What Is The Minimum Wage Before Paying Tax, Corporate Tax In Singapore How To Pay Tax Rate Exemptions Singaporelegaladvice Com

What is the minimum wage before paying tax Indeed lately is being sought by consumers around us, perhaps one of you. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the post I will talk about about What Is The Minimum Wage Before Paying Tax.

- What National Insurance Do I Pay As An Employee Low Incomes Tax Reform Group

- Http Www Ntrc Gov Ph Images Journal 2017 J20170304a Pdf

- Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

- Enrolling In The Hfsa Smart Move

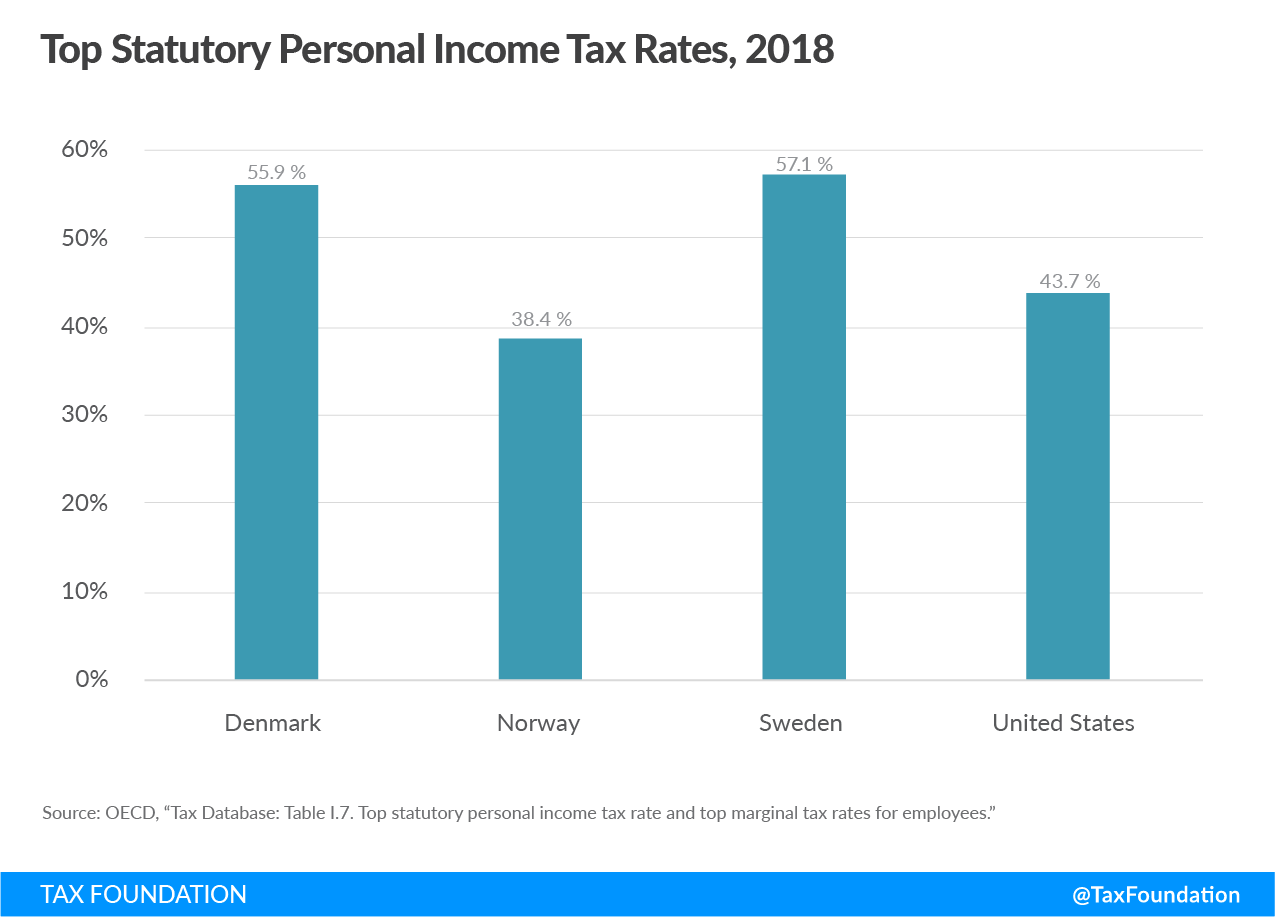

- How Scandinavian Countries Pay For Their Government Spending

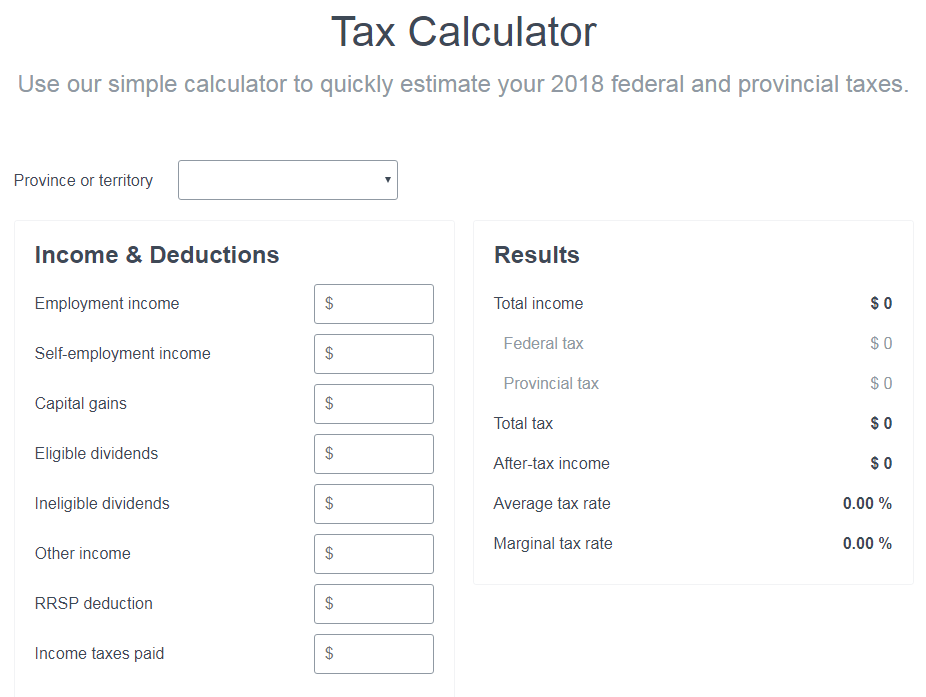

- Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips

Find, Read, And Discover What Is The Minimum Wage Before Paying Tax, Such Us:

- Period Summary View Payroll Preview Brightpay Documentation

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

- How Does The Corporate Income Tax Work Tax Policy Center

- Property Tax In The United States Wikipedia

- Should We Pay A Minimum Wage Or A Living Income Business The Guardian

If you are looking for Marijuana Legalization 2020 Tn you've arrived at the ideal place. We have 104 images about marijuana legalization 2020 tn adding images, photos, photographs, wallpapers, and much more. In such page, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Youll pay 40 income tax on earnings between 50001 to 150000.

Marijuana legalization 2020 tn. Even though the minimum wage changes with age there is no minimum age when you have to start paying income tax. The social security tax rate was reduced to 104 for 2011 and 2012 with the employer paying 62 and employees paying 42 but it went back up to 124 in 2013. 1890 an hour before tax.

If you earn 150001 and over you pay 45 tax. Your current employer must pay you the adult minimum wage. In most cases your employer will also deduct tax from an occupational pension if you have one.

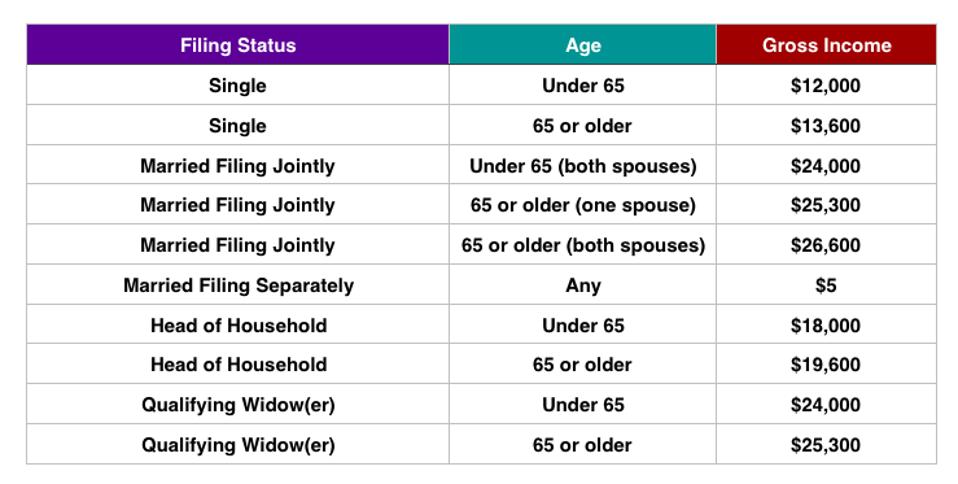

When in doubt i say go ahead and file. I ts that time of year when people begin wondering whether they need to file a federal income tax return. Your employer must pay you at least the minimum wage for every hour you work.

Your 2019 tax returns are due on july 15 2020 and we recommend turbotax because its 100 free to file for most people. In total these minimum wage workers would be taxed 251025 before deductions. Current minimum wage rates.

But when making a decision this important you probably want some hard numbers so im going to give them to you. The adult minimum wage rate for employees aged 16 years or older. The other tax to be paid is the national insurance tax and you only pay this if youre over 16.

This tax has a maximum capthe wage baseof 137700 in earnings for 2020. All these processes take place before you receive your pension or wages. A married couple in which only one partner works for a total wage of 19760 per year would be taxed at 10 percent for the entire amount.

This pay as you earn section includes key information about the national minimum wage and the current payment rates. Your minimum wage pay is the amount of pay you receive before things like tax national insurance and pension contributions have been taken off but after certain other deductions have been made including for costs you have incurred in connection with your work that are not reimbursed by your employer more on this below. An amount of income tax and national insurance contributions get taken or deducted from wages.

756 before tax for a 40 hour week. After you have worked for them.

More From Marijuana Legalization 2020 Tn

- Michigan Minimum Wage History

- Legalization Of Marijuana Use

- Minimum Wage Florida 2019

- Us Federal Minimum Wage 2021

- What Is The Minimum Wage In Us Per Hour

Incoming Search Terms:

- You Don T Have To Pay Federal Income Tax If You Make This Much Money Marketwatch What Is The Minimum Wage In Us Per Hour,

- How Much Does A Small Business Pay In Taxes What Is The Minimum Wage In Us Per Hour,

- Capital Gains Tax 101 What Is The Minimum Wage In Us Per Hour,

- Pay Taxes With Credit Card Million Mile Secrets What Is The Minimum Wage In Us Per Hour,

- Form W 2 Understanding Your W 2 Form What Is The Minimum Wage In Us Per Hour,

- Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto What Is The Minimum Wage In Us Per Hour,