What Is Minimum Wage After Taxes Per Hour, How Much Money Do You Earn Per Hour

What is minimum wage after taxes per hour Indeed recently is being hunted by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of the post I will talk about about What Is Minimum Wage After Taxes Per Hour.

- Hourly To Salary What Is My Annual Income

- This Is What The Minimum Wage Looks Like Around The World Al Arabiya English

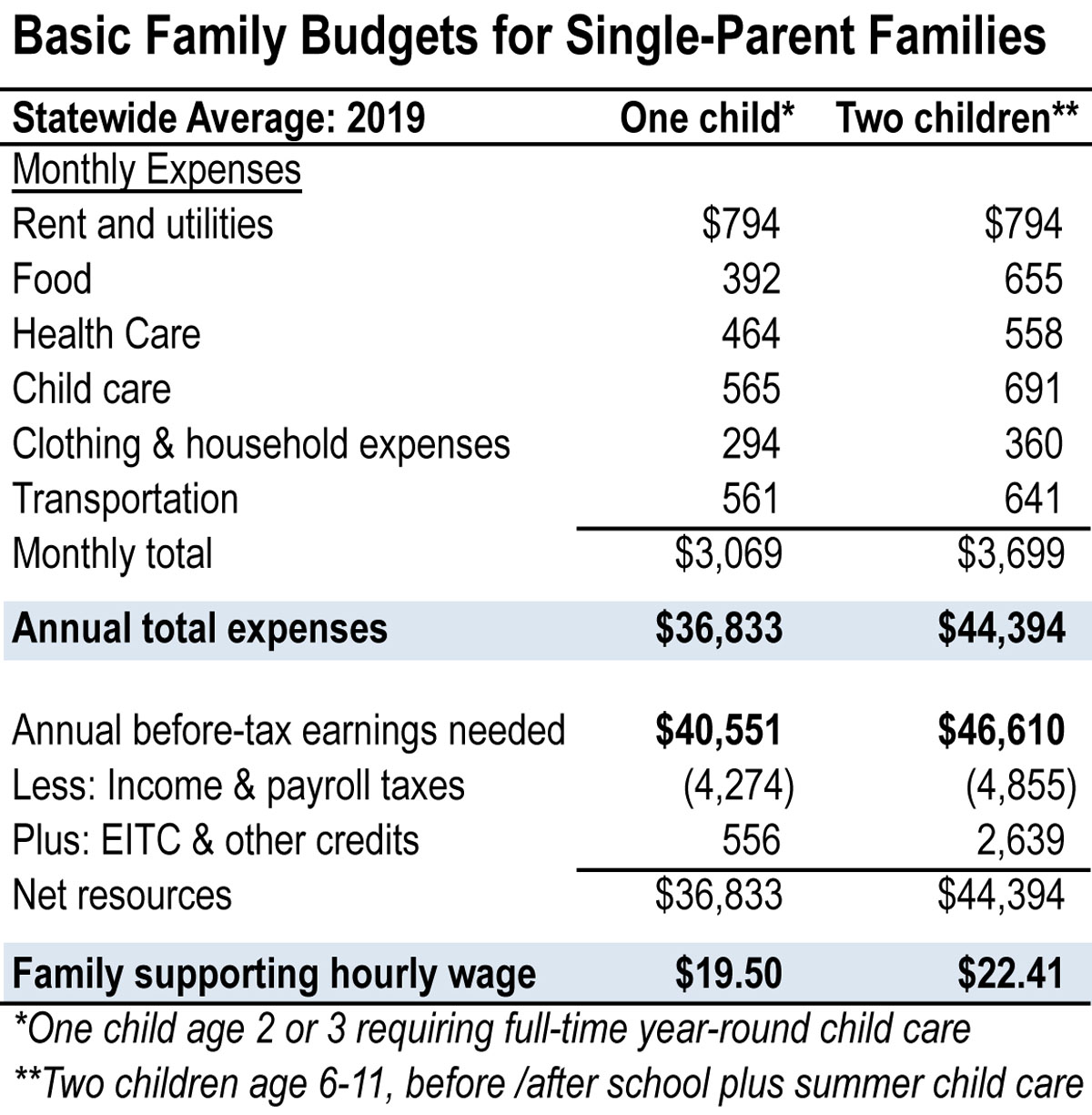

- Our Minimum Wage Is Untenable Atlanta Volunteer Lawyers Foundation

- List Of European Countries By Minimum Wage Wikipedia

- Lpc Welcomes Acceptance Of Its 2019 Minimum Wage Rate Recommendations Gov Uk

- Methodology For Paying Taxes

Find, Read, And Discover What Is Minimum Wage After Taxes Per Hour, Such Us:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcse1casyppslxvqcrappdjibmj6xfsix2c6zw8xzdvd32w0k9wv Usqp Cau

- In 2010 Many Unskilled Workers In The United Stat Chegg Com

- What Is The National Minimum Wage Low Incomes Tax Reform Group

- How Doug Ford S Pledge Of Zero Income Tax Leaves Minimum Wage Earners Worse Off Cbc News

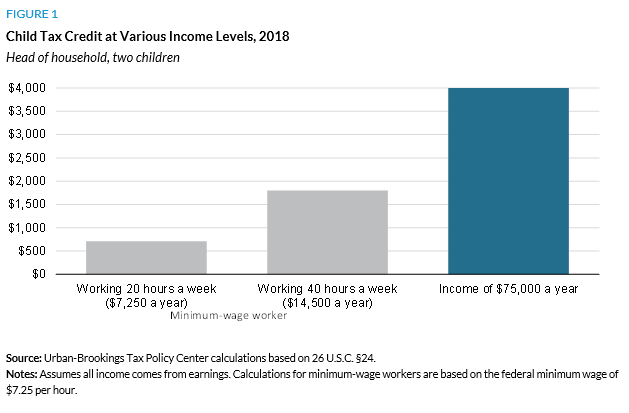

- Report Strengthening Child Tax Credit Would Reduce Poverty Improve Opportunity Center On Budget And Policy Priorities

If you are looking for Minimum Wage In California Today you've reached the perfect place. We ve got 104 graphics about minimum wage in california today adding images, photos, photographs, backgrounds, and much more. In such web page, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

How Doug Ford S Pledge Of Zero Income Tax Leaves Minimum Wage Earners Worse Off Cbc News Minimum Wage In California Today

We created this table of hourly wage calculator with assumption of 375 hours of work per week.

Minimum wage in california today. The adult minimum wage rate for employees aged 16 years or older. The hourly wage tax calculator uses tax information from the tax year 2020 to show you take home pay. The federal minimum wage is 750 per hour as of 2015.

060 per hour is a 15 percent tax on a baseline hourly wage of 41 per hour. Divide this by 12 to obtain monthly wages since not all months have the same number of days. 756 before tax for a 40 hour week.

Committees across different sectors agree on the minimum wage in belgium meaning wage legislation varies between industries. See where that hard earned money goes federal income tax social security and other deductions. For industries that dont have a minimum wage set by their committees the nationwide belgian minimum wage applies.

You see below the minimum wages after tax take home calculations as well as those of common hourly wages in the uk. 1890 an hour before tax. More information about the calculations performed is available on the about page.

Viewed through the lens of this simple example the 15 per hour minimum wage would raise the tax rate on labor income an additional 15 percentage points for the group a workers 84 percent of full time workers in new jersey. The minimum wage in 2019 is 159380 a month or 19126 a year taking into account 12 pay periods. Your current employer must pay you the adult minimum wage.

Using the federal minimum wage rate of 725 per hour this amounts to total gross wages of 15080 in one calendar year. Based on a 40 hour work week this works out to an annual salary of 15600. If you make 50 400 a year living in ireland you will be taxed 13 407 that means that your net pay will be 36 993 per year or 3 083 per month.

Suppose a worker earning minimum wage clocks 40 hours per week. Current minimum wage rates. This calculation results in 125667 in monthly gross wages.

Your average tax rate is 2660 and your marginal tax rate is 4850this marginal tax rate means that your immediate additional income will be taxed at this rate. As of 2015 this would mean that a single filer would be paying 10 percent federal income tax on the first 9075 and 15 percent on the remaining 6525.

More From Minimum Wage In California Today

- Minimum Wage 2020 London Uk

- What Is The Minimum Wage Ny

- Legalization Of Weed Uk

- Minimum Wage 2020 What Is It

- What Is The Minimum Wage In Wisconsin 2020

Incoming Search Terms:

- Living Wage Calculator What Is The Minimum Wage In Wisconsin 2020,

- How Doug Ford S Pledge Of Zero Income Tax Leaves Minimum Wage Earners Worse Off Cbc News What Is The Minimum Wage In Wisconsin 2020,

- What S Hidden Under The 15 Minimum Wage Higher Taxes Rutgers Business School What Is The Minimum Wage In Wisconsin 2020,

- Cost Of Living In Iowa Iowa Policy Points What Is The Minimum Wage In Wisconsin 2020,

- Wages And Labour Costs Statistics Explained What Is The Minimum Wage In Wisconsin 2020,

- Our Minimum Wage Is Untenable Atlanta Volunteer Lawyers Foundation What Is The Minimum Wage In Wisconsin 2020,

/cdn.vox-cdn.com/uploads/chorus_asset/file/13201377/uber_ridester.png)