What Is Minimum Wage After Tax, Mcdonald S Can T Figure Out How Its Workers Survive On Minimum Wage The Atlantic

What is minimum wage after tax Indeed recently is being hunted by consumers around us, maybe one of you. Individuals now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this article I will talk about about What Is Minimum Wage After Tax.

- Progressive Tax Rates Help Ease Tax Bite On Income Increases Minimum Wage Or Otherwise Don T Mess With Taxes

- Minimum Wage In Australia 2019 Per Hour After Tax For International Students Youtube

- Illinois Tops Neighboring States With 10 Minimum Wage On July 1

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqnq9ep08usrs9 Nafqbvwakehgheprhpyqb58tylzitmnswfob Usqp Cau

- It S Time To Raise The Minimum Wage By House Budget Committee Majority Medium

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

Find, Read, And Discover What Is Minimum Wage After Tax, Such Us:

- What Can The Minimum Wage Buy You In Ireland Thejournal Ie

- The Eitc And Minimum Wage Work Together To Reduce Poverty And Raise Incomes Economic Policy Institute

- After Taxes The Minimum Wage Is Higher Than It Was In 1968 National Review

- After Tax Effects Of Minimum Wage The Libertarian Party Of Maryland

- State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

If you re searching for Legalization Of Marijuana Effects you've come to the perfect location. We ve got 104 images about legalization of marijuana effects adding images, photos, photographs, backgrounds, and more. In these webpage, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

After Taxes The Minimum Wage Is Higher Than It Was In 1968 National Review Legalization Of Marijuana Effects

1512 an hour before tax.

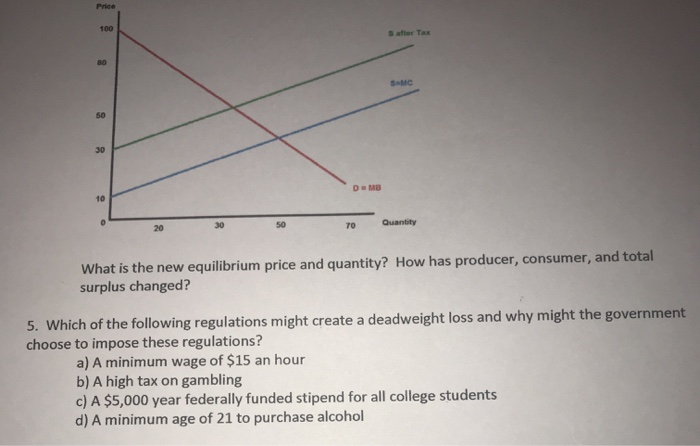

Legalization of marijuana effects. The federal minimum wage is 750 per hour as of 2015. Understanding those laws as well as any tax breaks or exclusions that are legally provided is important for anyone working a minimum wage job since doing so makes it possible to claim those benefits and receive a return of the employee taxes withheld by employers. Your minimum wage pay is the amount of pay you receive before things like tax national insurance and pension contributions have been taken off but after certain other deductions have been made including for costs you have incurred in connection with your work that are not reimbursed by your employer more on this below.

Your current employer must pay you the adult minimum wage. If you supervise or train other workers. Based on a 40 hour work week this works out to an annual salary of 15600.

Minimum wage workers in the district of columbia earn the most in the nation with an hourly rate of 950. After you have worked for them for 6 months. Current minimum wage rates.

Different types of minimum wage rates. Since tax laws vary from one country to the next any number of factors may impact taxes on minimum wage earners. In states with a higher rate such as oregon and washington minimum wage workers earn more than the national average.

Working tax credits are only given if you are over 25 or disabled so they dont help the people who are most likely to be working minimum wage jobs the 18 25 bracket i would have thought. 60480 before tax for a 40. The minimum wage the lowest hourly amount that an employee may be paid for their labor is determined by both state and federal labor laws in the united statesunder the federal fair labor standards act states and localities are permitted to set their own minimum wage rates which will take precedence over the federal minimum wage rate if they are higher.

Award and agreement free juniors get paid a percentage of the national minimum wage. The minimum wage rate for starting out workers is. This years increase in the nlw to 872 brings the rate to the target of.

The national minimum wage is currently 1984 per hour or 75380 per 38 hour week before tax. Casual employees covered by the national minimum wage also get at least a 25 casual loading. As of 2015 this would mean that a single filer would be paying 10 percent federal income tax on the first 9075 and 15 percent on the remaining 6525.

More From Legalization Of Marijuana Effects

- Minimum Wage In New Zealand 2020

- What Is Minimum Wage Massachusetts

- 15 Minimum Wage Florida

- What Is The Minimum Wage Scotland 2020

- What Is Minimum Wage In Indiana

Incoming Search Terms:

- Oecd Ilibrary Home What Is Minimum Wage In Indiana,

- 15 Minimum Wage And The Earned Income Tax Credit Public Policy Interactions District Measured What Is Minimum Wage In Indiana,

- The Eitc And Minimum Wage Work Together To Reduce Poverty And Raise Incomes Economic Policy Institute What Is Minimum Wage In Indiana,

- What Can The Minimum Wage Buy You In Ireland Thejournal Ie What Is Minimum Wage In Indiana,

- List Of European Countries By Minimum Wage Wikipedia What Is Minimum Wage In Indiana,

- New Zealand S Minimum Wage Will Rise To 18 90 In 2020 Stuff Co Nz What Is Minimum Wage In Indiana,