What Is The Minimum Wage Before You Pay Tax, Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

What is the minimum wage before you pay tax Indeed recently has been hunted by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the post I will discuss about What Is The Minimum Wage Before You Pay Tax.

- Simple Paye Taxes Guide Tax Refund Ireland

- National Living Wage Earners Fall Short Of Average Family Spending Office For National Statistics

- Payroll Tax Wikipedia

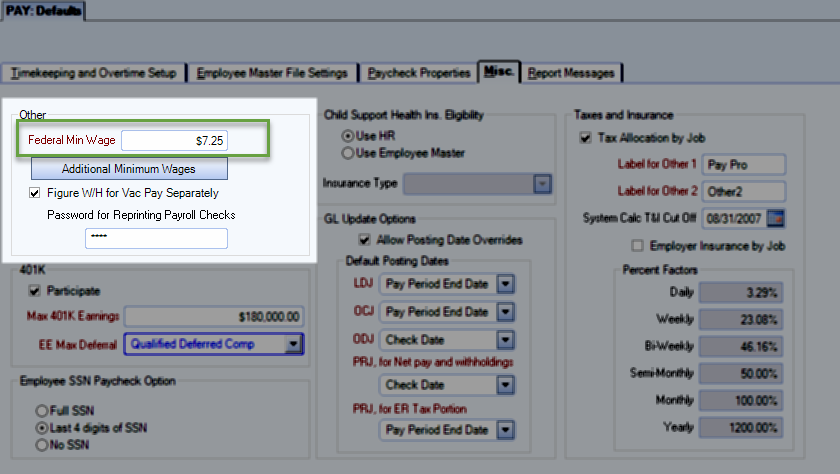

- Setting Up Multiple Minimum Wage Rates

- How Much Money Do You Need To Earn A Year To Be Rich Yougov

- Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Find, Read, And Discover What Is The Minimum Wage Before You Pay Tax, Such Us:

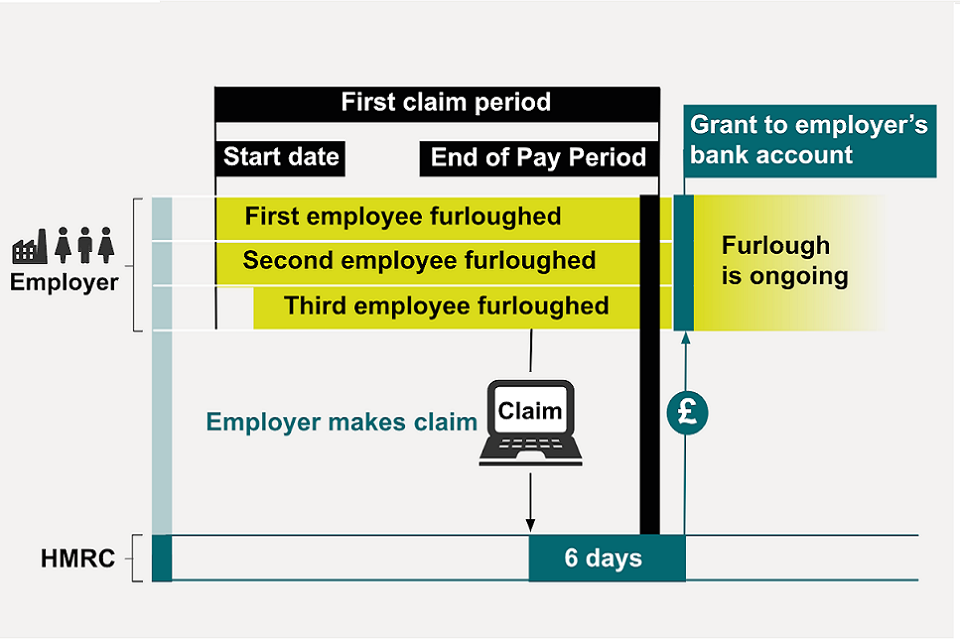

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- The Jobkeeper Payment Explained Everything You Need To Know Taxbanter

- The Minimum Wage Tax Increase Competitive Enterprise Institute

- Https Www2 Illinois Gov Rev Research Publications Bulletins Documents 2020 Fy2020 13 Pdf

- New Tax Year Changes 6th April 2020 What Should I Be Aware Of Crunch

If you are looking for Germany Minimum Wage 2020 After Tax you've come to the ideal place. We ve got 104 images about germany minimum wage 2020 after tax adding pictures, photos, pictures, backgrounds, and more. In such page, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Your current employer must pay you the adult minimum wage.

Germany minimum wage 2020 after tax. The updated itr12 comprehensive guide will be available once the tax season opens. The adult minimum wage rate for employees aged 16 years or older. If you file jointly and youre both over the age of 65 the minimum income requirement increases to 27000.

Most taxpayers have until monday april 15 to file their 2018 taxes. Your rights at work and trade unions. Your minimum wage pay is the amount of pay you receive before things like tax national insurance and pension contributions have been taken off but after certain other deductions have been made including for costs you have incurred in connection with your work that are not reimbursed by your employer more on this below.

If you make more than 50000 in 20192020 you will pay 40 percent tax on any income you earn over this amount. There is a federal minimum wage and some states have their own minimum legal pay. Current minimum wage rates.

If only one of you is over 65 you need to file a tax return after making more than 25700. The tax season for 2020 opens on 1 september 2020. Your pay tax and the national minimum wage.

The amount is based on the information you provided on the form w 4 you would have filled out when you started the job. Total income tax withheld from your pay by your employer appears in box 2 of form w 2. 756 before tax for a 40 hour week.

If you make more than the tax filing threshold during any given year youre required to file an income tax return. The income tax return which should be completed by individuals is known as the itr12 form. Your employer must pay you at least the minimum wage for every hour you work.

1890 an hour before tax. And if you earn more than 150000 per year youll pay an additional rate of. Every year sars announces its tax season a period during which you are required to submit your annual income tax return.

Federal income tax withholding. However there is no minimum amount to file taxes and for some people its worth it to file a return even if its not required so that you can claim the refund that youre due. Includes national minimum wage rates keeping pay records and pay rights.

If you file jointly and youre both under 65 you dont have to file a tax return until your annual gross income exceeds 24400.

More From Germany Minimum Wage 2020 After Tax

- What Is The Minimum Wage For California Right Now

- Us Federal Minimum Wage History

- What Is Minimum Wage In Canada Right Now

- How Much Is Minimum Wage In Texas 2020

- California Minimum Wage For Salaried Employees

Incoming Search Terms:

- Https Www2 Illinois Gov Rev Research Publications Bulletins Documents 2020 Fy2020 13 Pdf California Minimum Wage For Salaried Employees,

- Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips California Minimum Wage For Salaried Employees,

- What S Hidden Under The 15 Minimum Wage Higher Taxes Rutgers Business School California Minimum Wage For Salaried Employees,

- Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service California Minimum Wage For Salaried Employees,

- Six Easy Ways To Pay Less Tax California Minimum Wage For Salaried Employees,

- How To Give An Employee Salary Advance California Minimum Wage For Salaried Employees,