalization. When it comes to how the 29764 should be taxed when it is paid to jane ultimately it should be allocated back to the tax year to which it relates 201718 and the tax calculated on it as if it were paid in that year meaning that if janes total earnings including the minimum wage arrears were below the personal allowance then no. This short report accompanies the 2020 increases in the national living wage nlw and national minimum wage nmw. 872 if over 25 820 21 24 years old 645 18 20 years old 455 for under 18 years old and 415 for apprentice.

See where that hard earned money goes with uk income tax national insurance student loan and pension deductions. Keeping your pay and tax records. The 20202021 uk minimum wage national living wage per hour is currently.

This places united kingdom on the 5th place out of 72 countries in the international labour organisation statistics for 2012. The 20162017 net salary tax calculator page. Most individuals pay income tax through the pay as you earn paye system.

Employers use this system to take income tax and national insurance contributions from. Income tax rates across the uk income tax rates scotland income tax rates wales. The rates have risen for the national minimum wage and the national living wage image.

721500 apprentices minimum wage after tax. The most common deductions from employee wage slips are pensions and student loans. From 1 april 2020 872 820.

We have included a few extra options to help make sure the figures you see are spot on. The 20202021 uk real living wage is currently 1075 in london and 930 elsewhere. National minimum wage rates apply to employees up to the age of 24.

This years increase in the nlw to 872 brings the rate to the target of. Your pay tax and the national minimum wage a to z. Getty for instance those aged 21 to 24 the rate is now 820 per hour up from 7.

The hourly wage tax calculator uses tax information from the tax year 2020 2021 to show you take home pay.

More From Global News Marijuana Legalization

- What Is The Minimum Wage Rate For A Farm Labourer Set By Government

- What Is Minimum Wage For Waitresses In Pa

- How Much Is Minimum Wage Colorado

- How Much Is Minimum Wage For 17 Year Old

- Minimum Wage In New Zealand

Incoming Search Terms:

- Income In The United Kingdom Wikipedia Minimum Wage In New Zealand,

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk Minimum Wage In New Zealand,

- What Is The National Minimum Wage Low Incomes Tax Reform Group Minimum Wage In New Zealand,

- What Is The Real Living Wage Living Wage Foundation Minimum Wage In New Zealand,

- Coronavirus Key Workers Are Clapped And Cheered But What Are They Paid Bbc News Minimum Wage In New Zealand,

- 2020 21 Tax Year Updates Accountancy Services In Buckingham Minimum Wage In New Zealand,